- After a 30% rally from July lows, traders are taking profits, contributing to current selling pressure on Bitcoin.

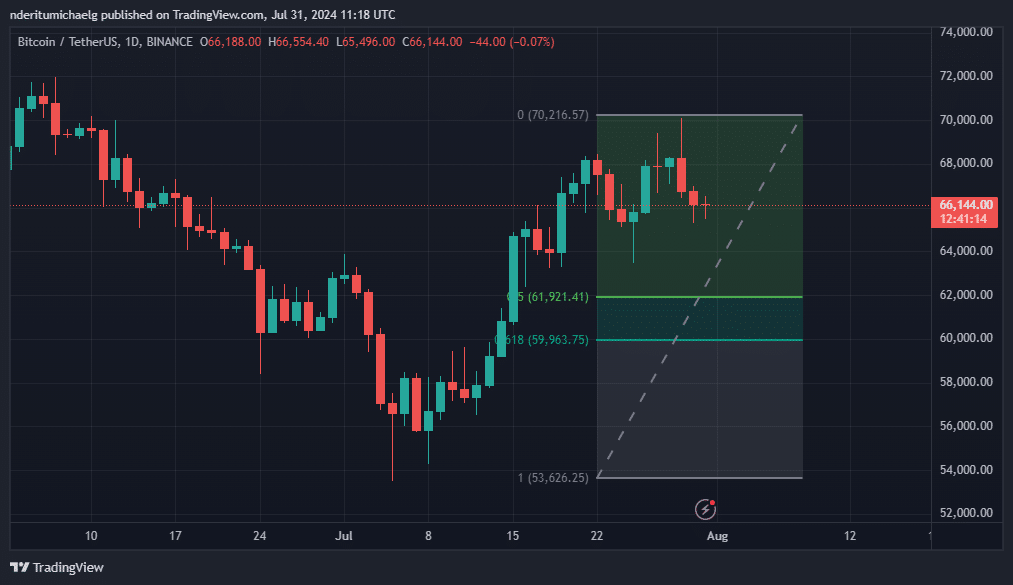

- Fibonacci retracement analysis suggests potential further decline, with key levels expected between $61,921 and $59,693.

Bitcoin’s price momentum has faltered this week, despite recent euphoria and expectations of surpassing $70,000. The cryptocurrency, which saw a sharp rise last week, driven by positive news and heightened anticipation surrounding the Bitcoin 2024 conference, is now experiencing a downturn.

This week, Bitcoin’s price shifted as negative news began influencing the market, leading to a near 6% decrease in its price to a level of $66,042.

This drop is a reversal from the 30% rebound Bitcoin achieved from its July lows, spurred by traders capitalizing on lower prices. Now, these traders might be looking to secure profits, contributing to the current sell-off.

The Sell Pressure on Bitcoin is Becoming More Evident

Analysis using the Fibonacci retracement tool suggests potential future declines, with levels possibly falling between $61,921 and $59,693 if the downward trend persists.

Furthermore, the broader market context includes a cooldown in the speculative fervor that marked the previous week. Political and economic speculations have given way to a more cautious approach among traders, largely due to upcoming economic data from the Federal Open Market Committee (FOMC) and the Federal Reserve’s meetings. Investors are likely selling their positions in anticipation of clearer signals post these events.

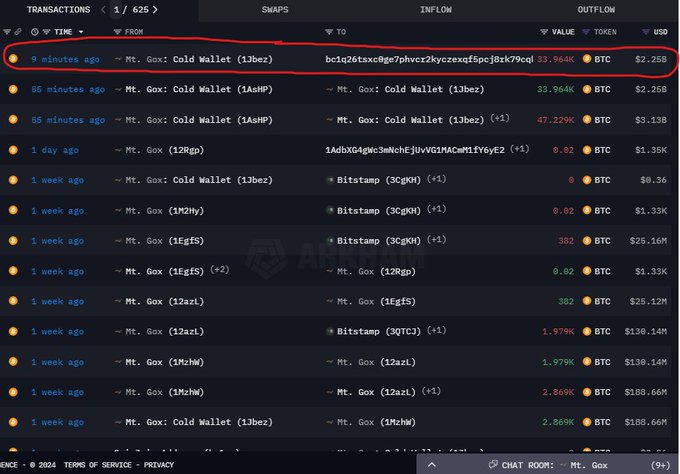

This cautious sentiment is compounded by recent unsettling developments involving Bitcoin transfers.

Mt. Gox moved 47,229 $BTC($3.13B) to 3 unknown wallets again in the past 3 hours!#MtGox has moved 61,559 $BTC($3.89B) to #Bitstamp, #Kraken, #Bitbank, and SBI VC Trade for repayment since July 5.https://t.co/f2q66eQNuk pic.twitter.com/3G1tp47rav

— Lookonchain (@lookonchain) July 31, 2024

According to data from Lookonchain, 47,229 BTC were moved to anonymous wallets over the last 24 hours, a move that could significantly increase sell pressure if these coins are sold on the market. This could potentially introduce an additional $3.8 billion in sell pressure.

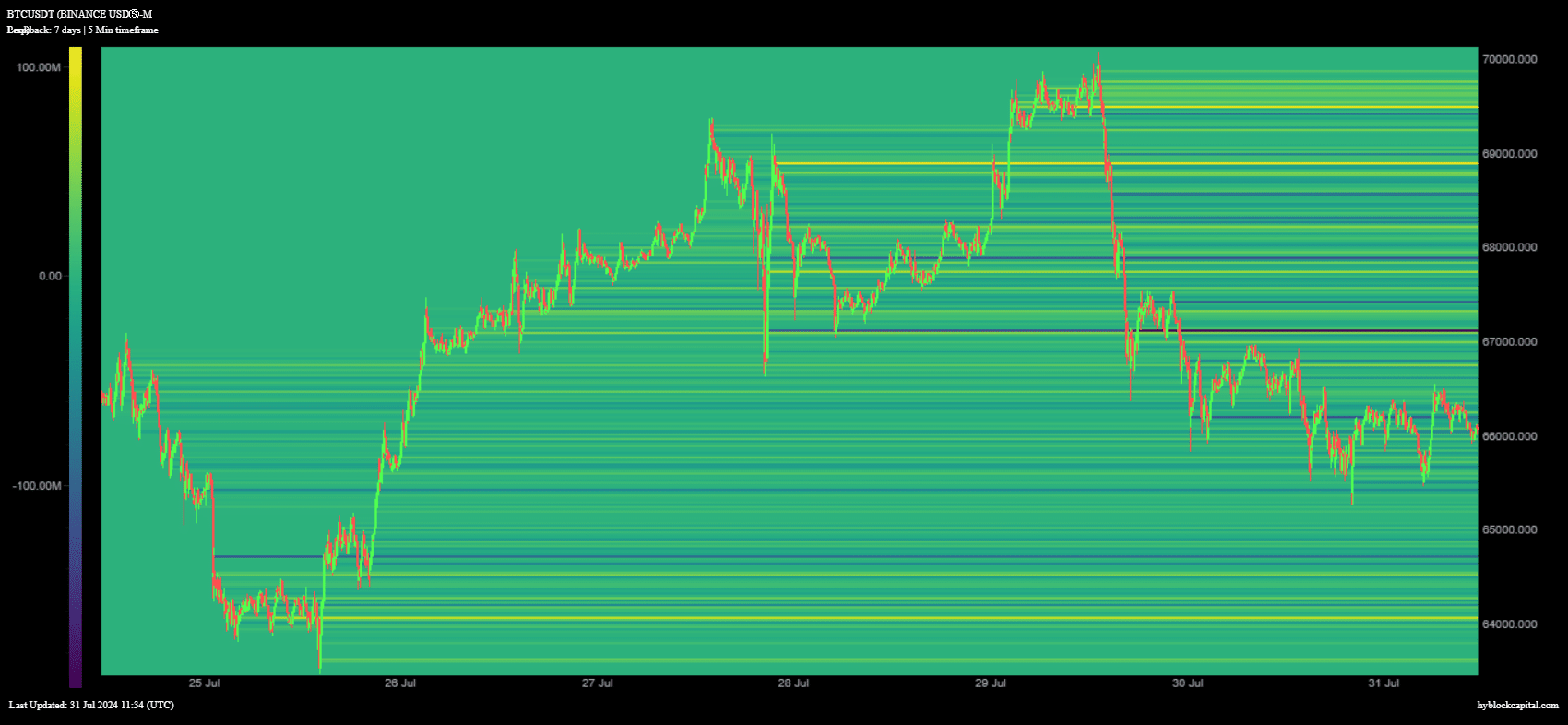

In addition to market reactions to news and economic data, the structure of Bitcoin investments also shows signs of strain. Long positions have seen liquidations, particularly at price levels around $68,875 to $69,500, where amounts were previously staked.

As Bitcoin’s price dropped below these levels, it triggered sell-offs, providing liquidity for short sellers and pushing prices down further.

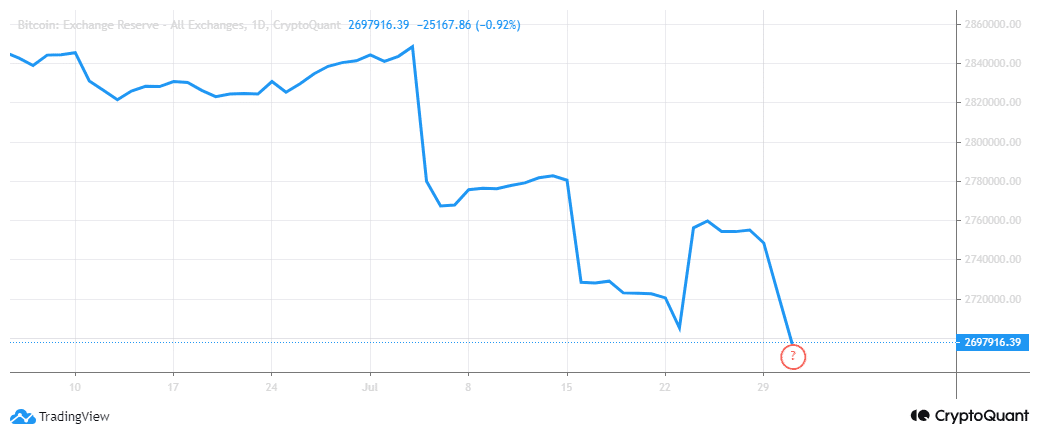

Bitcoin wraps up the month with its exchange reserves at the lowest since 2018, holding approximately 2.6 million BTC, the market remains on edge. Whether Bitcoin will face further declines or recover is uncertain, as market conditions can shift rapidly.

What is clear, however, is that Bitcoin’s path forward is currently clouded by a mix of profit-taking, speculative adjustments, and broader economic concerns.