- Federal Reserve maintains interest rates; Bitcoin responds with minor movements, closing July with a modest 2.95% gain.

- Ethereum experiences a decline of 5.88% in July despite the positive potential of new U.S.-based spot Ether ETFs.

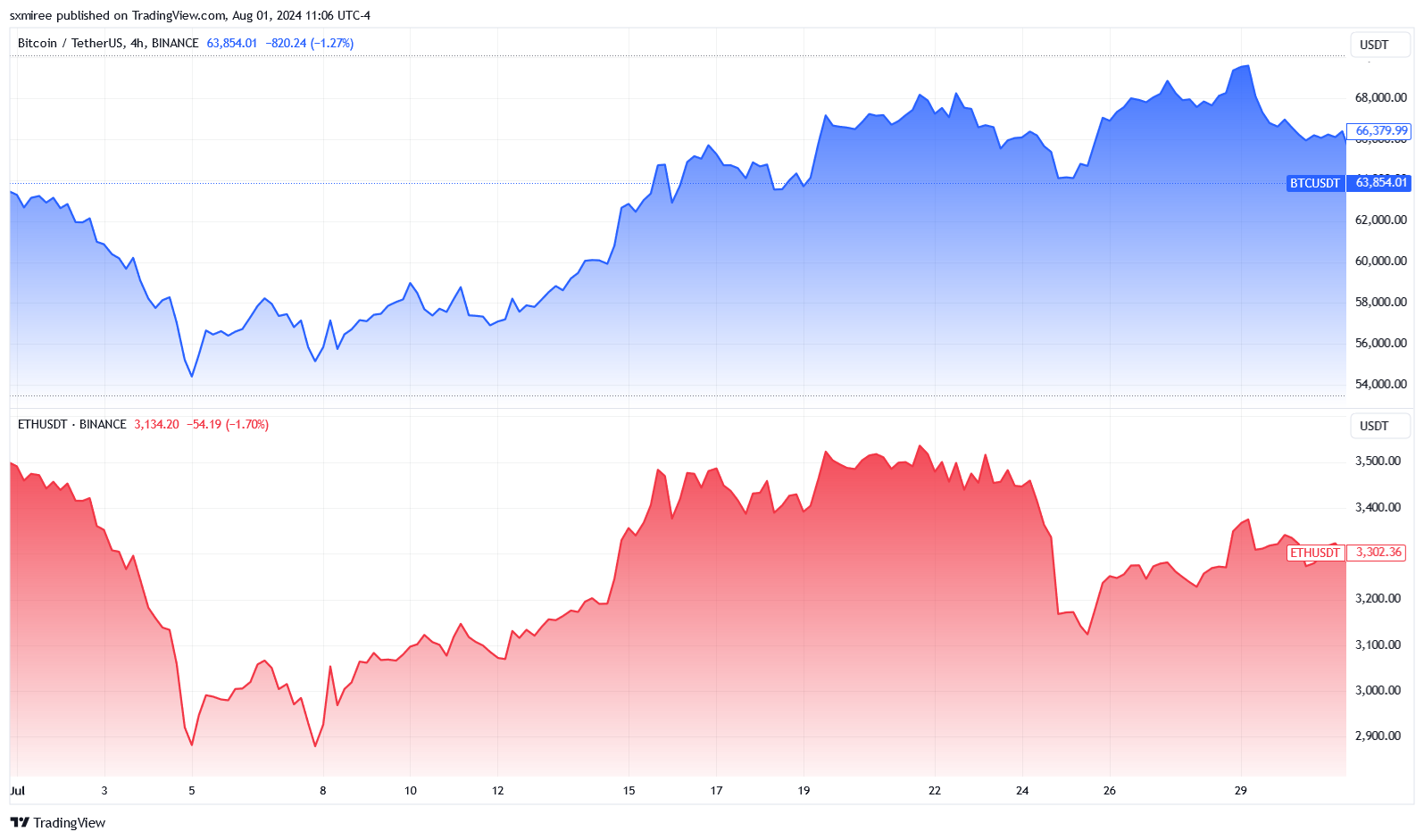

July presented a mixed bag for Bitcoin and Ethereum, leaving investors pondering what August might hold. Despite fluctuations triggered by various market events, the closure of the month saw Bitcoin barely move in response to the Federal Reserve’s decision to maintain interest rates at their current highs.

During its latest meeting, the Federal Open Market Committee (FOMC) chose not to alter the federal funds rate, which remains at 5.25%-5.50%. This decision met market expectations, which had already factored in the possibility of the first rate cut of the year potentially occurring in September.

Federal Reserve Chair Jerome Powell expressed that further robust economic data might solidify plans for such a rate reduction. If realized, this could enhance market liquidity, likely benefiting cryptocurrencies.

Throughout July, Bitcoin achieved a modest gain of 2.95%, according to data from Coinglass, despite a slight pullback before the month’s end. These gains set a cautious yet hopeful stage for Bitcoin to aim for new highs within the year.

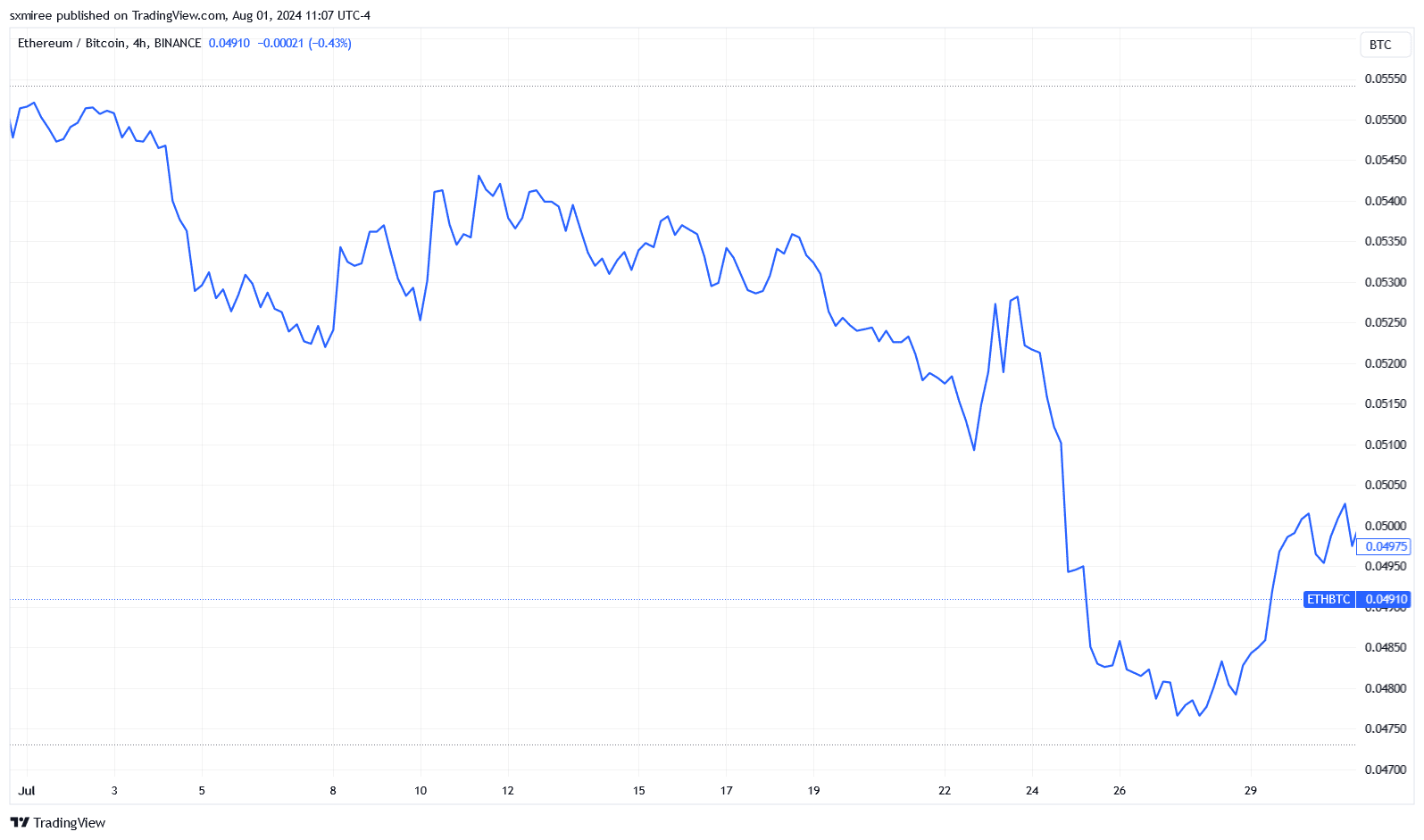

Ethereum, however, did not fare as well, dropping 5.88% over the same period, despite the launch of U.S.-based spot Ether ETFs which generally should have provided positive momentum.

The relative performance of Ethereum against Bitcoin worsened, with the ETH/BTC ratio declining by 10.72% by month’s end.

A trend in July was strategic accumulation by larger Bitcoin holders. IntoTheBlock reported that addresses holding at least 0.1% of Bitcoin’s circulating supply added about 84,000 BTC to their holdings, marking the most significant accumulation since October 2014.

This type of activity typically indicates that investors are positioning for a potential price increase.

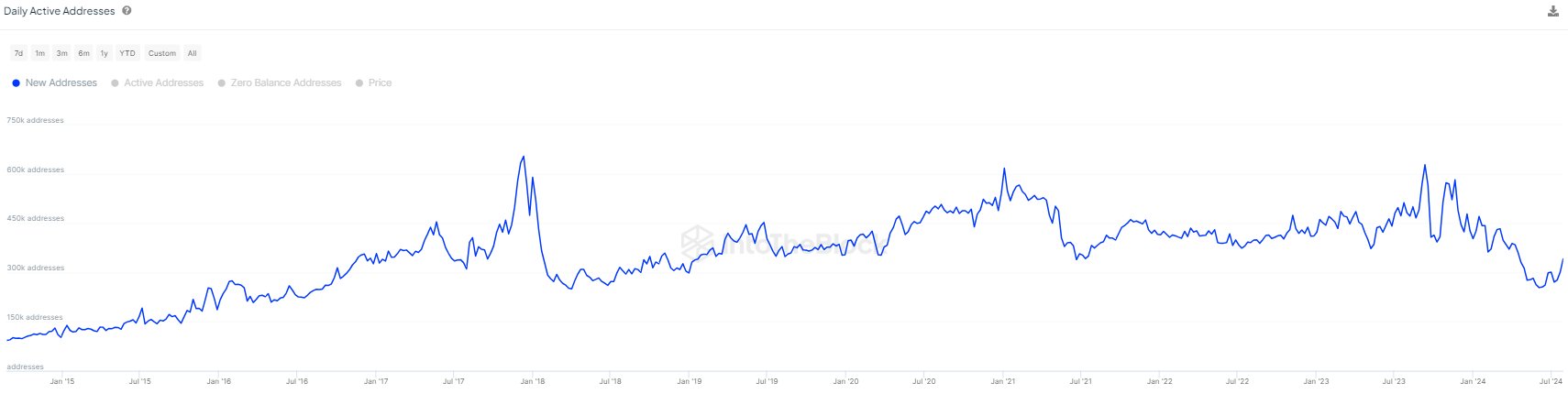

Adding to the optimism, daily new addresses for Bitcoin surged by 35% on July 30, bouncing back from multi-year lows seen in early June. This resurgence in activity and the increasing capital flowing into stablecoins—whose total market cap rose by 2.11% to $164 billion, reaching its highest level since April 2022—suggests a growing confidence among investors.

[mcrypto id=”12344″]As Bitcoin continues to oscillate between $58,000 and $70,000, a breakout above the $69,600 resistance level could be great. Overcoming this barrier might pave the way to test the $72,000 level, challenging March’s all-time highs.