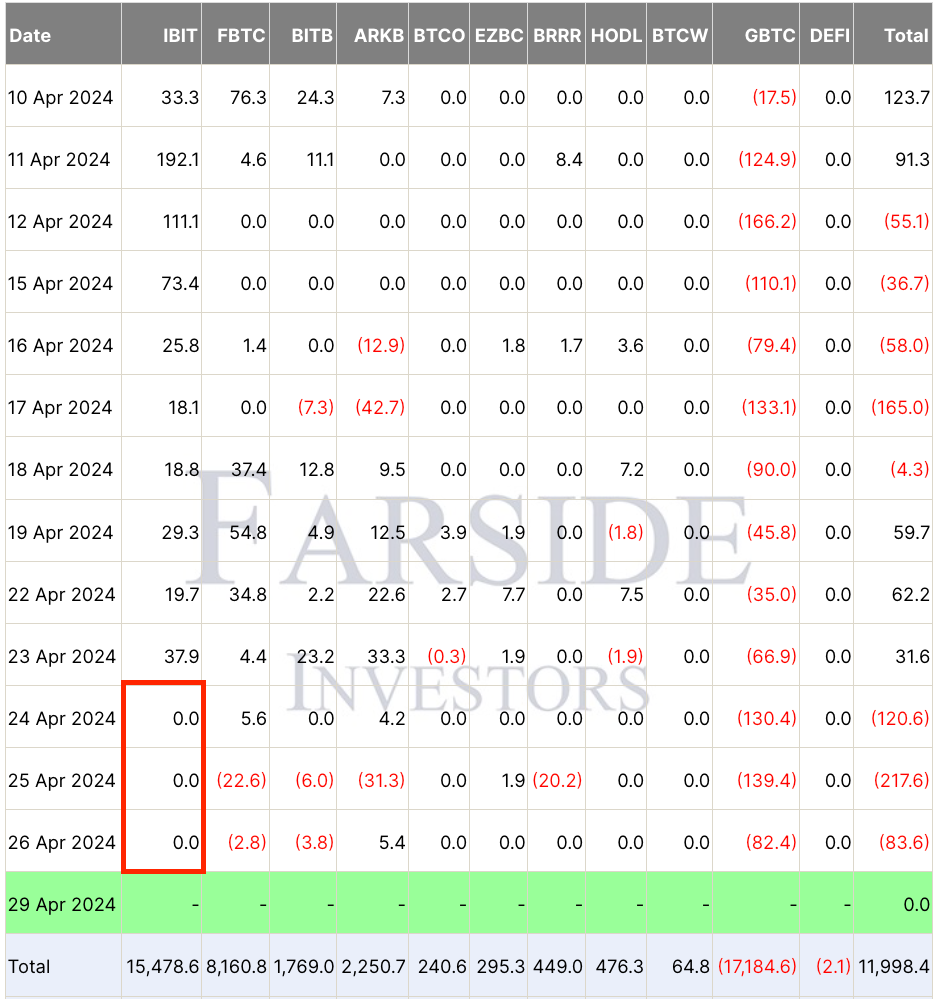

- Lack of flows towards BlackRock’s Bitcoin ETF reflects institutional investors’ disinterest.

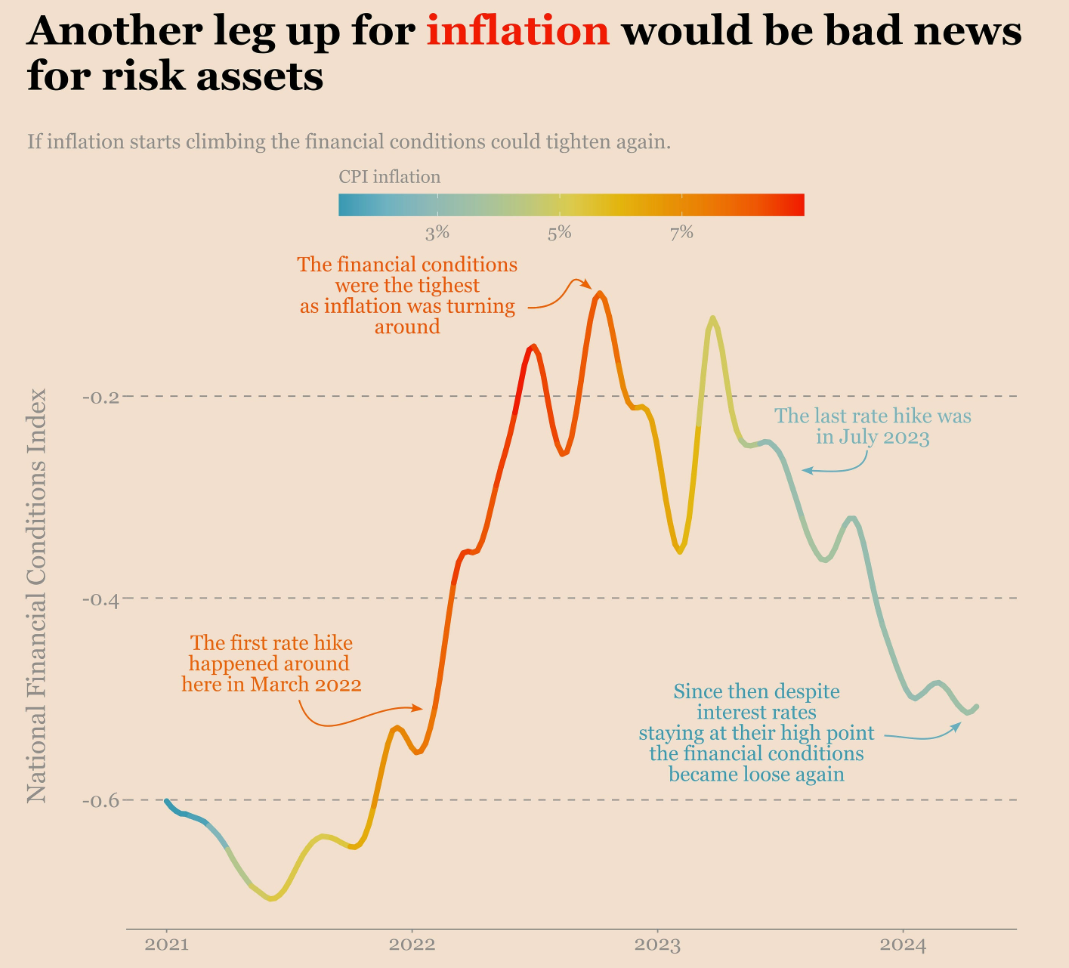

- Concerns over stagflation in the US could affect expectations regarding Federal Reserve decisions.

Last week witnessed a notable event in the realm of cryptocurrency investment funds: a substantial outflow totaling $435 million.

US$435 outflows continue as incumbent ETF issuers continue to see withdrawals.

The outflows were focussed solely on Bitcoin and Ethereum which saw US$423m and US$38m respectively, while a broad range of altcoins saw inflows.

Read the full report: https://t.co/mOrbDKQYwP pic.twitter.com/knWTt6UkGB

— CoinShares (@CoinSharesCo) April 29, 2024

This significant movement of funds suggests a shift in investor sentiment, potentially driven by apprehensions regarding inflationary pressures and the stagnant growth in Bitcoin’s bullish market.

Simultaneously, there’s been a noticeable deceleration in the influx of new investors into the market. This slowdown in new issuances indicates a waning interest among recent investors, hinting at a possible erosion of confidence in the upward trajectory of the market.

Particularly noteworthy is the lack of activity surrounding BlackRock’s Bitcoin ETF, which recorded zero flows. This dearth of interest in BlackRock’s offering may signal a lack of enthusiasm among institutional and retail investors for this specific product.

Investor concerns regarding stagflation in the United States further contribute to the prevailing unease. This economic phenomenon, characterized by sluggish growth coupled with persistent inflation, has the potential to influence expectations regarding the Federal Reserve’s interest rate decisions.

Despite these developments, some analysts view the current situation as a temporary pause rather than the onset of a negative trend in Bitcoin’s bullish market. They anticipate a resumption of market momentum, especially with the anticipated integration of ETFs into banking and financial advisory platforms.

“We don’t expect the Bitcoin ETF slowdown to be a worrying trend, but believe it is a short-term pause before ETFs become more integrated with private bank platforms, wealth advisers and even more brokerage platforms.”

Looking ahead, analysts at Bernstein maintain an optimistic price target of $150,000 for Bitcoin by the end of 2025. This projection is underpinned by the sustained demand for ETFs and other factors driving market dynamics.

The introduction of Bitcoin ETFs has undeniably reshaped the cryptocurrency sector, creating new avenues for demand. However, the future trajectory of the market hinges on the evolution of financial and macroeconomic conditions, particularly in relation to the monetary policy decisions of the US Federal Reserve.