- Bitcoin experienced a 16.2% drop early July, stabilizing at $53.5k before recovering by 9.33% in a day and a half.

- Anticipated short-term trading range for Bitcoin is between $58.8k and $53.5k, with $56.2k acting as mid-range support.

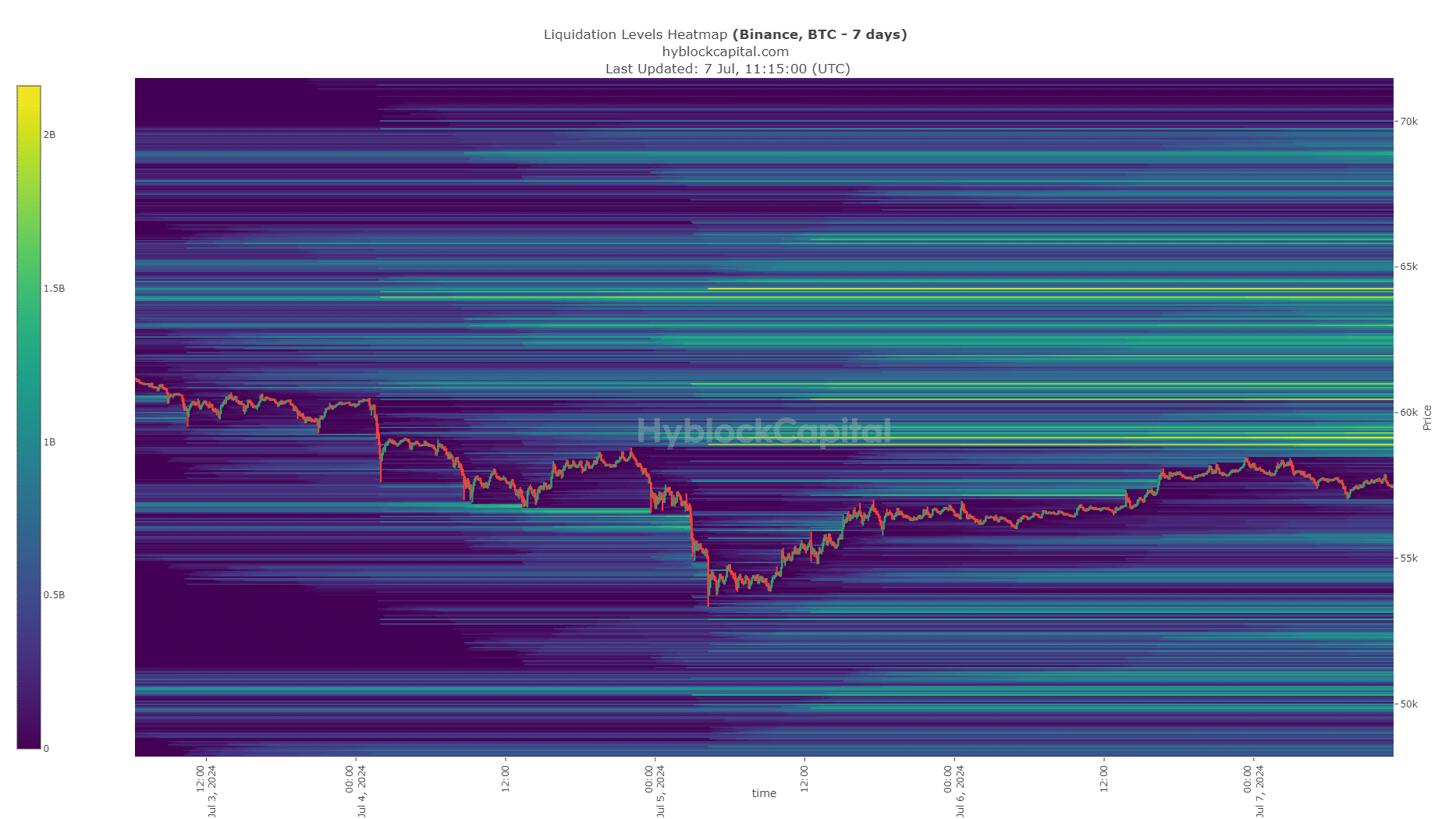

Continuing with the reports about the decline of Bitcoin in ETHNews, recent data indicates a potential for a price range formation. Analyzing the recent trends, Bitcoin dropped by 16.2% from the beginning of July to the 5th, finding a temporary floor at $53.5k.

[mcrypto id=”12344″]This decrease was followed by a 9.33% recovery over the subsequent day and a half, suggesting a stabilization might be setting in.

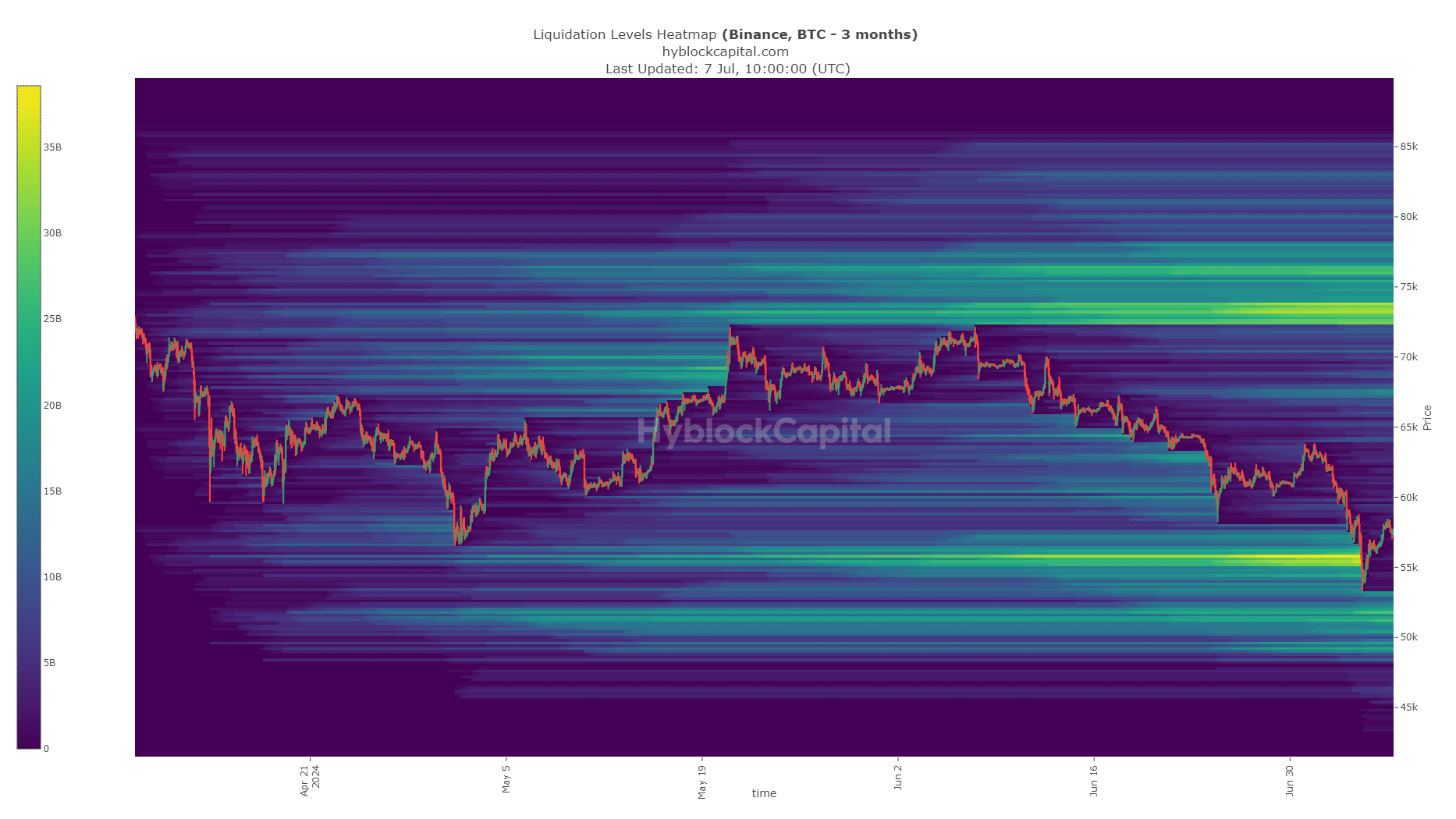

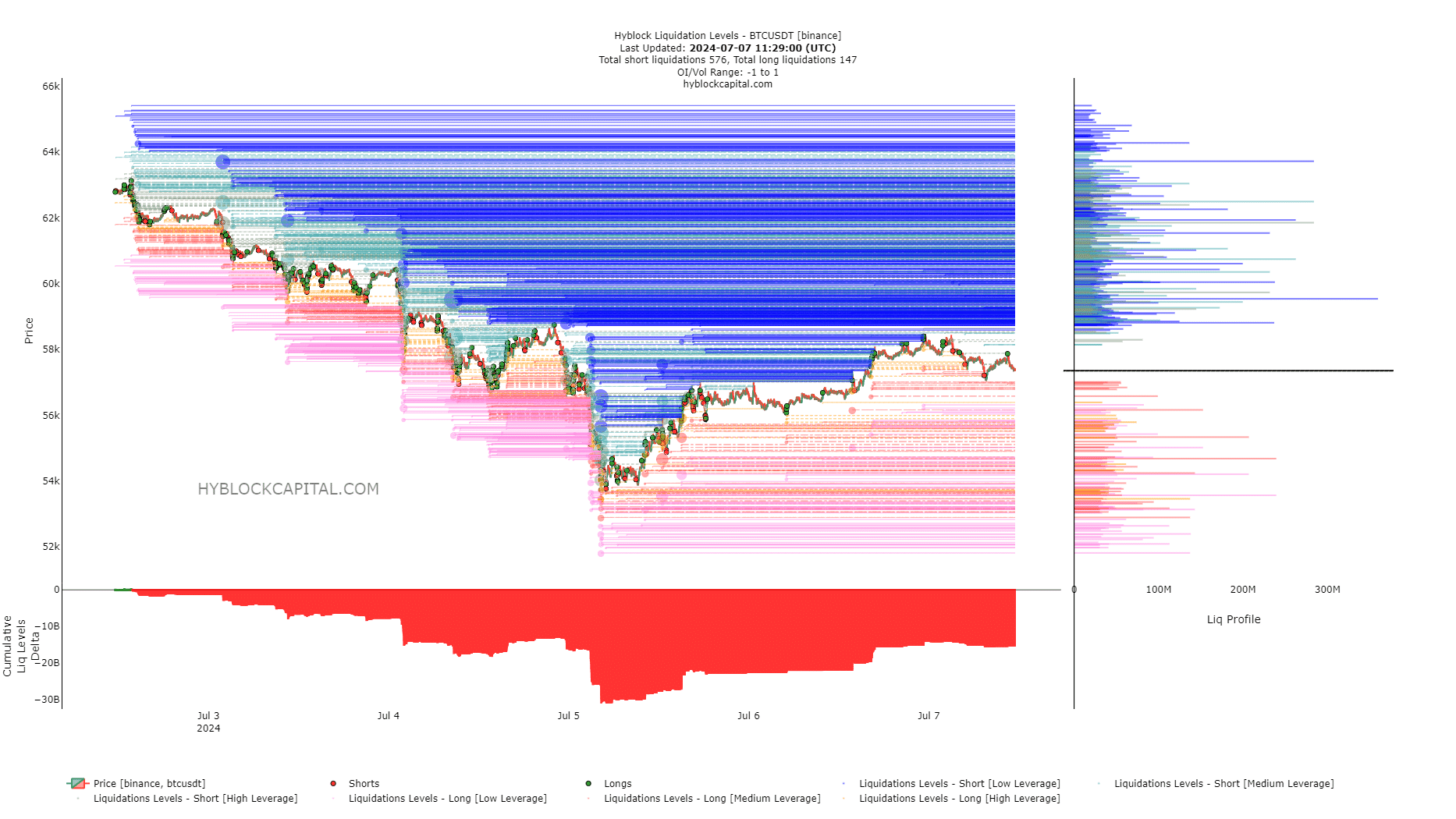

The analysis of liquidation charts and recent price actions by ETHNews shows that Bitcoin may establish a short-term trading range between $58.8k and $53.5k. On July 5th, the mid-range level of $56.2k acted as a support when prices attempted an upward correction.

Despite these fluctuations, the overall sentiment remains cautious as Bitcoin’s price movements have been closely tied to large liquidation levels particularly around $55.5k, drawing prices toward this region.

The On-Balance Volume (OBV) indicator continues its downward trend, hinting at sustained selling pressure. Additionally, the Relative Strength Index (RSI) on the four-hour chart faced rejection at the neutral 50 mark, though there’s potential for an increase if Bitcoin approaches the higher end of the current range.

Looking ahead, a amount of liquidations has accumulated near the $59k mark, aligning with the upper boundary of the projected trading range. This zone may serve as a magnet for price in the short term, potentially leading to increased market activity as traders position themselves around these critical levels.

Despite the lack of strong bullish momentum to drive a sustained rally beyond $60k, and taking into account the previous reports that we have written, market participants should remain vigilant. The probability of a bearish reversal from the $59.2k region is high, especially with expected volatility at the New York market open.