- Bitcoin ETFs face record outflows, with $937M in withdrawals, signaling investor caution amid price correction and economic concerns.

- BlackRock’s $160M Bitcoin outflow adds to growing selling pressure, with institutional investors shifting assets as market volatility rises.

Bitcoin holders closely monitor recent market movements as BlackRock’s ETF experiences outflows. With institutional interest dropping in the U.S., these developments raise concerns of a potential sell-off. Bitcoin’s recent price correction, falling under $88,500, signals the possibility of further volatility, making investors uneasy.

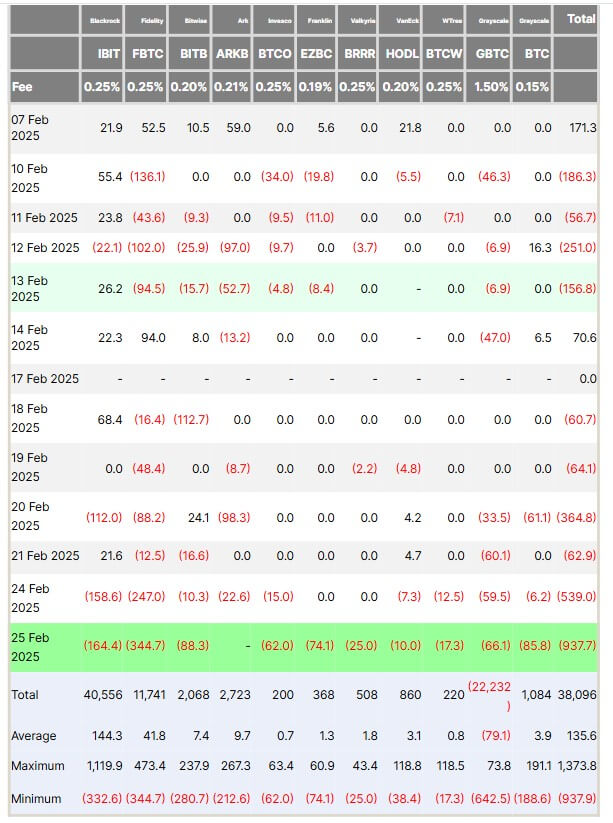

Spot Bitcoin ETFs in the United States have faced a major setback, recording six ongoing days of outflows. On February 25, 2025, net outflows hit $937 million, the largest single-day outflow since the ETFs’ inception. Fidelity’s FBTC and BlackRock’s IBIT were the leading funds in these withdrawals, with $344 million and $144 million in outflows, respectively.

For the first time, Bitcoin ETFs saw a daily trading volume surge of 167%, reaching $7.74 billion, but outflows continued to dominate, signaling investor doubt. The cumulative outflows from Bitcoin-backed exchange-traded products (ETPs) now total $1.7 billion for the week, contributing to a wider market downturn.

BlackRock’s $160 Million BTC Outflow Raises Concerns

One of the additional developments is BlackRock’s movement of $160 million worth of Bitcoin. This massive withdrawal has fueled speculation about a sell-off in the making. As one of the largest asset management firms globally, BlackRock’s moves often profoundly impact market sentiment. The outflow from BlackRock’s ETF, alongside similar trends in other funds, suggests a more cautious stance from institutional players.

As noted in our previous post, Bitcoin’s price struggles below the $90,000 mark have contributed to investors’ heightened caution. This drop is compounded by broader economic concerns, including rising inflation and potential new taxes proposed by the Trump administration. These concerns, reflected in a declining U.S. consumer confidence index, further undermine investor optimism.

With the possibility of inflationary pressure due to tariffs on Canadian and Mexican goods, the Federal Reserve is expected to maintain higher interest rates, making speculative assets like Bitcoin less attractive in the near term.

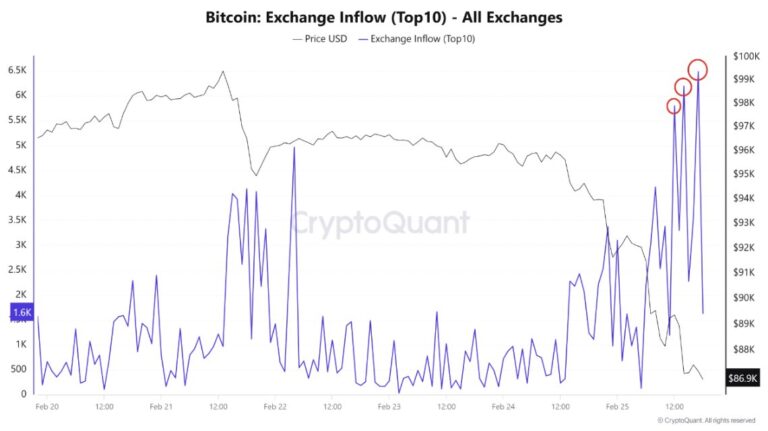

Increased Exchange Activity Signals Potential Selling Pressure

Increased Bitcoin exchange activity also suggests investors are preparing for further downward pressure. The “Exchange Inflow (Top 10)” metric exceeded 5,000 BTC multiple times in a single day, showing transfers of Bitcoin to exchanges. This trend is typically associated with selling, as large holders may be preparing to liquidate their positions. On-chain data supports this, with a notable shift of Bitcoin moving from wallets to exchanges, signaling increased selling pressure.

According to Santiment’s on-chain data, whale holdings are also decreasing, signaling a reduction in institutional Bitcoin positions. This trend matches the net outflows in spot Bitcoin ETFs, which have seen 12 outflows in the last 16 trading days, amounting to approximately $2.41 billion since February.

While some analysts suggest this is a short-term correction, the persistent outflows and shifting on-chain metrics indicate that Bitcoin holders should remain watchful. As more institutional funds move out of Bitcoin ETFs, market participants question whether a larger sell-off is looming.