- Long-Term Bitcoin Investors Show Confidence, Holding Their Investments Despite Market Fluctuations And Approaching Highs.

- Technical Analysis Identifies $63,440-$65,470 As Key Support Levels For Bitcoin, Indicative Of Strong Buying Interest.

Bitcoin continues to demonstrate resilience as it approaches its previous high, with long-term holders showing no signs of selling their stakes. This trend is indicative of a strong belief in Bitcoin’s value over the long term, regardless of current market volatility.

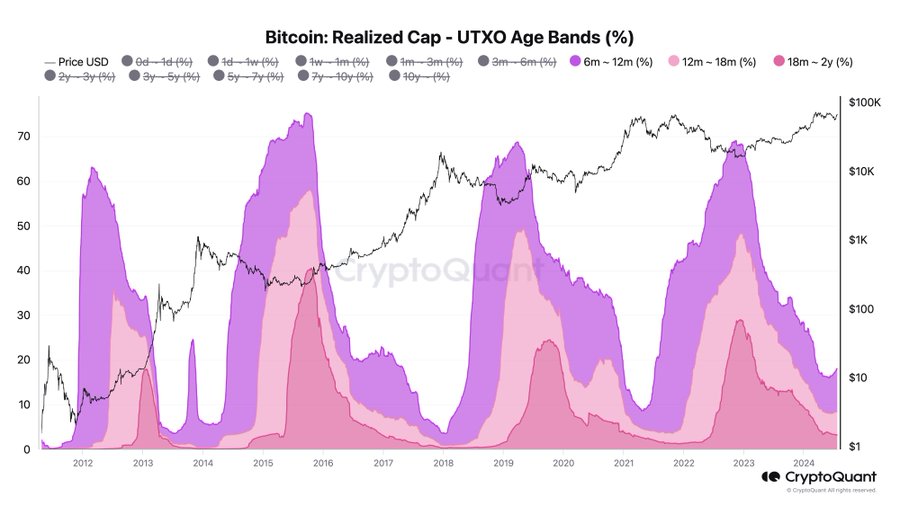

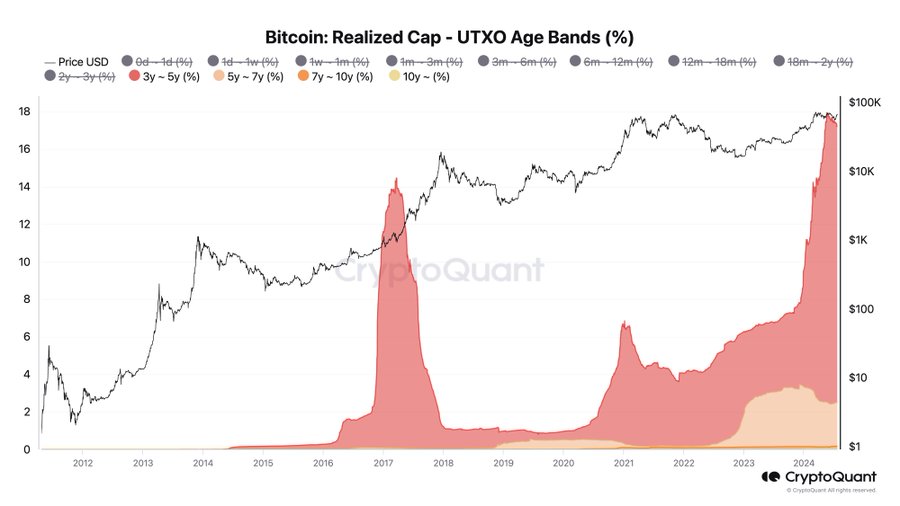

If you're selling #Bitcoin now, you likely haven't held it for over 3 years, as veteran holders aren't selling.

• Bull market investors (holders of 6 months to 2 years) sold most of their BTC as it approached its previous ATH.

• Bear market investors (holders of over 2 years)… pic.twitter.com/9crhTU7lea

— Ki Young Ju (@ki_young_ju) July 22, 2024

Investor Behavior Amid Market Fluctuations

Data from CryptoQuant indicates that Bitcoin holders who have retained their investments for over three years are not participating in the recent sales.

This suggests that the veteran investors are not swayed by short-term price movements and maintain their holdings based on a longer-term outlook on Bitcoin’s value.

Technical Analysis and Market Indicators

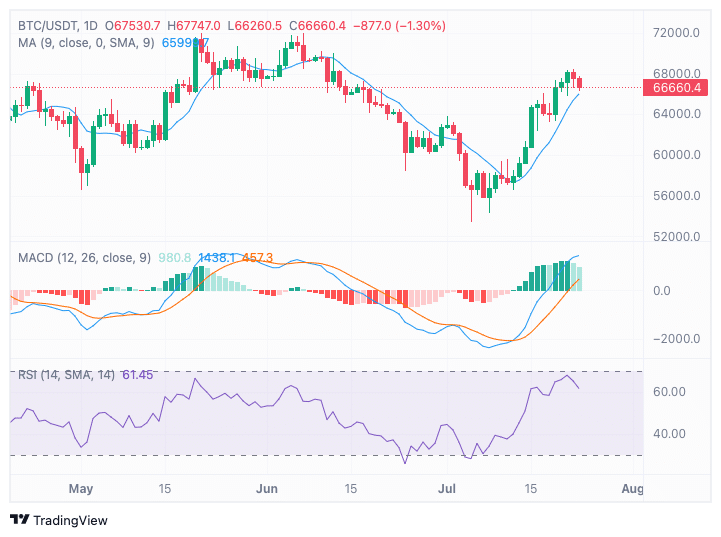

Technical indicators by ETHNews reveal that Bitcoin has established solid support between $63,440 and $65,470. These levels are critical as they represent buying interest that could stabilize prices during potential market dips.

According to market analyst Ali Martinez, breaking through multiple trend lines on the hourly chart has identified these zones as key supports for Bitcoin’s price.

On the lower time frames, #Bitcoin is showing signs of a double bottom pattern with bullish RSI divergence. If confirmed, $BTC could rebound to $67,600.

However, the $66,000 support level needs to hold! pic.twitter.com/NBr7xbsyMZ

— Ali (@ali_charts) July 23, 2024

At present by ETHNews, Bitcoin trades at $66,680.44 with a daily trading volume of approximately $43.18 billion, showing a minor decline of 0.85% in the past 24 hours.

The Moving Average Convergence Divergence (MACD) currently shows a bullish trend with the signal line below the MACD line, an indicator of potential bullish momentum. However, traders should exercise caution as the indicator approaches overbought levels, suggesting a possible price correction.

Current and Future Market Outlook

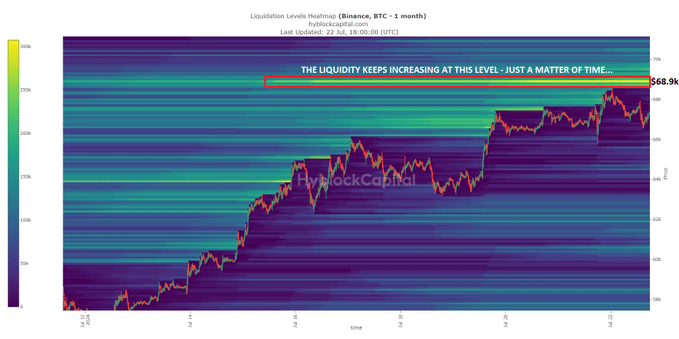

Market analysts like CrypNuevo suggest that Bitcoin could potentially reach the $68,900 mark. However, the pathway to this level is uncertain—whether it will encounter a correction before climbing further or ascend directly.

The Relative Strength Index (RSI) at 61.45 supports a bullish view but is nearing overbought territory, which could signal a forthcoming adjustment in price.

On-Chain Observations

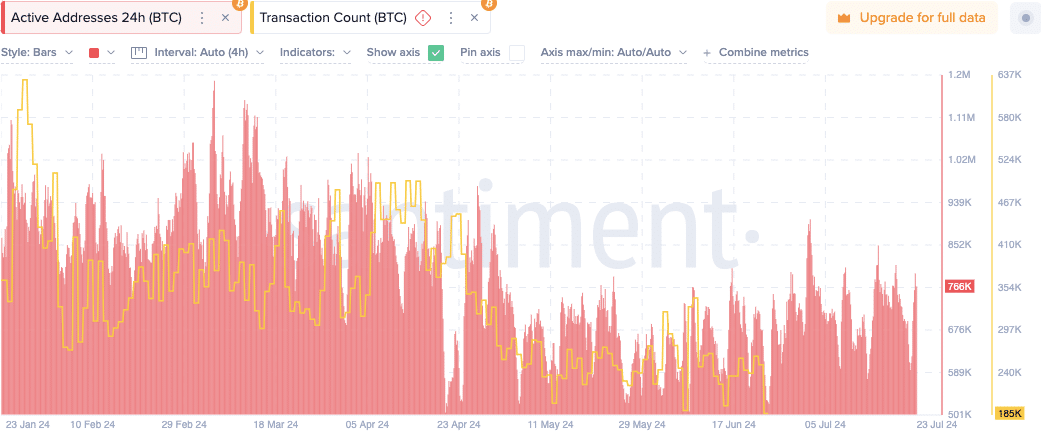

On-chain metrics show a decrease in active addresses and transaction counts since their peak in late February and early April, indicating a slowdown in market engagement. This aligns with the overall observed market behavior, suggesting a cooling period following a phase of heightened activity.