- Binance leads Q2 2024 liquidity rankings with the highest trading volume and market depth.

- Mastercard now allows crypto purchases on Binance, boosting its liquidity and volume.

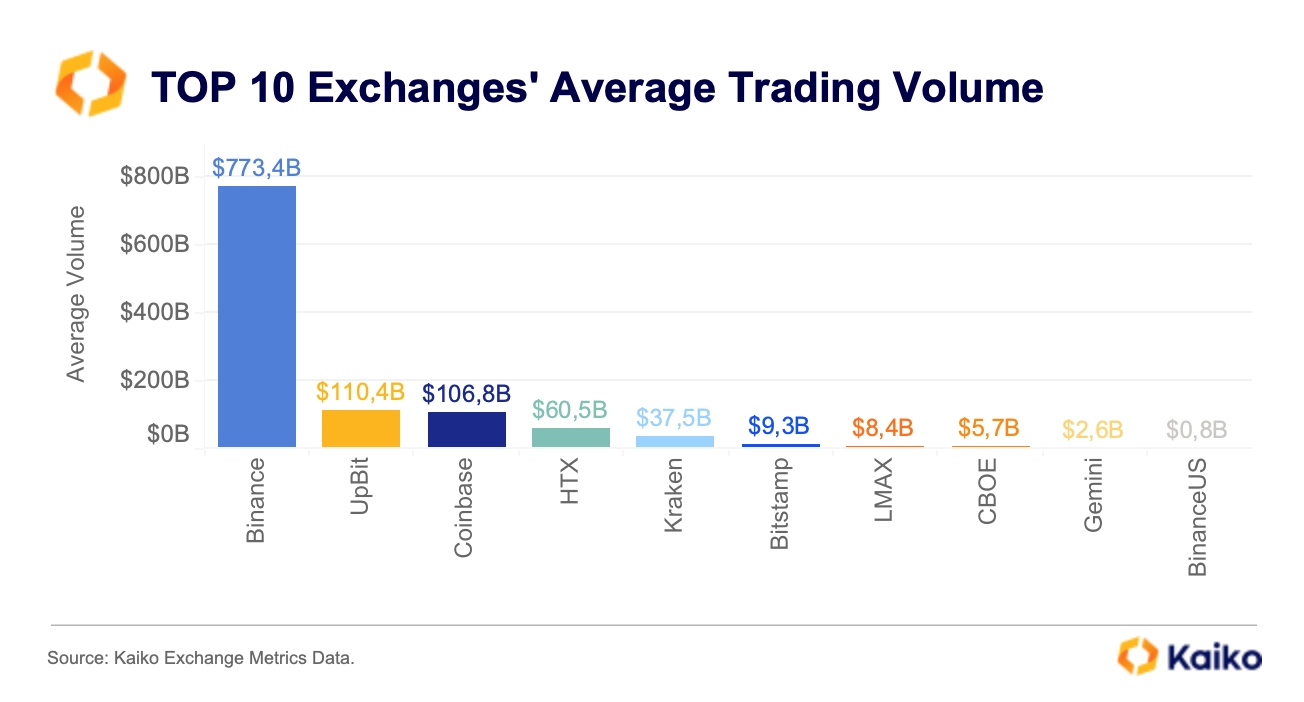

Recent Kaiko analysis indicates that, out of 43 exchanges examined for the second quarter of 2024, Binance continues to be the most liquid cryptocurrency exchange. Coinbase comes in third, and Upbit and HTX tie for fourth place.

The ranking factors were Trading Volume, Volume Contribution, +/-1 Market Depth, Coefficient of Variation (CV) Dispersion Score, and Market Quality Score.

According to Kaiko research, among the 43 exchanges surveyed in Q2 2024, Binance still leads in liquidity, Bybit ranks second, Coinbase ranks third, and UpBit and HTX rank fourth. The criteria include: Trading Volume, Volume Contribution, +/-1 Market Depth, Cofficient of… pic.twitter.com/c42pTojMtR

— Wu Blockchain (@WuBlockchain) June 7, 2024

Key Factors Driving Binance’s Dominance

Binance’s large trading volume, large volume contribution, and broad market depth are what mostly propel it to be the liquidity leader. Because of their trade volumes and market depths, Bybit and Yobit also display strong liquidity rankings.

Nevertheless, their poorer market quality scores—which take into account more factors than only liquidity—can be linked to their lower overall rankings.

Volume largely determines exchange liquidity ranks. Reflecting the liquidity that has already been processed, it provides information about how well an exchange can manage a lot of trading activity.

In this sense, Binance is exceptional; over the last three months, it has had the largest average trading volume.

Comparing Top-Ranked Exchanges

Both liquidity and trading volume are tops for Binance among the top 10 exchanges for Q2 2024. Remarkably, Upbit, a South Korean exchange, ranks 10th overall, despite being behind Binance in terms of trade volume.

The small executive team of Upbit—just one member has been named—helps to explain some of its poor ranking.

Remarkable is the volume disparity between Upbit and Binance. Having four times the trading volume of Upbit, Binance provides twice as many assets. The range of assets that Binance offers perhaps helps explain why it is the leader in volume and liquidity.

Mastercard’s Crypto Integration

On the other hand, ETHNews reported that Mastercard has started enabling its customers to buy a variety of cryptocurrencies on Binance, including Bitcoin, XRP, and Shiba Inu. Expectedly, this action will increase Binance’s trading volume and liquidity even more.

As of writing, Binance Coin (BNB) is valued at about $688.33, down 2.55% over the last 24 hours, according to CoinGecko data. Over the last seven days, nevertheless, BNB has demonstrated a bullish tendency, rising 15.67%.

[mcrypto id=”51355″]