- Long-term investors show strong interest, purchasing $1.34 billion worth of Ethereum as prices briefly lowered.

- Large transactions increase significantly, indicating active accumulation by major investors despite broader market uncertainties.

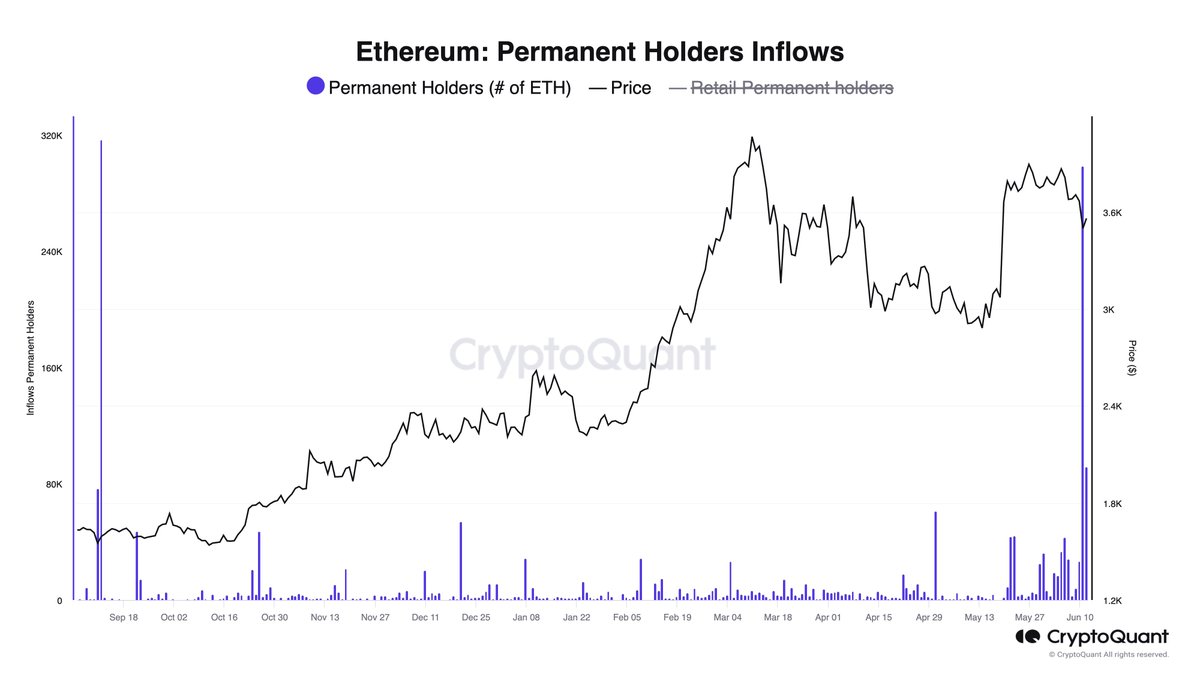

Ethereum has experienced a substantial increase in holder activity, with approximately 298,000 ETH tokens being purchased within a 24-hour period. This surge in buying activity indicates a strong interest from long-term holders, despite the overall market’s mixed signals and recent price volatility.

Accumulation and Market Dynamics

On June 12, Ethereum witnessed its second-largest single-day purchase event, with long-term investors acquiring nearly $1.34 billion worth of Ethereum. This activity occurred during a minor 2% price dip, showcasing the strategy of buying during market lows to capitalize on potential future price increases.

This pattern of accumulation closely follows the largest recorded buying day for Ethereum, which took place on September 11, 2023, when investors snapped up 317,000 Ether as prices briefly fell below $1,600.

Investor Confidence and Transaction Trends

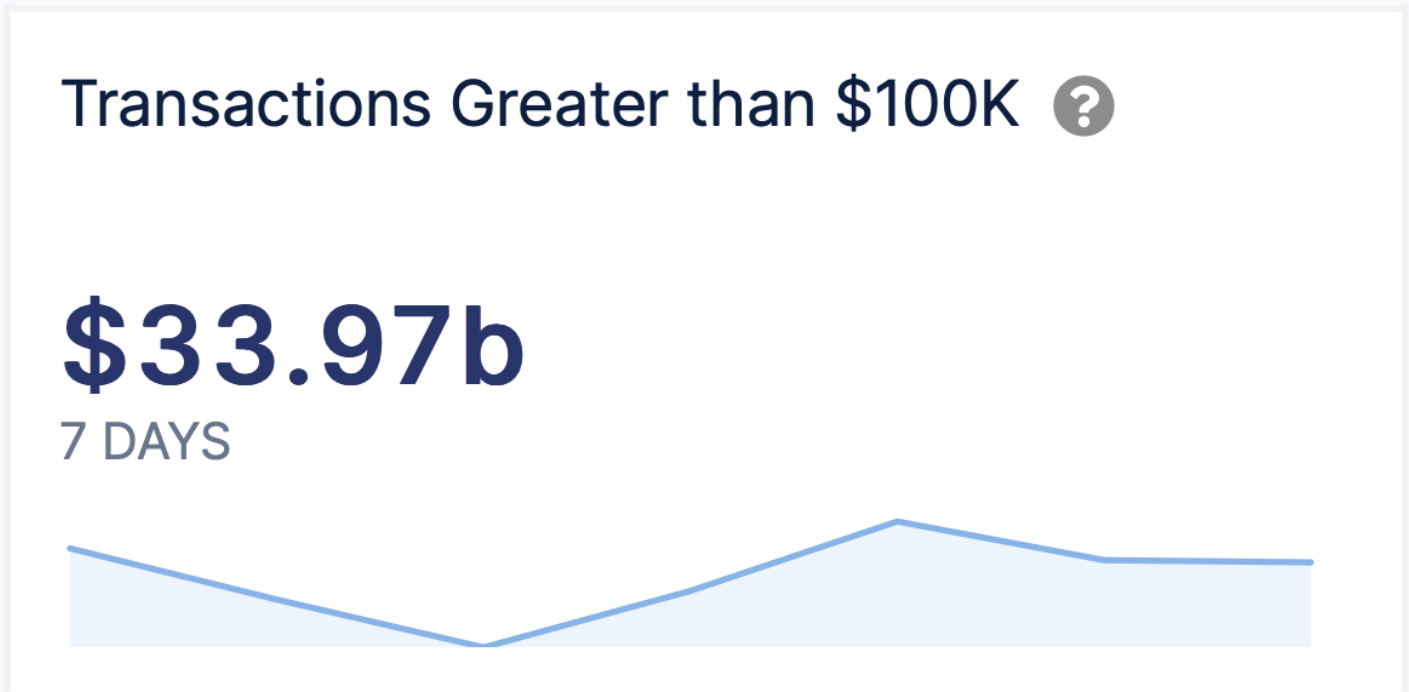

The confidence of long-term holders in Ethereum’s value is further underscored by an increase in large transactions. Data from IntoTheBlock indicates that the number of transactions exceeding $100,000 rose significantly earlier in the week, from below 4,000 to over 6,000.

Such robust activity from major investors, or ‘whales,’ highlights a bullish sentiment despite the broader market’s uncertainties.

Market Indicators and Technical Analysis

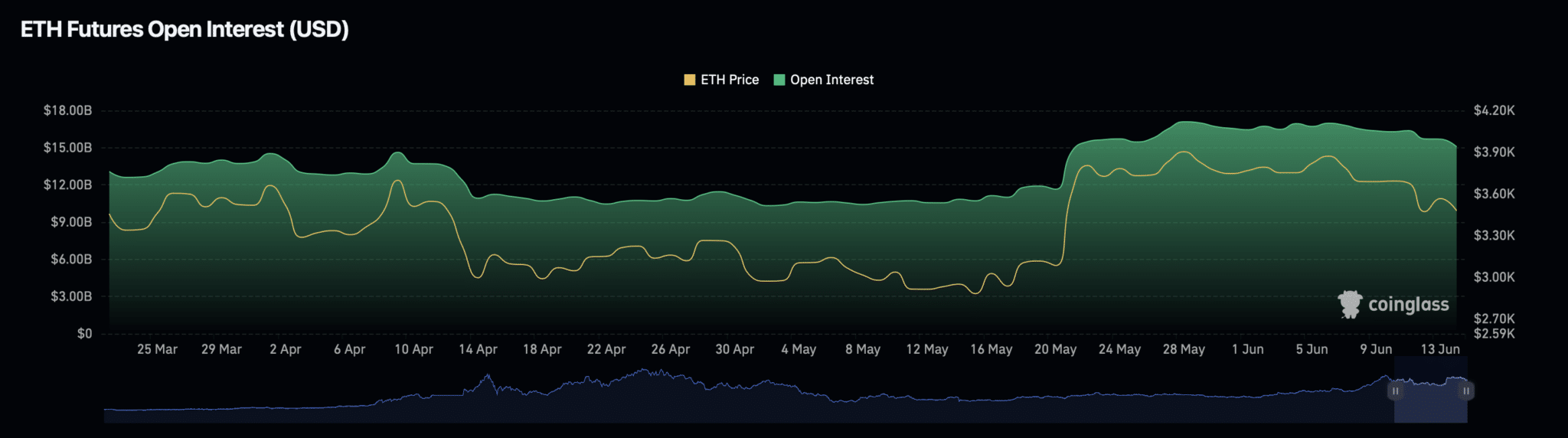

Contrary to this optimistic accumulation, other market indicators present a more cautious scenario. Ethereum’s open interest, a measure of market participation in futures and options, has seen a slight decrease of about 2%, dropping to $15.41 billion.

Additionally, Ethereum’s trading volume has decreased by 25.77%, now totaling $24.19 billion. These figures suggest that while some investors are aggressively accumulating, others remain wary, potentially bracing for further price adjustments.

From a technical perspective, Ethereum’s current price action on the daily chart has triggered a sell setup, indicating potential downward pressure in the near term. However, a more granular view from the 4-hour chart suggests a possible short-term rise to around $3,800, which could provide liquidity for an anticipated continuation of the downtrend.

Exchange Reserves and Future Outlook

Compounding the complex market dynamics is the notable decrease in Ethereum held on exchanges, which has reached an eight-year low according to ETHNews. This decline in exchange reserves, combined with the recent approval of spot Ethereum ETFs by the U.S. Securities and Exchange Commission, might lead to a significant supply shock, potentially catalyzing a sharp increase in Ethereum’s price.

[mcrypto id=”12523″]As the market navigates these varied indicators, Ethereum stands at a pivotal point, with its current trading price at $3,519. The actions of long-term holders and the evolving market conditions will play critical roles in shaping Ethereum’s price trajectory in the coming months.