- Despite regulatory uncertainty, BlackRock optimistic about launching an Ethereum ETF, even if classified as a security by the SEC.

- Competition heats up as eight issuers, including BlackRock, file for SEC approval to launch a spot Ether ETF.

Amid the ongoing debates around cryptocurrency regulation, Larry Fink, CEO of BlackRock, the world’s largest asset management firm with assets totaling $9.1 trillion, shared insights that could stir the cryptocurrency community.

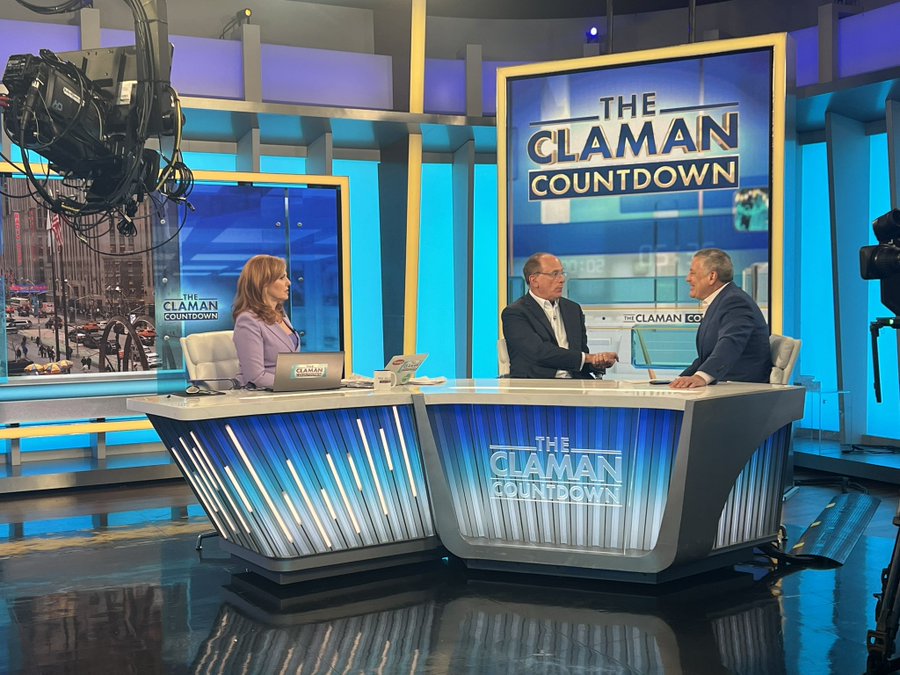

In a recent interview with Fox Business, Fink touched on the possibility of launching an Ethereum Exchange-Traded Fund (ETF), despite the looming regulatory uncertainties surrounding Ethereum’s classification as a security.

Fink’s perspective is intriguing, especially considering the current regulatory environment. He suggested that even if Ethereum were classified as a security by regulatory bodies, it would not hinder the potential for an Ethereum ETF.

🚨NEW: Larry Fink on $ETH spot ETF: @CGasparino: There's a lot of noise about the SEC declaring ether a security which would take it out of the bitcoin category as a commodity. How does that translate into an ETF?

Fink: “I don’t think – look and I really can’t talk about this… https://t.co/si9ZiM6z30 pic.twitter.com/SVFcGvwRRg

— Eleanor Terrett (@EleanorTerrett) March 27, 2024

Nate Geraci, an ETF specialist, weighed in on Fink’s comments, noting their significance amid the Securities and Exchange Commission’s (SEC) indications towards classifying Ethereum as a security.

Geraci pointed out that despite the skepticism surrounding an Ether ETF’s approval in May, there’s a viable path forward after such classification, especially considering the precedent set by the approval of Ethereum futures ETFs.

*Highly* interesting comments…

Just reading b/w lines & speculating, sounds like SEC seriously trying to classify eth as security.

If so, tough to have optimism on May spot eth ETF approval.

That said, Fink says SEC could still allow spot eth ETF post-security classification. https://t.co/hZTvea17a6

— Nate Geraci (@NateGeraci) March 28, 2024

SEC’s active efforts to label Ethereum as a security, a stance that contrasts with the Commodity Futures Trading Commission’s (CFTC) classification of Ethereum as a commodity.

The Ethereum Foundation finds itself at the heart of this regulatory tug-of-war, highlighting the complex landscape cryptocurrencies navigate in seeking mainstream acceptance and regulatory clarity.

In the same discussion, Fink also expressed optimism about Bitcoin’s future, citing an unexpected surge in retail interest. BlackRock’s Bitcoin ETF, IBIT, has witnessed unprecedented growth, becoming the fastest-growing ETF in history.

This contrasted with the insights from Robert Mitchnick of BlackRock, who noted a lower demand for Ethereum and other altcoins among their clients, with Bitcoin remaining the primary focus.

Concerns Over Centralization

However, this growth has brought forth concerns within the Ethereum community, notably regarding potential transaction failures and the risk of centralization. The latter concern is heightened by the dominance of staking pools like Lido, which holds a significant portion of staked ETH. This situation has ignited a debate on the potential shift towards centralization, contradicting Ethereum’s decentralization ethos.

Proposed Solutions for Decentralization

In response to these challenges, there are proposals aimed at preserving Ethereum’s decentralized nature. Vitalik Buterin, co-founder of Ethereum, suggests introducing penalties for validators to enforce fairness and decentralization.

You may be interested: BlackRock Enters Tokenization Race: Launches Ethereum-Based Fund Amid Regulatory Rumors – Is ETH in Danger?

These would be proportional to each validator’s failure rate, with increased penalties for simultaneous failures among multiple validators. Additionally, there’s discussion on revising the 32 ETH requirement for validators to mitigate centralization concerns and encourage wider, more equitable participation.

Ethereum (ETH-USD) is currently trading at $3,564.19, marking a decrease of $60.85 or approximately -1.68%. Ethereum has seen a broad range of trading activity, with its price fluctuating between $3,467.26 and $3,589.59 within the day.