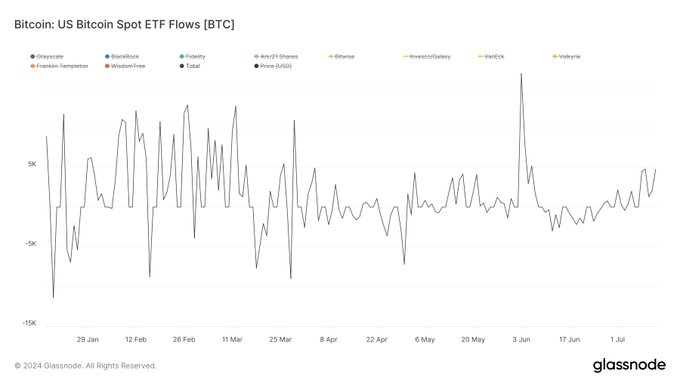

- Bitcoin ETFs have accumulated investments of $16.35 billion since January 2024, reflecting growing trust and market potential.

- Recent investment influx coincides with Bitcoin’s price recovery; ETFs now hold 888,607 Bitcoin, 4.5% of total circulation.

Bitcoin ETFs have gathered a total of $16.35 billion in investments since their inception in January 2024, coinciding with an increase in Bitcoin’s market price. These funds, which allow investors to trade shares linked to Bitcoin’s market value, recorded an influx of $1.05 billion in the week ending July 15th.

This sharp rise in investments is indicative of growing trust in Bitcoin’s stability and potential for growth, attracting attention from both individual and institutional investors.

Bitcoin’s Price Recovery

As we point out in ETHNews, the recent influx into Bitcoin ETFs aligns with Bitcoin’s recovery in market price, suggesting that the ETFs are influencing Bitcoin’s market dynamics positively.

With Bitcoin ETFs now holding 888,607 Bitcoin, they account for approximately 4.5% of the total Bitcoin in circulation. This extensive holding underscores the significant role ETFs play in the cryptocurrency market.

Germany’s Influence on Bitcoin’s Market

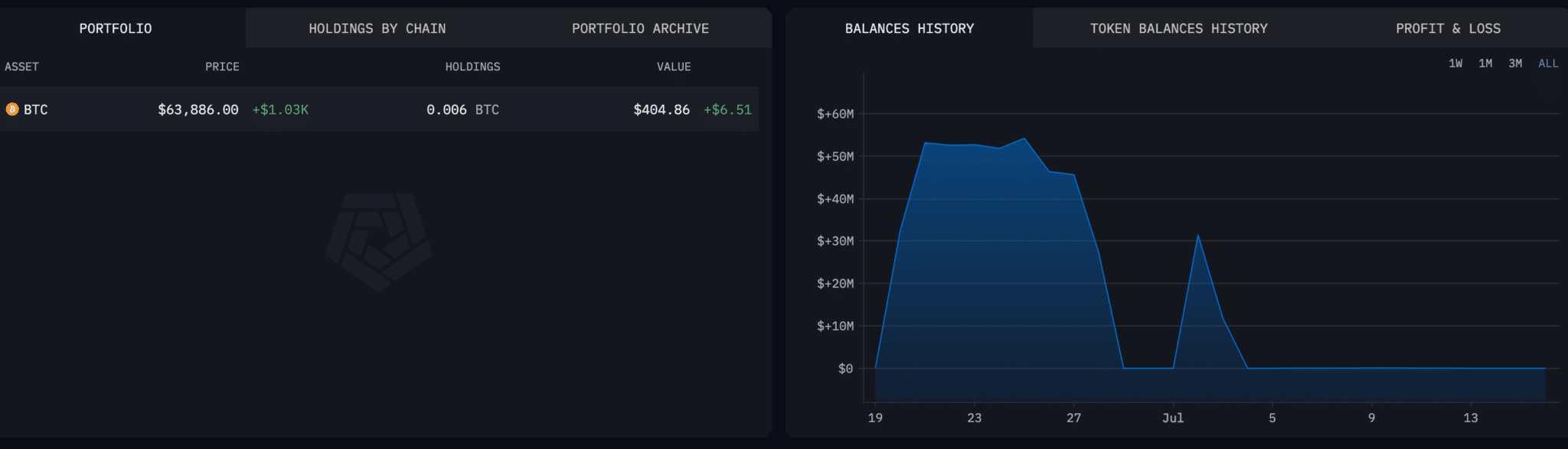

Additionally, the market absorbed a major sell-off by Germany, involving around $3 billion worth of Bitcoin, which had initially caused a dip in Bitcoin’s price.

Following this event, there was a modest inflow of about $420 back into Bitcoin, spread over several small transactions from various sources.

These transactions, some with references to public figures or containing messages, indicate a small but symbolic participation by individuals in reaction to government actions.

Current Market Conditions

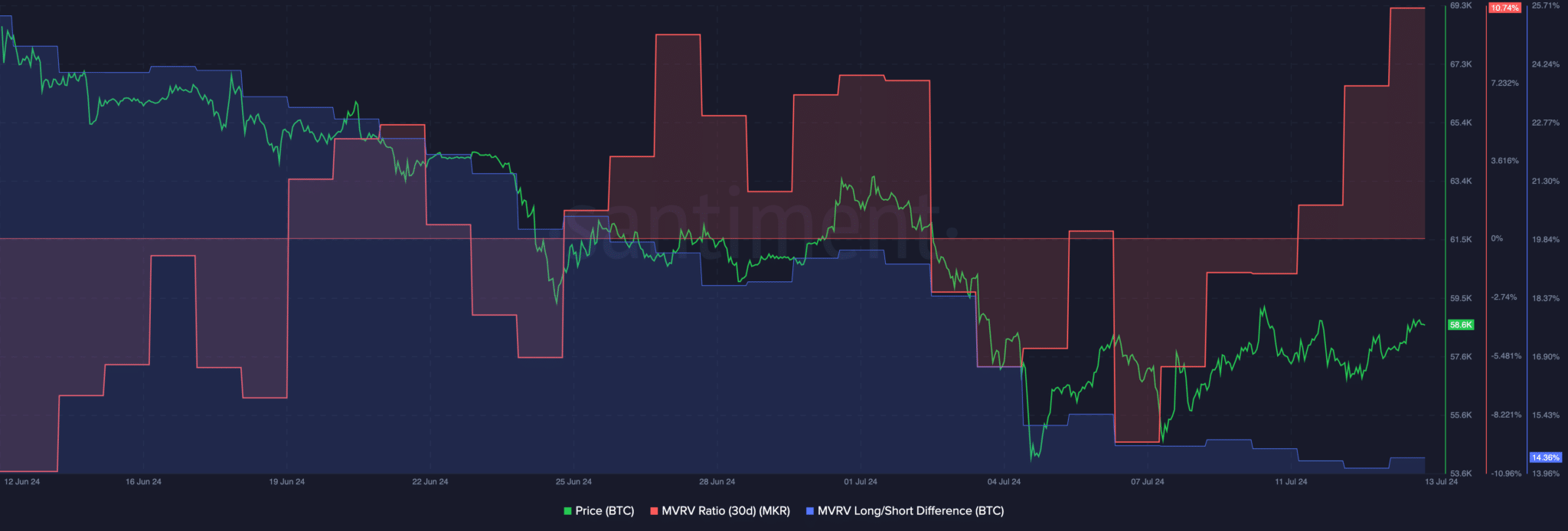

[mcrypto id=”12344″]As of the latest update, Bitcoin is trading at $64,882.81, showing a slight increase of 1.53% in the last 24 hours.

The increase in Bitcoin’s MVRV ratio suggests that many holders are currently in a profitable position, which, while potentially boosting market sentiment, might also lead to increased selling pressure as investors may choose to realize their gains.

The continual investment in Bitcoin ETFs and the interactions between investor sentiment and market actions will be crucial in shaping Bitcoin’s pricing and market stability in the foreseeable future.