- Bitcoin’s price stagnation raises questions about a market peak, but historical halving data suggests peaks occur 12–18 months post-halving, pointing to mid-2025.

- Stablecoin supply hit $219 billion, nearing Ethereum’s market cap, signaling investor caution and potential mid-cycle liquidity buildup.

Bitcoin’s recent price stagnation has sparked debates about whether the market has hit its peak. On-chain analytics platform IntoTheBlock analyzed historical trends and stablecoin metrics to assess the likelihood of a cyclical high. Their findings suggest the current cycle may still have room to run.

Is the market peak in?

When looking at historical halving data, peaks often land 12–18 months post-halving, pointing to mid–late 2025. While institutional flows & regulations may reshape this cycle, it is likely there is more time in the current cycle pic.twitter.com/1YOikAYMyJ

— IntoTheBlock (@intotheblock) March 15, 2025

Historical halving events provide a framework for predicting market peaks. According to IntoTheBlock, previous cycles show prices peaking 12–18 months after halvings, which for the 2024 event would point to mid-to-late 2025.

While institutional activity and regulatory changes could alter this timeline, the data implies the current cycle is not yet exhausted. This aligns with Bitcoin’s historical pattern of gradual post-halving rallies, though external factors like macroeconomic shifts remain wildcard variables.

Stablecoin metrics further support the mid-cycle narrative

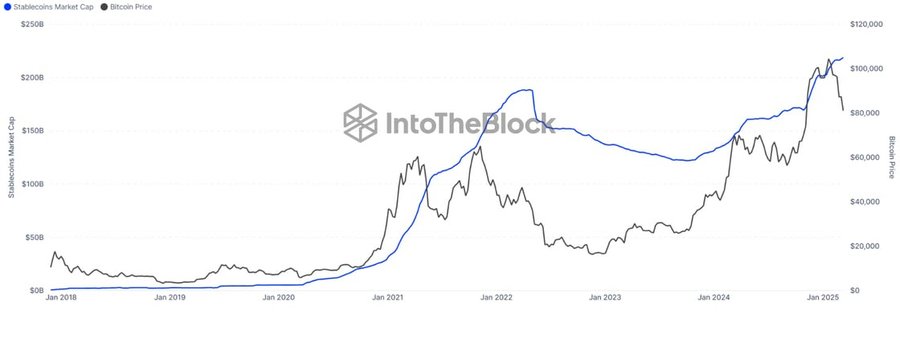

Stablecoin supply, which often peaks near market highs, reached $187 billion in April 2022—just as the bear market began. Today, the combined stablecoin market cap exceeds $219 billion and continues rising.

This growth reflects heightened caution among investors, who may be accumulating liquidity in preparation for future volatility. Notably, stablecoins now rival Ethereum’s market cap, underscoring their role as a barometer for risk appetite.

The interplay between Bitcoin’s halving schedule and stablecoin trends paints a cautious but optimistic outlook. While prices could face short-term resistance, historical precedents and stablecoin accumulation suggest a potential rally extending into 2025.

However, institutional adoption rates and regulatory clarity will likely influence the trajectory.