- The adjustment mechanism maintains a consistent block time of about 10 minutes, despite hashrate fluctuations.

- Increased difficulty dilutes individual miners’ earnings as more computing power joins the network.

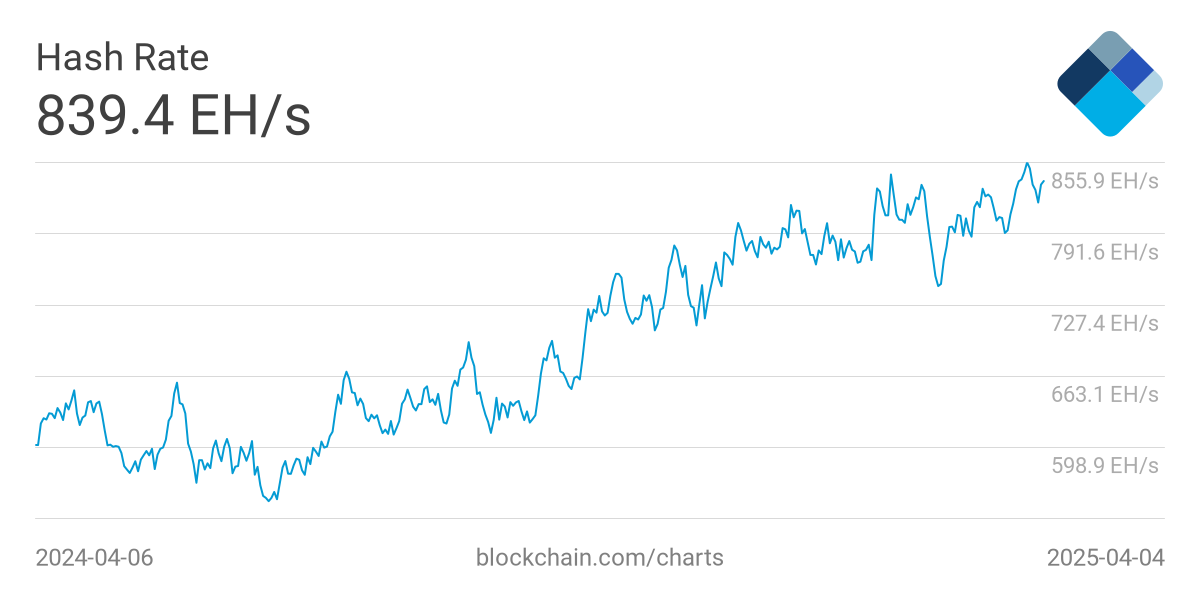

On Saturday, the Bitcoin network is poised to undergo a significant change that will result in a 5% increase in mining difficulty. This adjustment, which is the highest recorded to date, will heighten the challenge faced by miners engaging with the world’s foremost cryptocurrency.

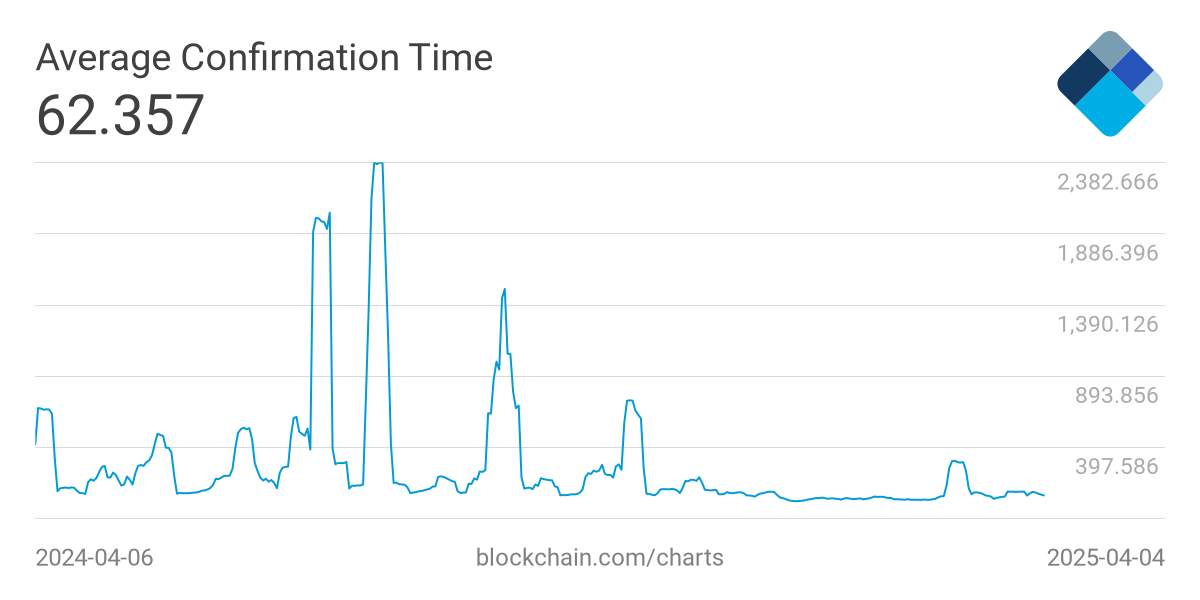

The term “Difficulty” within the Bitcoin ecosystem refers to the complexity of the computations miners must solve to record transactions on the blockchain. This mechanism adjusts biweekly in response to fluctuations in the network’s total computing power, or hashrate, ensuring that the average time to mine a block remains about 10 minutes.

This automated system was embedded into Bitcoin’s code by its pseudonymous creator, Satoshi Nakamoto. The primary objective of this feature is to maintain a consistent mining pace, regardless of any increases in hashrate.

The upcoming adjustment is set to increase the Difficulty to 120.17 trillion hashes, surpassing the previous high of 114.16 trillion hashes observed in February. This change is in response to the miners’ enhanced performance, with recent data showing blocks being mined at an average of 9.47 minutes.

Miners primarily earn through the block subsidy, a set amount of Bitcoin awarded for each block mined. However, as Difficulty increases, the same amount of Bitcoin is distributed among a larger pool of computing power, effectively diluting individual miners’ earnings.

Potential Outcomes for Miners

With the Difficulty set to rise sharply, miners may face reduced profitability, prompting some to cease operations temporarily. This adjustment could lead to a short-term decline in hashrate unless offset by an increase in Bitcoin prices, which would improve earnings in dollar terms. The network’s ability to adapt to rapid changes in miner activity showcases the robustness of the decentralized system envisioned by Nakamoto.

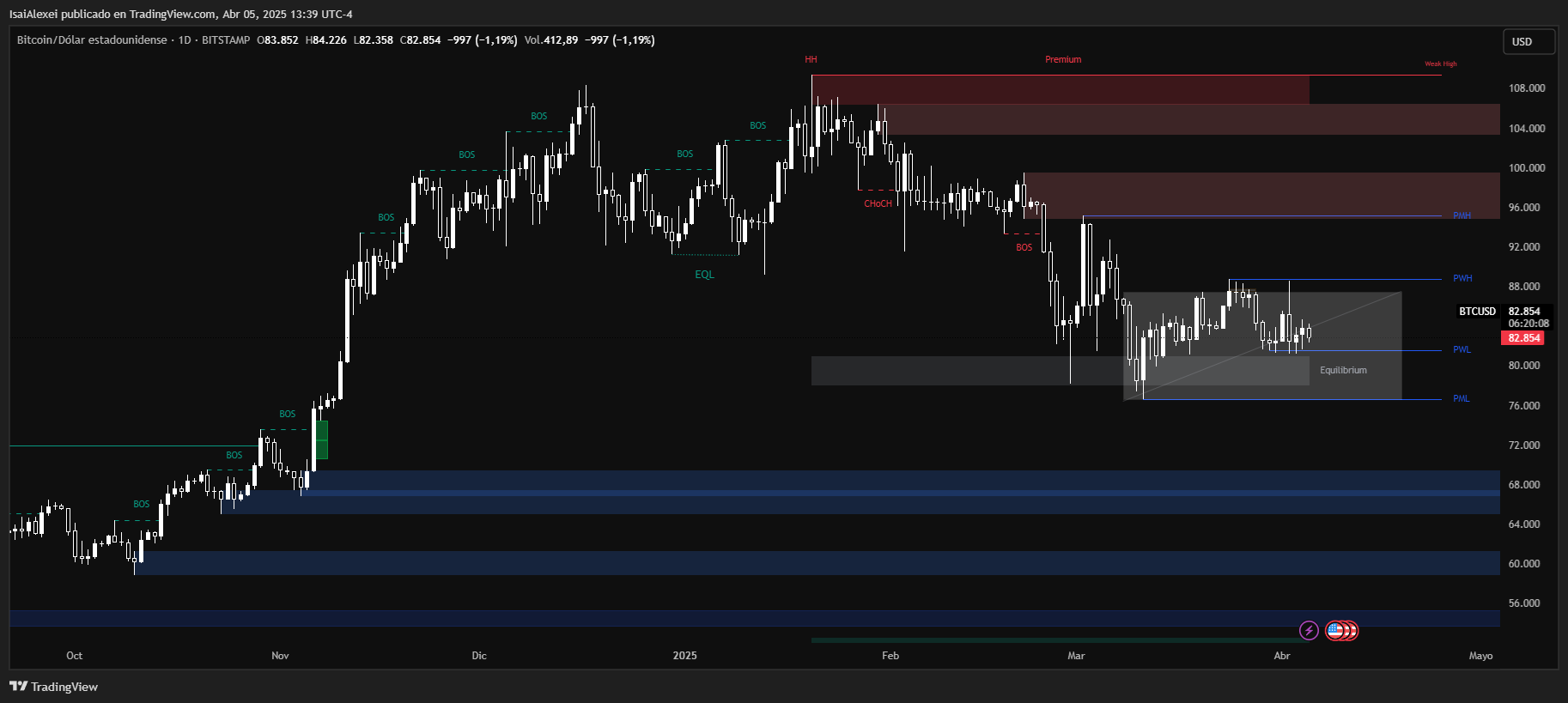

Bitcoin (BTC) is currently trading at $82,855 USD, reflecting a daily drop of −1.19%. Over the past week, the price is down 1.80%, and for the month, it has fallen 8.53%. Despite these short-term pullbacks, BTC remains up more than 31% over the past six months, showcasing the strength of its longer-term trend.

However, its year-to-date performance has slipped to −11.23%, as volatility has intensified following recent macroeconomic events like U.S. tariff policies and global market corrections.