- Recent U.S. Bitcoin ETFs attracted $700 million in investments, countering GBTC’s declining outflows, as per CoinShares data.

- Leading ETFs by BlackRock and Fidelity reported weekly inflows of $884 million and $674 million, respectively.

In the realm of United States Bitcoin exchange-traded funds (ETFs), a recent phenomenon has enticed a substantial influx of fresh capital, surpassing a backdrop of declining outflows that had been plaguing Grayscale’s GBTC fund, as illuminated by insights from CoinShares.

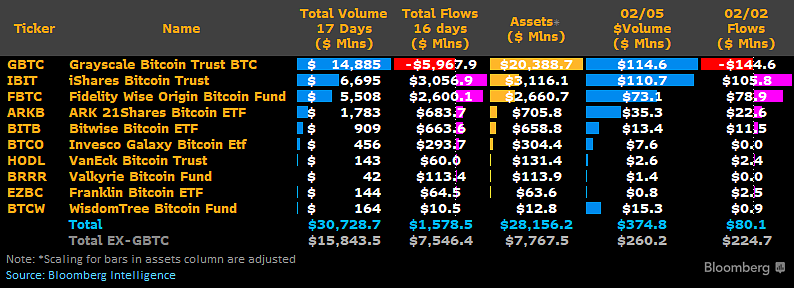

Prominent ETFs overseen by the BlackRock and Fidelity behemoths have divulged weekly injections of $884 million and $674 million, correspondingly. In contrast, GBTC has encountered a conspicuous ebb in outflows, plummeting from a staggering $2.2 billion in the prior week to a more modest $927 million.

This development has stirred disquiet and ignited fervent discourse within the sphere of investors and cryptocurrency analysts, particularly among ardent aficionados of Bitcoin.

A Look at Grayscale’s Holdings

According to reports, Bitcoin holdings in Grayscale have decreased from 619,000 BTC in January to 478,000 BTC. This reduction has caught the attention of cryptocurrency experts as Grayscale is one of the major players in the cryptocurrency investment market.

The decline in Grayscale’s holdings has coincided with the introduction of Bitcoin spot ETFs (Exchange-Traded Funds) in the United States. This new investment option has captured the attention of investors worldwide and has brought about a shift in the cryptocurrency sector.

An interesting aspect of this situation is that while Grayscale has seen a decrease in its holdings, investment giants like BlackRock and Fidelity have actively been absorbing the outflow of funds. It is reported that BlackRock’s holdings now amount to a staggering $3.2 billion in Bitcoin.

A Grim Forecast for Grayscale?

With $26 billion still held in the Grayscale Bitcoin Trust (GBTC), some analysts have projected a doomsday scenario for Grayscale. If the sale of Bitcoin continues at the current rate, they estimate that Grayscale could deplete its holdings in 176 days, potentially leading to its demise as one of the major players in the cryptocurrency investment market.

Success of Bitcoin Spot ETFs

On the other hand, Bitcoin spot ETFs in the United States have had a successful start. In less than a month since their launch, these ETFs have accumulated $7.7 billion in funds, surpassing the $6 billion outflows from funds like the Grayscale Bitcoin Trust (GBTC).

Leaders in Fund Inflows

Two of the Bitcoin spot ETFs, Fidelity’s Wise Origin Bitcoin Fund (FBTC) and BlackRock’s iShares Bitcoin Trust (IBIT), have experienced substantial inflows. FBTC has recorded positive inflows totaling $2,600.1 million, while IBIT boasts $3,059.9 million in the same period. These numbers indicate strong investor interest in these new Bitcoin investment options.

Change in Outflow Trends

It is important to note that despite initial concerns about outflows from Grayscale’s funds, the figures indicate that the pace of outflows from the Grayscale Bitcoin Trust (GBTC) is decreasing. Grayscale has reported a reduction in outflows over the past two weeks, suggesting a stabilization in fund flows.

Grayscale’s situation raises questions about the future of cryptocurrency investment and the competition faced by traditional investment funds in this new landscape of Bitcoin spot ETFs.

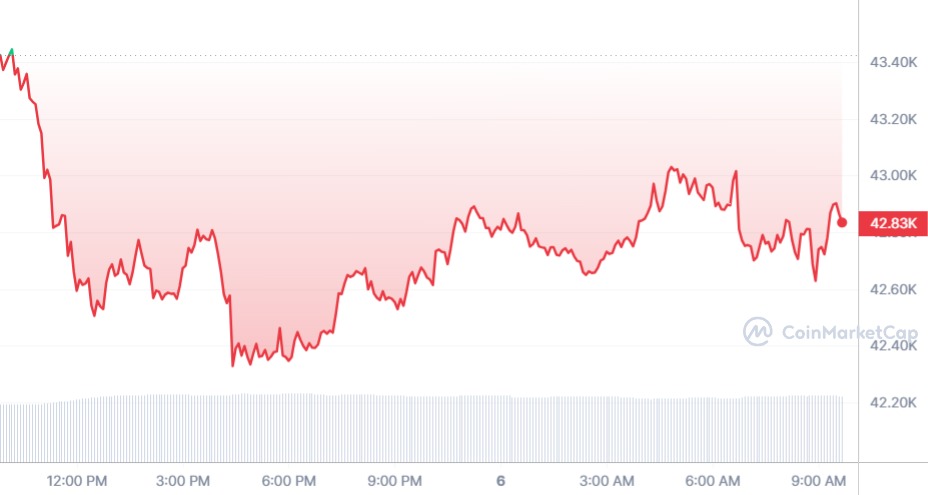

As of now, Bitcoin price stands at $42,836, and these developments have sparked a renewed interest and debate within the crypto community, leaving many to speculate on the future trajectory.

Investors and analysts continue to closely monitor market trends and how the cryptocurrency sector will evolve in the coming months. The entry of new participants and the emergence of alternative investment options make it an exciting and challenging field for both investors and institutions alike.