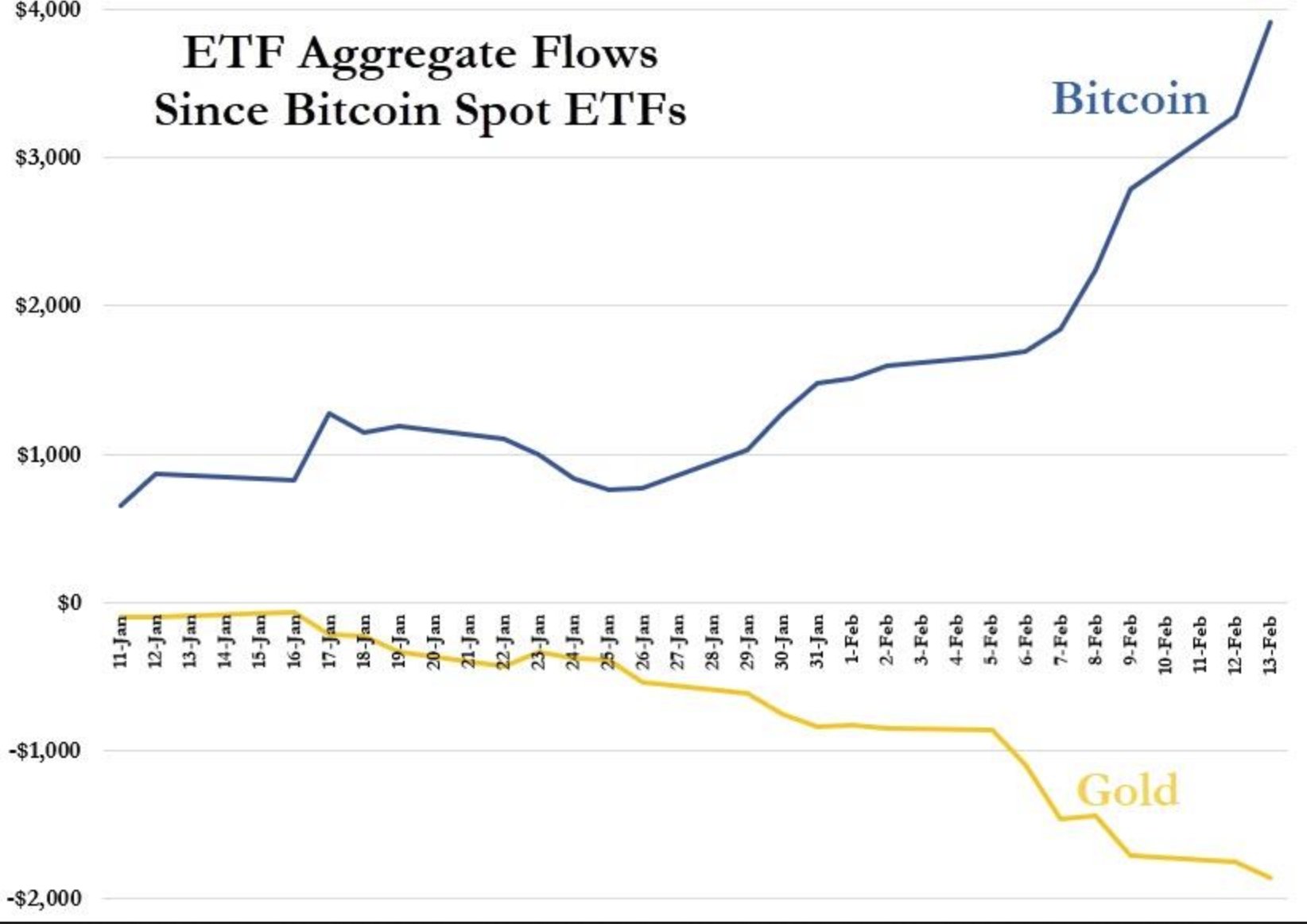

- Bitcoin spot ETFs capture investor interest, adding $3.89 billion in capital versus outflows in gold.

- Gold declines 3.4% in value this year, while Bitcoin grows 23.5%, highlighting shifts in investment preferences.

The year 2024 has marked an interesting shift in investor preferences, highlighting especially in the gold and Bitcoin exchange-traded funds (ETFs) sector.

As we watch $2.4 billion exit gold ETFs, spot Bitcoin ETFs captured the attention of new investors, reflecting an adjustment in investment strategies worthy of exploration.

Let’s Focus Initially on Gold

Historically, it has been considered a safe haven in times of economic uncertainty. However, this year, we have witnessed significant fund outflows from major gold ETFs, particularly iShares products.

This situation sends a warning signal about a change in the perceived safety and value of gold. On theother hand, spot Bitcoin ETFs, which recently received the green light, are experiencing a surge in investments, totaling $3.89 billion in new capital and recording record trading volumes .

What is driving this turn in investment trends?

This does not simply boil down to a transfer of funds from gold to Bitcoin. What we are witnessing is a more complex system, where the search for fresh investment opportunities and the revaluation of Bitcoin against gold play key roles.

The attraction to U.S. stocks and the fear of being left out of what’s hot also play a role in this shift, notes Bloomberg Intelligence’s Eric Balchunas.

This comes at a time when gold has declined 3.4% in value since the start of the year, hitting a two-month low. In contrast, Bitcoin has experienced a 23.5% rise in the same span, reaching levels not seen in two years. This difference in the trajectory of both assets not only reflects market variations but also a change in how investors value these assets.

Contrary to expectations that gold would outperform Bitcoin this year, current events suggest another reality. The struggle to be seen as the asset of choice in times of economic instability and geopolitical conflict has intensified.

While Bitcoin and gold share characteristics as stores of value, it is clear that investment dynamics are being redefined, with Bitcoin attracting those interested in diversifying their portfolios beyond conventional assets.

The complexity between the performance of these two assets signals a broader shift in the investment market. With long-term Treasuries and the U.S. dollar facing challenges of their own, many investors are adjusting their investment strategies.

So what implications does this change in direction have for the future of gold and Bitcoin? While some see Bitcoin as a fad, others see it as a breakthrough in the search for security and value.

We are at a turning point, where investment decisions are based not only on historical returns but also on expectations of future stability and growth.

It looks like another classic pump-and-dump is going on with #Bitcoin and the @exchangeETF. The four-day conference kicked-off on Super Bowl Sunday and ends on Valentine's Day. There's a lot of hype surrounding the newly listed #BitcoinETFs. I wonder when the massacre will begin.

— Peter Schiff (@PeterSchiff) February 12, 2024

This situation also raises questions about the position of traditional gold investors such as Peter Schiff, known for his criticism of Bitcoin. The irony of this shift does not go unnoticed, especially when looking at the graphical comparisons between the two assets shared by leading figures in the Bitcoin sector.