- GBTC outflows exceed $100 million, while inflows into Bitcoin ETFs from BlackRock and Fidelity increase.

- Optimism in the market is reflected in the Bitcoin price, surpassing $46,000 in anticipation of the halving event.

A detailed look at recent activity shows how investors are redeploying their assets, potentially marking a shift in the perception of value and safety in the cryptocurrency sector.

Fluctuations in GBTC and Bitcoin ETFs

In recent days, the Grayscale Bitcoin Trust (GBTC) experienced an increase in outflows, surpassing $100 million on Thursday, February 8, reaching a total of $102 million in outflows .

In parallel, there was a notable increase in inflows into spot Bitcoin ETFs, particularly from two industry giants BlackRock and Fidelity. On Thursday, flows into these ETFs reached $403 million, the highest amount on record in February.

BlackRock, with its IBIT ETF, led this movement with more than $204 million in inflows, while Fidelity, with its FBTC ETF, followed with nearly $128 million. This pattern reflects how these two players dominate the Bitcoin spot ETF investment landscape since launch.

Solid volumes all around today but $IBIT topped the group. pic.twitter.com/S8R5IbCyC4

— James Seyffart (@JSeyff) February 8, 2024

Bitcoin Market Optimism

Despite the GBTC outflows, the mood in the cryptocurrency market remains upbeat. Total net flows showed an increase to $2.1 billion, evidencing investor confidence in Bitcoin ETF products.

This optimism has been reflected in the Bitcoin price, which surpassed the $46,000 mark, reaching its highest point in a month. This increase is associated with consistent flows into Bitcoin ETFs and anticipation of the upcoming halving event scheduled for April.

Caroline Mauron, co-founder of Orbit Markets, suggests that Bitcoin could continue its uptrend following the slowdown in Grayscale outflows. Mauron anticipates that the narrative around halving will gain traction, possibly pushing Bitcoin beyond $50,000 in the coming weeks.

Bitcoin Futures and Options Indicators

Recent data indicates that the BTC futures premium reached a three-week high on February 8, crossing the 10% threshold that marks bull markets. This indicator suggests moderate optimism, providing support for Bitcoin to hold its $45,000 support level.

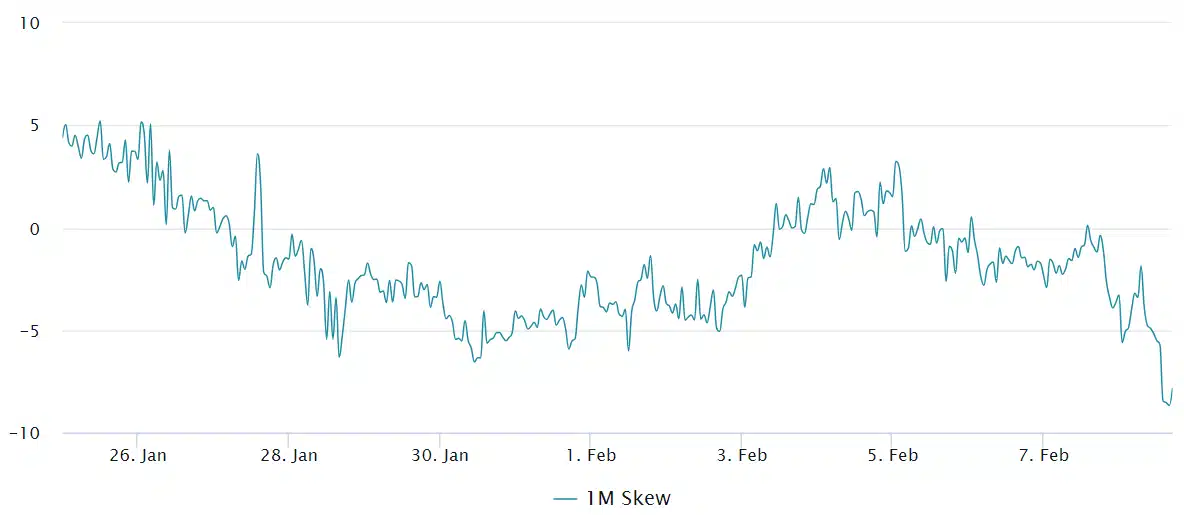

After Bitcoin’s price took off above $45,000 on February 8, the 25% tilt in BTC options entered bullish territory for the first time in two months, reaching the -7% range.

This level, similar to the BTC futures indicator, denotes moderate optimism, highlighting concerns over deteriorating macroeconomic conditions that could negatively impact the Bitcoin price.

Recent movements in capital flows between GBTC and Bitcoin ETFs, along with the increase in the Bitcoin price, underscore a time of adjustment and reassessment by investors in the cryptocurrency market.

Anticipation of halving and indicators from futures and options suggest a potentially bullish path for Bitcoin, despite macroeconomic uncertainties.