- Mt. Gox’s repayment process starts this month, potentially increasing market supply with over $9 billion in Bitcoin.

- Over $260 million in liquidations occurred recently, affecting over 100,000 traders amid ongoing market volatility.

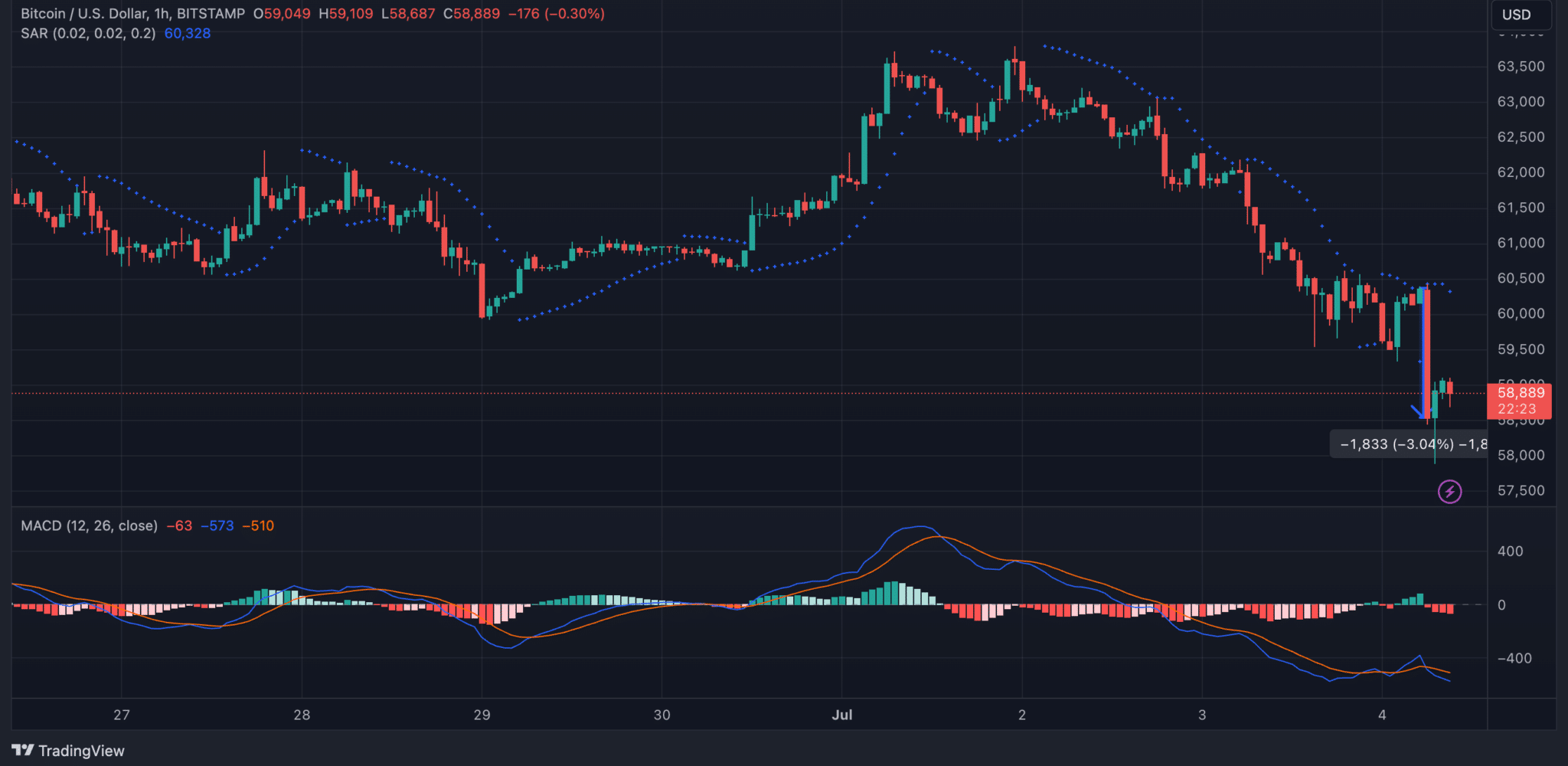

The cryptocurrency market is experiencing a downturn, with Bitcoin’s value recently falling below $60,000, representing a 4% decline within a single day. This recent decrease has impacted Bitcoin, marking it as one of the most affected cryptocurrencies during a broader market downturn that has also influenced other major digital assets such as Ethereum, DOGE, BNB, and LINK.

This decline coincides with a broader market retreat of over 4% in the last 24 hours, affecting these major assets.

It is important to note that the Fear & Greed Index, a measure of market sentiment, indicated a neutral position at 48, suggesting that investors are neither overly fearful nor excessively greedy, though uncertainty prevails.

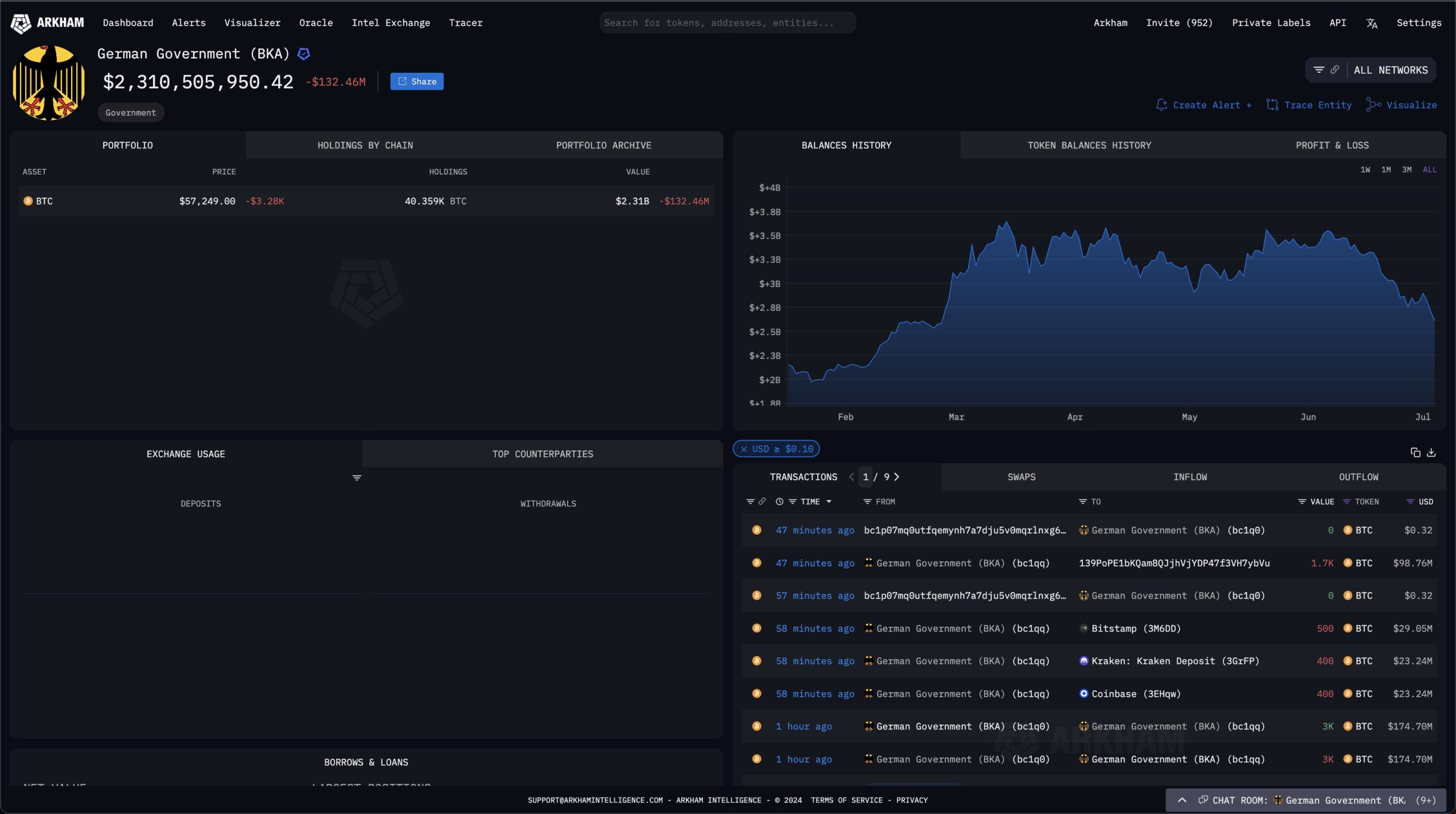

A contributing factor to this uncertainty is the anticipated repayment process by Mt. Gox, set to begin this month.

Over $9 billion in Bitcoin is due to be repaid to more than 127,000 creditors, many of whom may sell to realize their profits, adding selling pressure to the market.

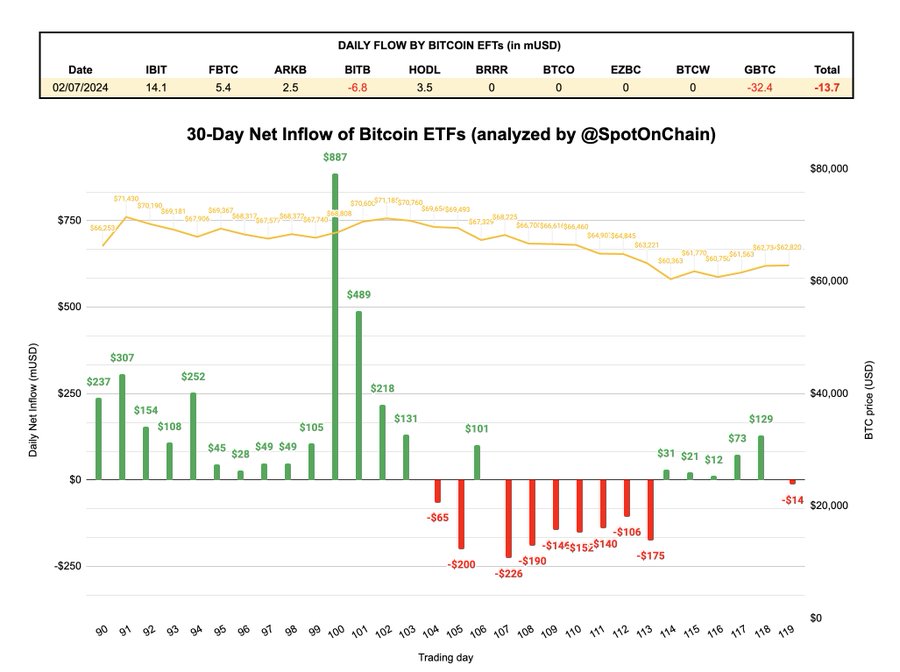

Furthermore, the within Bitcoin exchange-traded funds (ETFs) in the U.S. have played a role in the ongoing market situation. After a period of inflows totaling $129.5 million up until July 1, a reversal occurred with an outflow of $13.7 million on July 2.

These outflows, particularly a $32.4 million withdrawal from Grayscale’s Bitcoin Trust, have countered earlier gains and raised investor concerns about Bitcoin’s price stability.

🚨 $BTC #ETF Net Inflow July 2, 2024: -$14M!

• The net inflow turned slightly negative after being positive for 5 days.

• #Grayscale (GBTC) saw an outflow of $32.4M, larger than the sum of all other Bitcoin ETFs' inflows.

• #BlackRock (IBIT) had the largest inflow of the… pic.twitter.com/GvXMN34Gq6

— Spot On Chain (@spotonchain) July 3, 2024

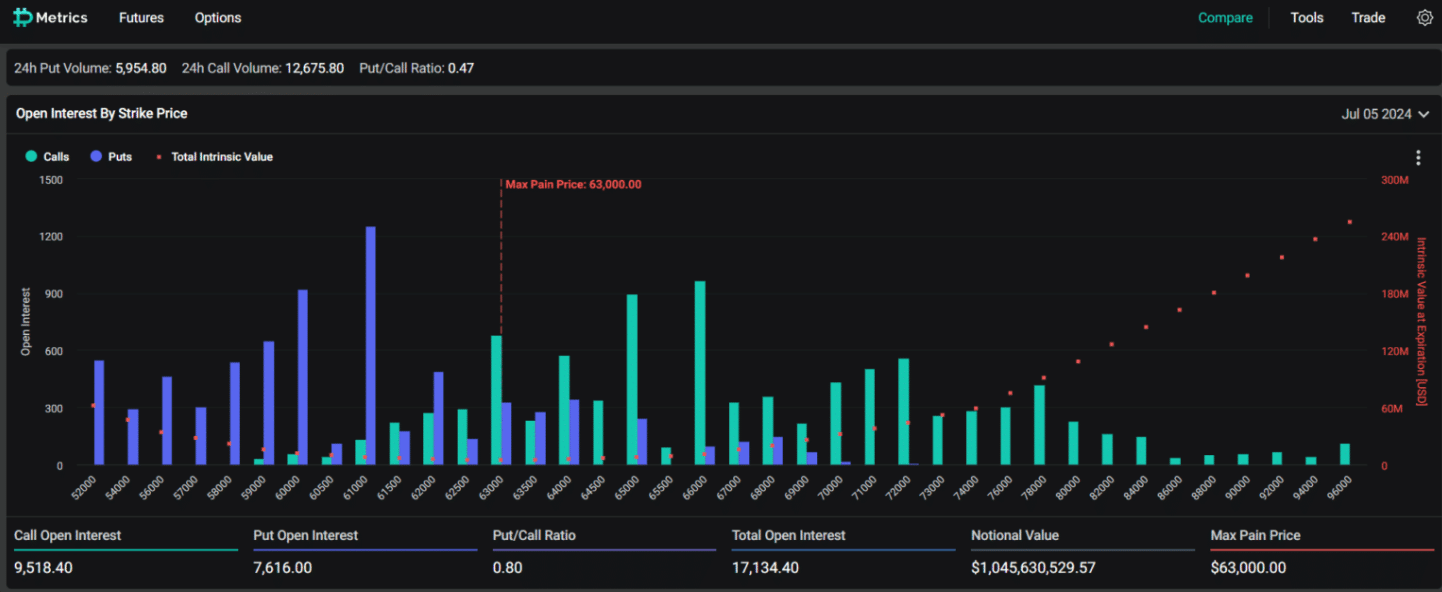

The market is also feeling the effects of the impending expiration of amounts of Bitcoin and Ethereum options, which add to the volatility. ETHNews Data shows that options worth over $1.04 billion are due to expire soon, with a price threshold set at $63,000. This situation has led to cautious trading and heightened uncertainty among investors.

Recent market actions have triggered over $260 million in liquidations within just 24 hours, affecting over 100,000 traders. Bitcoin and Ethereum faced big liquidations, totaling $67 million and $63 million, respectively.

Despite these challenges, some analysts remain hopeful about potential positive shifts, especially with upcoming regulatory decisions. However, Ali Martinez, has warned that if Bitcoin’s price rebounds to $62,600, the market could face further liquidations exceeding $1 billion.

Over $1 billion will be liquidated if #Bitcoin now rebounds to $62,600! pic.twitter.com/6gBiTTkPiH

— Ali (@ali_charts) July 3, 2024

Moreover, the delay in launching Spot Ethereum ETFs, with a new submission deadline set by the SEC for July 8, has further dampened market sentiment. The prolonged approval process has frustrated investors, with many now waiting for a potential market recovery as these ETFs go live.