- Bitcoin’s price often moves opposite to crowd predictions, with FUD signaling buy opportunities and FOMO indicating sell signals.

- Santiment’s data shows that extreme crowd sentiment, both FUD and FOMO, often precedes price corrections or reversals in Bitcoin’s market.

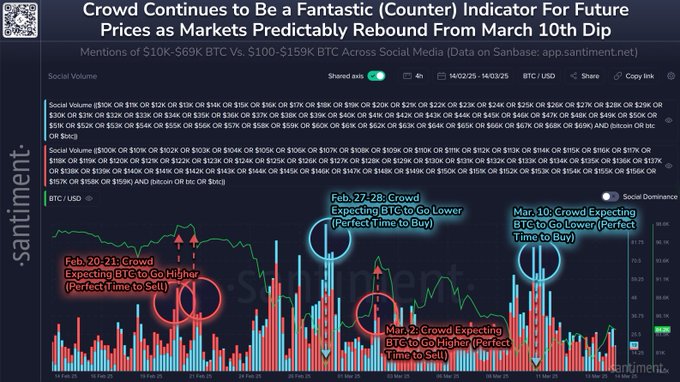

Bitcoin’s recent price action appears as an example of how fear, uncertainty, and doubt (FUD) alongside fear of missing out (FOMO), can influence market behavior. Bitcoin’s rally back to $84.5K last Friday coincided with a predictable drop in sentiment from the Monday crowd, who began selling. As Bitcoin dipped to $78K, social media was flooded with predictions of lower prices.

🗣️ Bitcoin's rally back to $84.5K Friday shows what happens when the Monday crowd claims it's time to sell. Predictably, FUD hit its peak as $BTC was down to $78K, with predictions pouring in for lower prices all across social media. This same phenomenon happened at the end of… pic.twitter.com/GB72pntDb3

— Santiment (@santimentfeed) March 15, 2025

However, this price movement mirrors what happened in late February when FUD led many to believe the price would continue falling, only for Bitcoin to surge in early March.

Bitcoin’s market dynamics over the past month show that the crowd’s predictions can often be reliable counter-indicators. Bitcoin’s price remained stable between $70K and $100K, with no dip below $70K or rise above $100K.

This range acts as a gauge for market sentiment. When the crowd predicts that Bitcoin’s price will fall below $70K, it often signals FUD and suggests a possible buying opportunity. Conversely, when predictions point to a price surge above $100K, it indicates FOMO, often a signal to consider selling.

FUD and FOMO in Action

According to Santiment data, there is a strong correlation between crowd sentiment and market reversals. For instance, during the period from February 20-23, predictions of rising Bitcoin prices were rising, signaling a potential sell-off. Indeed, Bitcoin’s price dropped after these predictions. On the other hand, on February 27-28, when the crowd predicted a price decline, Bitcoin’s price rose, confirming the idea that fear can signal a buying opportunity.

Further, the early March period also displayed this pattern. When predictions pointed to an upward move, Bitcoin’s price peaked, only to dip shortly afterward, supporting the idea that FOMO often precedes price corrections.

The current market conditions on March 15, 2025, strengthen this phenomenon as Bitcoin’s price fluctuates with social media sentiment.

Santiment’s data points out the value of monitoring crowd sentiment when it shifts. The current social media chatter, as reported by ETHNews, indicates heightened predictions for FUD and FOMO, with blue bars marking predictions of Bitcoin prices falling below $70K and red bars signaling expectations of Bitcoin rising above $100K. These emotional extremes are often followed by price corrections that do not align with crowd expectations.

Bitcoin’s Price Fluctuations and Key Metrics

As of the latest update, Bitcoin’s price stands at $84,468.33, reflecting a modest 0.55% increase. Over the past 24 hours, Bitcoin’s market cap is $1.67 trillion, with a trading volume of $15.39 billion, reflecting a significant decrease of 47.53%.

Despite fluctuations in its price, Bitcoin’s total circulating supply is still capped at 21 million BTC, with approximately 19.83 million BTC in circulation. This limited availability ensures that Bitcoin remains a scarce asset, further influencing its price movements.