- Litecoin shows signs of recovery, with a 3% increase in value, trading at $70.58 according to CoinMarketCap.

- Technical analysis suggests possible downtrend for LTC, facing resistance at $71 and support near $70.52.

In the last week, Litecoin (LTC) experienced a rebound in value, generating gains for its investors and showing signs of recovery. This phenomenon raises questions as to whether the increase is due to Litecoin’s own achievements or whether it is simply following in the wake of Bitcoin (BTC), the cryptocurrency market leader, which has also seen increases in its price.

⚡️📈 #Litecoin has had a mild emergence, rebounding back above $70 for the first time since January 22nd. For now, trading volume is rather dormant for the #19 ranked market cap asset. But monitor $LTC, as isolated pumps are often predecessors for $BTC. https://t.co/xViUwnLeOt pic.twitter.com/BO8u1moQNN

— Santiment (@santimentfeed) February 9, 2024

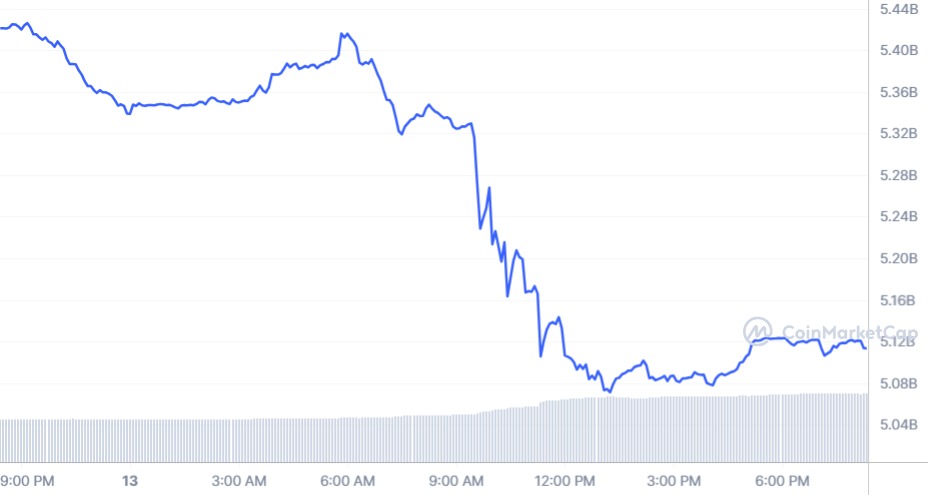

CoinMarketCap data indicates that Litecoin’s price rose more than 3% in the last seven days, trading at $70.58, with a market capitalization exceeding $5.2 billion. While this advance can be interpreted as positive, the influence of Bitcoin on the behavior of altcoins, including Litecoin, must be considered .

In this context, Santiment posted a tweet suggesting the possibility that the increase in Litecoin’s value is a direct consequence of Bitcoin’s gains.

However, looking at Litecoin recent performance, it is noticeable that its uptrend may be coming to an end. According to CoinMarketCap, LTC experienced a slight decline of 0.5% in the last 24 hours.

To understand the future directions LTC could take, it is crucial to examine its metrics and technical analysis.

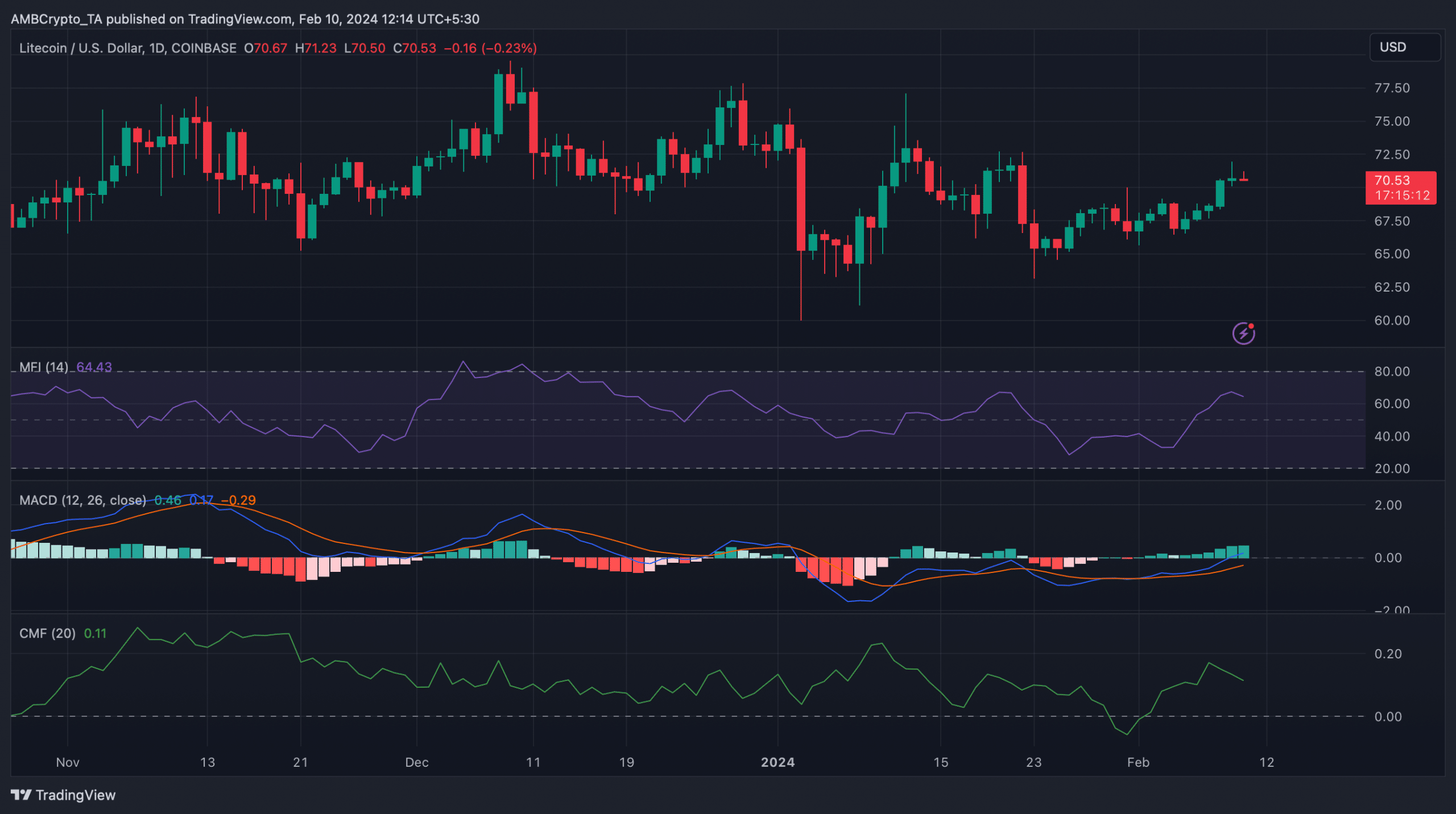

The analysis reveals that LTC encountered solid resistance near the $71 mark, which it failed to overcome over the past week. On the other hand, it has a support level near $70.52.

These indicators suggest the possibility that Litecoin price will continue its downward movement.

In addition, technical analysis of LTC shows that its Relative Strength Index (RSI) has recorded a recent decline, as has its Chaikin Money Flow (CMF). These indicators are key in forecasting a possible continuation of the downtrend, which could lead Litecoin to fall below its current support level.

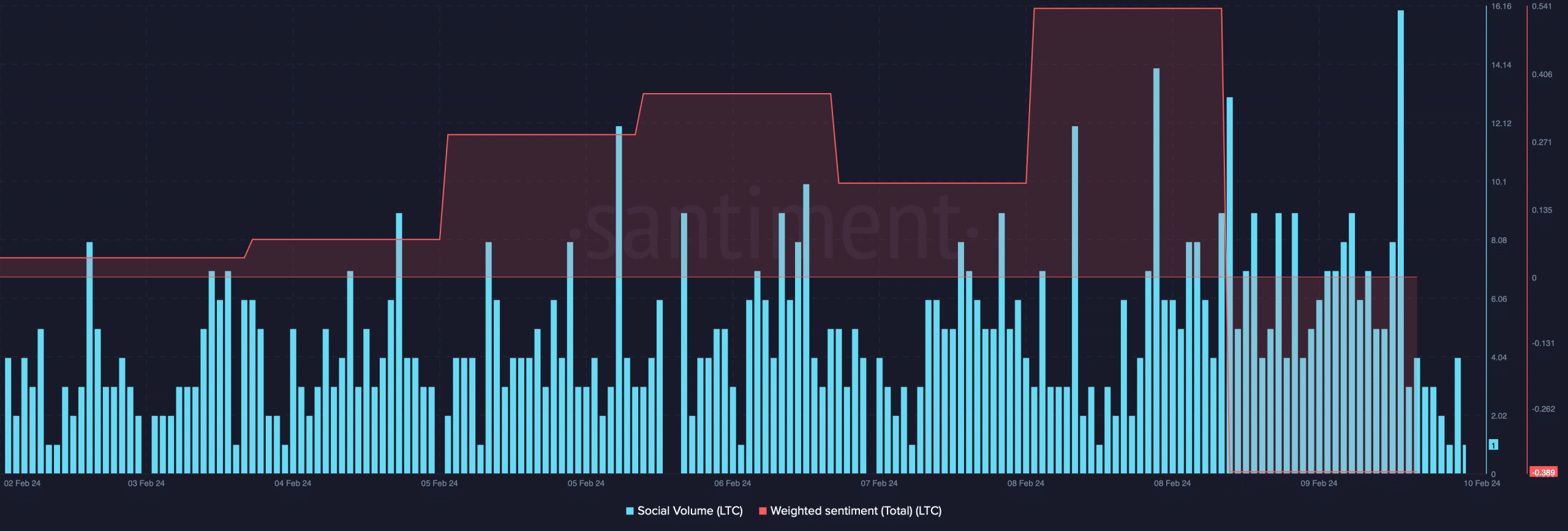

As for market sentiment towards Litecoin, Santiment’s analysis indicates that, after a peak on February 8, 2024, LTC’s weighted sentiment entered a negative zone in the following days.

This shows that overall confidence in LTC is low and investors anticipate a decline in its price. Despite this negative sentiment, Litecoin’s social volume remained high, reflecting its continued popularity and relevance in the cryptocurrency space.

Although Litecoin has seen an increase in value over the past week, technical indicators and market sentiment suggest caution. Bitcoin’s influence on the price behavior of altcoins such as Litecoin is an important factor to consider.

Resistance found near $71 and support at $70.52 are crucial in determining LTC’s future direction. As the market continues to evolve, investors should remain vigilant to these indicators to make informed decisions.