- Bitcoin price at $64,450 after a 3.5% drop; market watches for next movements at critical threshold.

- Long-term holder whales sell $1.2 billion worth, adding significant sell-side liquidity, potentially increasing market pressure.

Bitcoin is currently at a critical point, according to expert trader Josh Olszewicz. His analysis utilizes the Ichimoku Cloud indicator, which shows Bitcoin is nearing the lower boundary of the cloud. This position is critical as it signifies a potential turning point for the currency’s future value.

no one likes an ultimatum but it's do or die here pretty soon on the daily $BTC cloud pic.twitter.com/qTXwAf6cSj

— #333kByJuly2025 (@CarpeNoctom) June 18, 2024

The Ichimoku Cloud is a tool used in technical analysis that helps traders understand market trends. A green cloud suggests a bullish market, whereas a red cloud indicates a bearish trend.

Currently, Bitcoin is at the verge of transitioning from green to red, highlighting the urgency of its next movements. To regain positive momentum, Bitcoin needs to bounce back from this support level. If it fails and breaks below, a more significant price drop may occur.

At the time of writing, Bitcoin is trading at $64,450 on the Bitstamp exchange, having fallen 3.5% in the last 24 hours. This decline is part of a broader pattern of challenges within the cryptocurrency market.

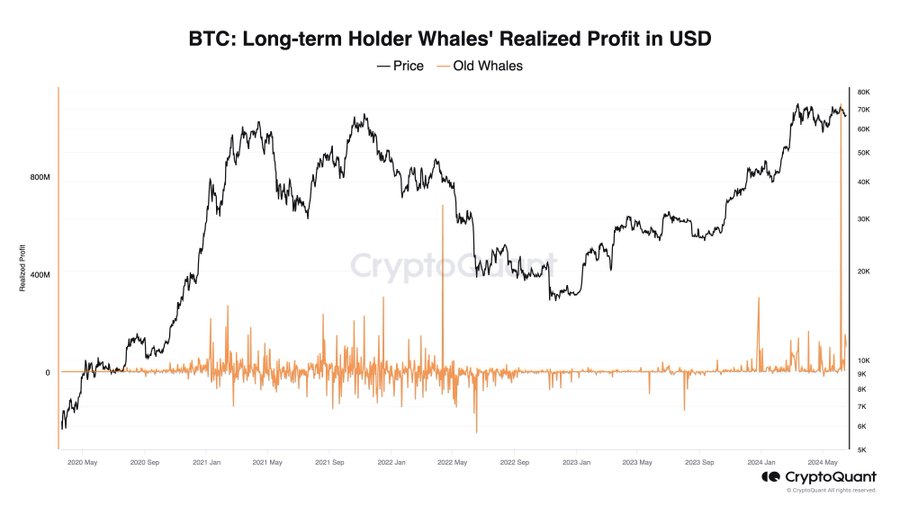

Adding to the pressure, Ki Young Ju, CEO of CryptoQuant, reports that long-term holder whales have sold approximately $1.2 billion worth of Bitcoin in the past week via brokers.

#Bitcoin long-term holder whales sold $1.2B in the past 2 weeks, likely through brokers.

ETF netflows are negative with $460M outflows in the same period.

If this ~$1.6B in sell-side liquidity isn't bought OTC, brokers may deposit $BTC to exchanges, impacting the market. pic.twitter.com/oYeKsRqKeF

— Ki Young Ju (@ki_young_ju) June 18, 2024

This selling, combined with $460 million in ETF outflows, injects a considerable amount of sell-side liquidity into the market. Ju cautions that this could lead to further drops if brokers begin moving significant amounts of Bitcoin to exchanges.

Further compounding Bitcoin’s challenges is a notable decrease in new user engagement. IntoTheBlock, has observed that the influx of new Bitcoin users has fallen to a multi-year low.

Many analysts are puzzled by Bitcoin’s current situation. Let’s break it down.

Firstly, Bitcoin's price made an early new high this cycle, surpassing previous peaks ahead of the anticipated halving, primarily driven by institutional demand.

At first glance, this appears… pic.twitter.com/Bn7ejo0HBe

— IntoTheBlock (@intotheblock) June 18, 2024

This decline suggests that Bitcoin may increasingly be seen as a vehicle for large investors rather than the general public.

Jurrien Timmer, director of global macro at Fidelity Investments, also highlighted the issue of slowing network growth, pointing to a potential stagnation in Bitcoin’s user base expansion.

The periodic table below (updated through May) shows an interesting juxtaposition of #bitcoin and gold at the top and bonds at the bottom. It’s as if the market is trying to tell us something about the emerging era of fiscal dominance. pic.twitter.com/ivmxlLrGUQ

— Jurrien Timmer (@TimmerFidelity) June 14, 2024

These factors combined suggest that Bitcoin is indeed in a “do or die” moment. Its ability to sustain or regain value could hinge significantly on its near-term market performance and investor confidence.

Whether Bitcoin can withstand these trials or if it succumbs to market pressures remains to be seen, but clearly, the stakes are high as it approaches this critical support threshold in its market trajectory.