- Bitcoin halving could increase the valuation of ETFs by increasing scarcity and demand for Bitcoin.

- Renewed institutional interest in Bitcoin post-halving could improve the liquidity and attractiveness of Bitcoin ETFs.

The halving of Bitcoin, known as ‘halving’, is an event that has historically had a significant impact on the price of Bitcoin, and thus could have a considerable influence on Bitcoin ETFs.

As we approach another halving event in April, it should be understood how this scheduled reduction in block reward affects not only the Bitcoin market but also associated financial products, such as ETFs based on this cryptocurrency.

First, halving tends to increase Bitcoin scarcity by halving the rewards miners receive for validating transactions and creating new blocks. This increase in scarcity has, in previous events, led to an increase in the price of Bitcoin due to a combination of positive expectation and real demand.

Bitcoin’s price is located at the threshold between the upper scarlet band and the blue True Market Mean Price of the crypto market. Historically, during market peaks, the price has managed to stay above this blue average.

Based on our positioning within the current cycle, there is a high probability to Bitcoin climbing to $70,000 or even higher before its value drops below $30,000.

Optimistic Signals for Bitcoin

Signs indicate a good bullish climate for Bitcoin, suggesting that it could reach $70,000. This optimism is supported by several factors such as the favorable macroeconomic environment, the U.S. election cycle, and a growing interest from traditional finance investors towards Bitcoin ETFs.

Despite slower than expected price action so far this year, history shows that Bitcoin has experienced rallies in 10 of its 13 years of existence, although January returns are more mixed.

A year ago, signals rightly indicated that Bitcoin would double in value, reaching $45,000 by the end of 2023. Although some predictions of spot ETF approval failed to materialize in January, a correction in price toward the mid-to-upper $30,000 area was anticipated for that month.

At the same time, it was noted that despite the Fed delaying the first rate cut until May or June, inflation is declining and growth remains stable.

The Connection Between Election Cycles and Bitcoin Value

The report also highlights the correlation between U.S. presidential election cycles and Bitcoin halving years, which historically have been positive for the cryptocurrency’s price.

In fact, Bitcoin posted gains of 152% in 2012, 121% in 2016 and 302% in 2020, with an average 192% increase. These data reinforce the idea that we are in a promising moment for Bitcoin investment, supported by a number of macroeconomic and political factors.

Impact of the Price Increase on Bitcoin ETFs

Bitcoin ETFs, an increase in the price of Bitcoin could result in a higher valuation of assets under management, attracting more investors interested in capitalizing on expected price appreciations.

This interest comes not only from individual investors but also from institutions looking to diversify their portfolios with digital assets. For Bitcoin ETFs, this interest could mean an increase in trading volume and greater liquidity, making it easier for investors to enter and exit positions.

Market Evolution and Diminishing Halving Impact

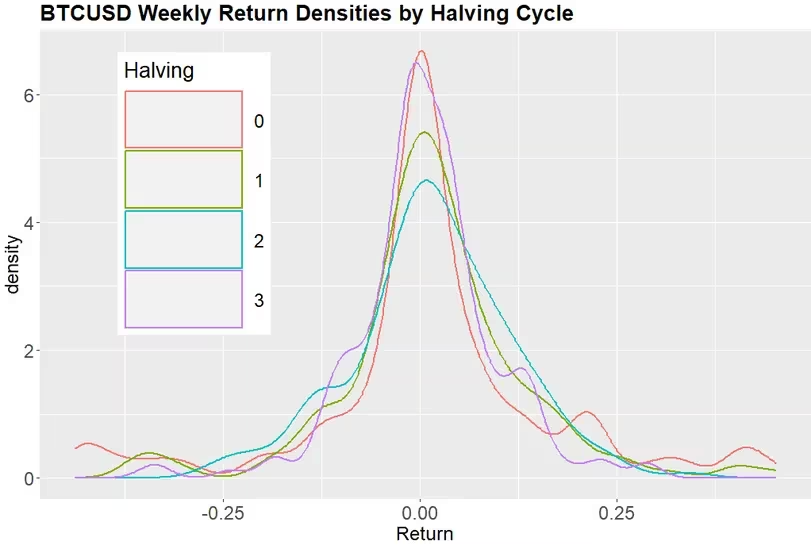

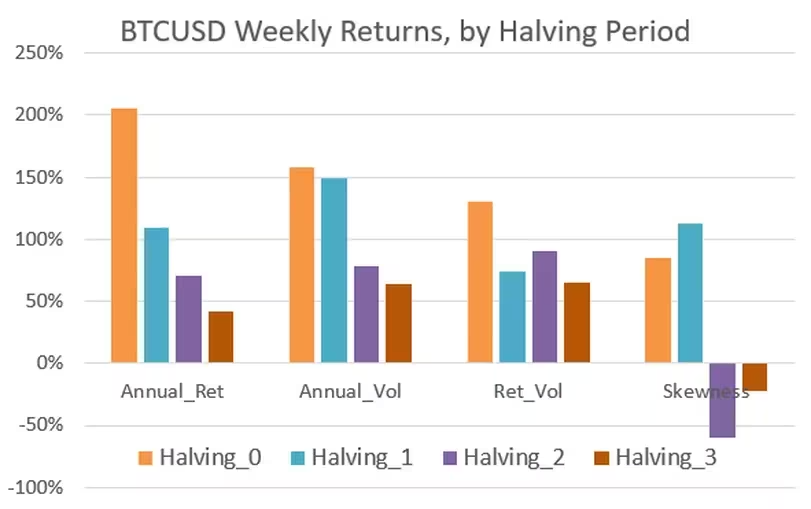

It is important to note that, according to Todd Groth of CoinDesk Indices, the effect of halving on the price of Bitcoin has diminished over time. This suggests that, while halving remains an important event, investors and markets are becoming more sophisticated and possibly less sensitive to these predictable events.

For Bitcoin ETFs, this means that, while they can expect a positive impact from halving, the degree of this impact could be minor compared to previous events.

The maturation of the Bitcoin market, with a narrower distribution of returns and a decrease in volatility, indicates a shift from a highly speculative asset to a more established and accepted one.

Challenges and Opportunities for Bitcoin ETFs as the Market Evolves

The evolution of the market toward the inclusion of new protocols and tokens, and the eventual transition of Bitcoin mining toward exclusive reliance on transaction fees, presents both challenges and opportunities for Bitcoin ETFs.

The upcoming Bitcoin halving will likely have a positive impact on Bitcoin ETFs, driving both the price of the underlying asset and interest in related financial products. However, the magnitude of this impact is uncertain, given the maturation of the market and the evolving profiles of Bitcoin holders.

Bitcoin ETF investors should remain vigilant to market trends and consider halving as one of several factors that may influence the cryptocurrency market in the near future.