- Bitcoin prices plummeted by 3% to $64,000 after the Fed meeting, triggering over $56 million in liquidations.

- Fed Chair Jerome Powell hints at potential 25 bps rate cut in September, depending on July’s inflation data.

Following the recent Federal Reserve meeting, where interest rates remained steady at 5.25-5.5%, Bitcoin experienced a significant price drop, falling by 3% to $64,000.

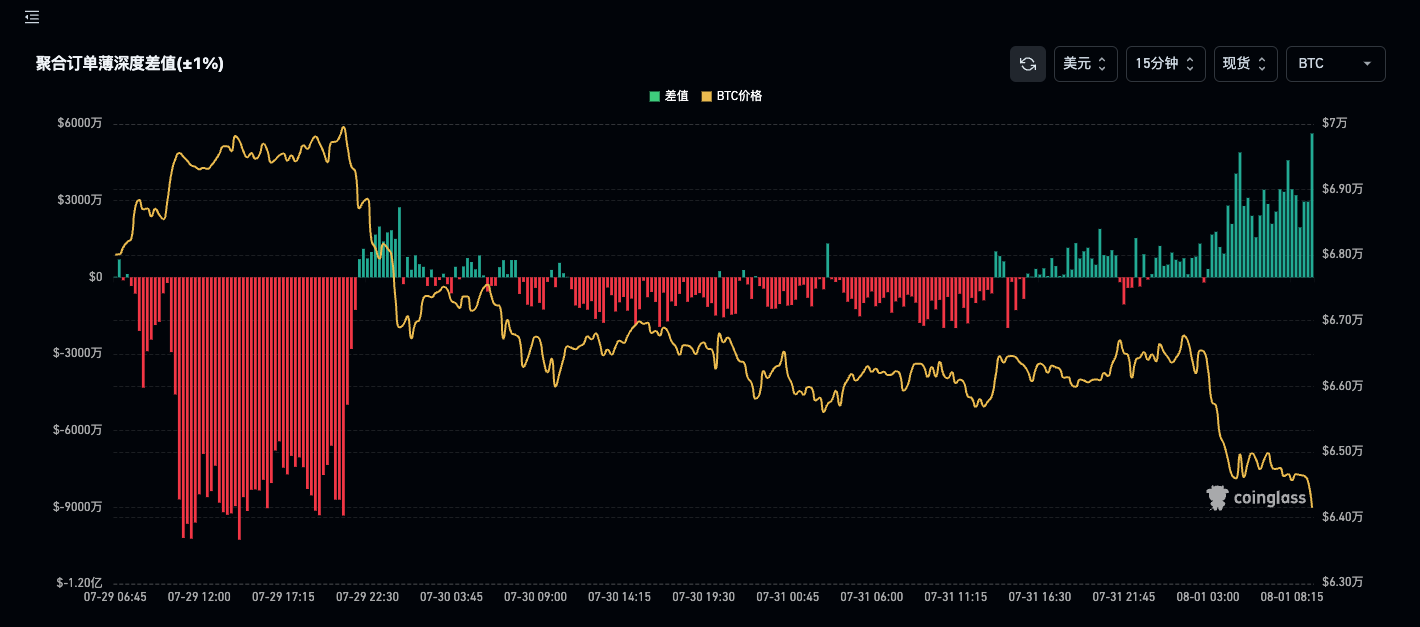

This downturn has triggered a surge in Bitcoin liquidations, totaling over $56 million within the last 24 hours.

During the meeting, Fed Chair Jerome Powell indicated the possibility of a 25 basis point rate cut in September, contingent on forthcoming inflation data aligning with expectations. Although this announcement aligned with market predictions, it led to a sell-off in the cryptocurrency market.

The Federal Reserve decided to hold interest rates steady at about 5.3% — a two-decade high where they have remained for a year now. Jerome Powell, the Fed’s chair, said at a news conference that a rate cut “could be on the table” at its next meeting. https://t.co/5holxMDFCD pic.twitter.com/7c4RITXKQY

— The New York Times (@nytimes) July 31, 2024

This reaction was not limited to Bitcoin; altcoins also faced substantial selling pressure, resulting in market-wide liquidations worth $193 million. Bitcoin and Ethereum accounted for more than half of these liquidations.

Specifically, Coinglass reported Bitcoin long liquidations of $45 million and short liquidations of $10.94 million. Ethereum saw $55 million in liquidations, 80% of which were long positions. Concurrently, Ethereum’s price fell by 3.3%, dipping below $3,200.

#Bitcoin liquidation heatmap (1 month)

Heatmap brighter liquidity cluster at $63460 and $70380.

👉https://t.co/Nu9kTJMzy2 pic.twitter.com/T3Cx0ftdkW

— CoinGlass (@coinglass_com) August 1, 2024

Adding to the market turmoil, the crypto exchange Mt. Gox announced on July 31 that it had commenced Bitcoin and Bitcoin Cash repayments, distributing assets to over 17,000 creditors in the past month.

UPDATE: MT. GOX MOVES $3.1B BTC

Last night Mt. Gox addresses moved 33.96K BTC ($2.25B) to addresses we believe are most likely BitGo:

bc1q26tsxc0ge7phvcr2kyczexqf5pcj8rk79cqk90h34c30dn9dskeq3gmw3f

bc1q48a5tjhdjtkfv8zv6tj68767h8lgep9dpx0emrkx0yhhmum7wscs95ft36BitGo is the 5th… pic.twitter.com/XWNiZ2boAN

— Arkham (@ArkhamIntel) July 31, 2024

In addition to these market movements, prominent Bitcoin critic Peter Schiff commented on the potential rate cut. He expressed skepticism about the effectiveness of a prospective September rate cut in reaching the Fed’s 2% inflation target.

Schiff argued that if Powell lacks confidence now, it is unlikely that confidence levels will improve by September. He suggested that delaying the rate cut might be intended to create an illusion of control over inflation, which he believes will not return to 2% soon.

If #Powell is not confident that #inflation is headed to 2% now, there is no reason that he would gain that confidence by Sept. Powell likely knows there's no way inflation is headed back down to 2%. So he's waiting until Sept. to cut rates to fool investors into believing it is.

— Peter Schiff (@PeterSchiff) July 31, 2024

Simultaneously, altcoins suffered even more significant losses. For instance, Solana’s price dropped by 6.6%, mirroring a similar decline in XRP, despite its 30% rally in July fueled by optimistic outcomes in the Ripple SEC lawsuit settlement discussions.

This week’s financial activities underscore the high volatility and reactive nature of cryptocurrency markets to economic announcements and regulatory news, reflecting a complex interplay of investor sentiment, regulatory actions, and broader economic indicators.