- Mike McGlone warns Dogecoin could mirror historic bubbles like 1929 and 2000, risking sharp price reversions seen in speculative assets.

- Bitcoin may drop to $10,000, echoing Nasdaq’s 2000 crash; gold’s ratio to BTC aligns with DOGE’s volatility.

Mike McGlone, a commodity strategist at Bloomberg Intelligence, stated that Dogecoin (DOGE) may face downward price pressure due to similarities with historical market bubbles.

In X, McGlone compared current crypto market conditions to major financial collapses, including the 1929 stock crash and the 2000 dot-com bubble. He suggested speculative assets like Dogecoin risk rapid price reversions, akin to past high-risk investments that lost value abruptly.

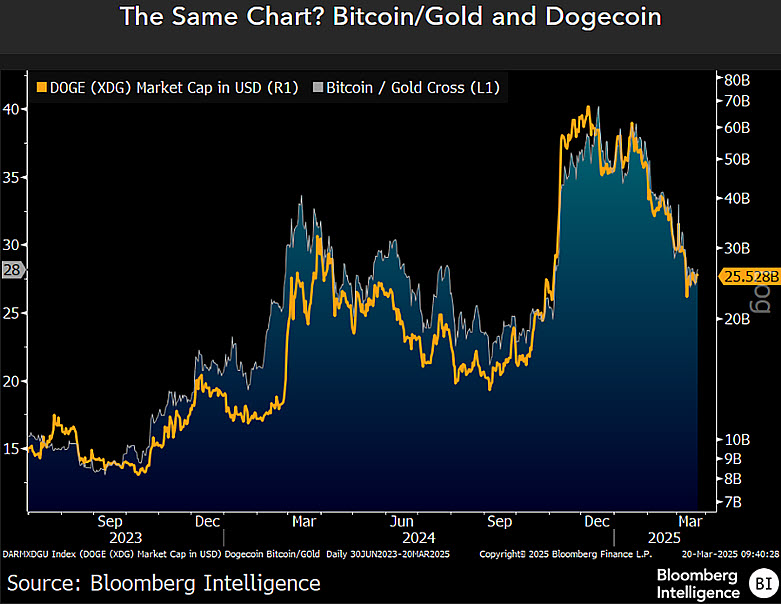

Dogecoin, 1929, 1999 Risk-Asset Silliness and Gold – The ratio of #gold ounces equal to #Bitcoin trading almost tick-for-tick with #Dogecoin may show the risks of reversion in highly speculative #digitalassets, with #deflationary implications underpinning the metal.

Full report… pic.twitter.com/pggizSffCR— Mike McGlone (@mikemcglone11) March 21, 2025

McGlone highlighted parallels between Bitcoin’s price behavior and the Nasdaq 100 index’s crash in 2000. The index fell from 4,700 points to 800 after peaking, a pattern he believes Bitcoin could replicate.

Earlier this month, McGlone predicted Bitcoin might drop to $10,000, citing similarities between today’s risk assets and the dot-com era’s overvalued tech stocks. He noted that the ratio of gold to Bitcoin prices currently mirrors Dogecoin’s price movements, implying both assets could decline if investors shift funds into gold.

Dogecoin has become a frequent subject of speculation. McGlone’s analysis aligns with his broader view that cryptocurrencies exhibit traits of market bubbles. He argues that investors might exit positions in Dogecoin and Bitcoin during periods of uncertainty, favoring traditional safe-haven assets like gold.

Separately, Cathie Wood, CEO of Ark Invest, recently reduced her firm’s holdings in Meta shares. While not directly linked to crypto, this move reflects a broader trend of investors adjusting portfolios amid concerns about overvalued risk assets. Wood’s decision underscores caution in markets where speculative investments have surged.

McGlone’s warnings come as Bitcoin trades near $26,000, down from its 2021 peak above $60,000. Dogecoin remains below its 2021 high of $0.74, currently priced near $0.06. Historical data shows that assets tied to speculative fervor often correct sharply, as seen in the Nasdaq’s 2000 collapse.

As of today, Dogecoin (DOGE) is trading at $0.16679, showing a 1.59% decline in the past 24 hours. Over the past week, DOGE has risen slightly by 0.98%, but it remains down 33.62% over the past month. Its year-to-date performance is down 47.20%, while the one-year gain stands at 9.70%, indicating a mixed overall trend.

Technical Analysis & Outlook

- Short-term (1-2 weeks): DOGE is currently holding near a key trendline support. Analysts highlight that it is forming a falling wedge pattern, which is typically a bullish reversal setup. If this support holds, a breakout could lead the price to $0.20-$0.22.

- Mid-term (1-3 months): Some projections suggest that if DOGE clears resistance at $0.18, it may rally towards $0.25-$0.30. However, if support fails at $0.16, it may retest $0.14 or even $0.12.

- Long-term (6-12 months): If momentum builds and macro sentiment improves—particularly with influence from figures like Elon Musk, who often impacts DOGE sentiment—it could target $0.40-$0.50 again, with $1 remaining a speculative long-term aspiration.

Technical indicators currently show a neutral trend, with a mix of buy and sell signals across different timeframes. Volatility remains a factor, so traders should monitor key levels closely.