- BlackRock launches IBIT in Brazil, marking a milestone in the acceptance of cryptocurrencies as a legitimate asset class.

- IBIT democratizes access to Bitcoin through a regulated vehicle, expanding the market to retail investors.

Did you know that BlackRock, the asset management giant, is marking a before and after in the world of cryptocurrencies? That’s right, and the stage for this revolution is none other than Brazil.

As we’ve seen in previous ETHNews reports, this move by BlackRock is a clear sign of validation for the sector, showing unprecedented recognition of cryptocurrencies as a legitimate and valuable asset class.

Opening doors: greater access for all

But what does this mean for you and me? In short, it means access. At first, this ETF will be available only to investors with deep pockets, those with more than R$1 million to invest.

However, the real magic begins when this product opens up to the retail investor. Imagine having the ability to invest in Bitcoin through a vehicle as familiar and regulated as an ETF.

This not only simplifies the investment process but also makes it more secure and accessible to all. According to previous ETHNews reports, democratizing access to Bitcoin is a step towards mass adoption.

Impact and growth on Brazil

IBIT’s launch is not only exciting for its novelty; it has the potential to be a game-changer in the cryptocurrency sector. Consider for a moment the massive flow of capital we are already seeing heading toward this ETF.

With BlackRock reporting an impressive inflow of $520 million in a single day, it’s clear that the appetite for Bitcoin is far from waning. This type of move not only injects vitality into the market but also promises further stability and growth.

As ETHNews previously noted, the entry of institutional and retail investors could usher in a new era for the cryptocurrency market.

By choosing to structure IBIT as a Brazilian Depositary Receipt (BDR), BlackRock is not only opening up the Brazilian market to investments in digital assets but also charting a path within existing regulatory frameworks.

This strategy allows Brazilian investors to diversify their portfolios with foreign assets in a regulated manner, offering an efficient and safe way to invest in Bitcoin. Following reports from ETHNews, this is not just an expansion of financial products; it is a redefinition of what these products can be.

IBIT’s launch in Brazil is not without its challenges

Especially when it comes to regulation. BlackRock’s collaboration with regulators and market operators such as B3 is vital to ensure regulatory compliance. This is a crucial aspect of IBIT’s success, given that Brazil is known for its complex regulatory environment.

The launch of IBIT by BlackRock in Brazil is much more than a new financial product; it is a milestone in the integration of cryptocurrencies into the traditional financial system.

As more investors, both institutional and retail, seek exposure to cryptocurrencies in a regulated and secure manner, we are likely to see an increase in the launch of cryptocurrency ETFs in other Latin American markets. This is just the beginning of what promises to be an exciting journey for financial investment.

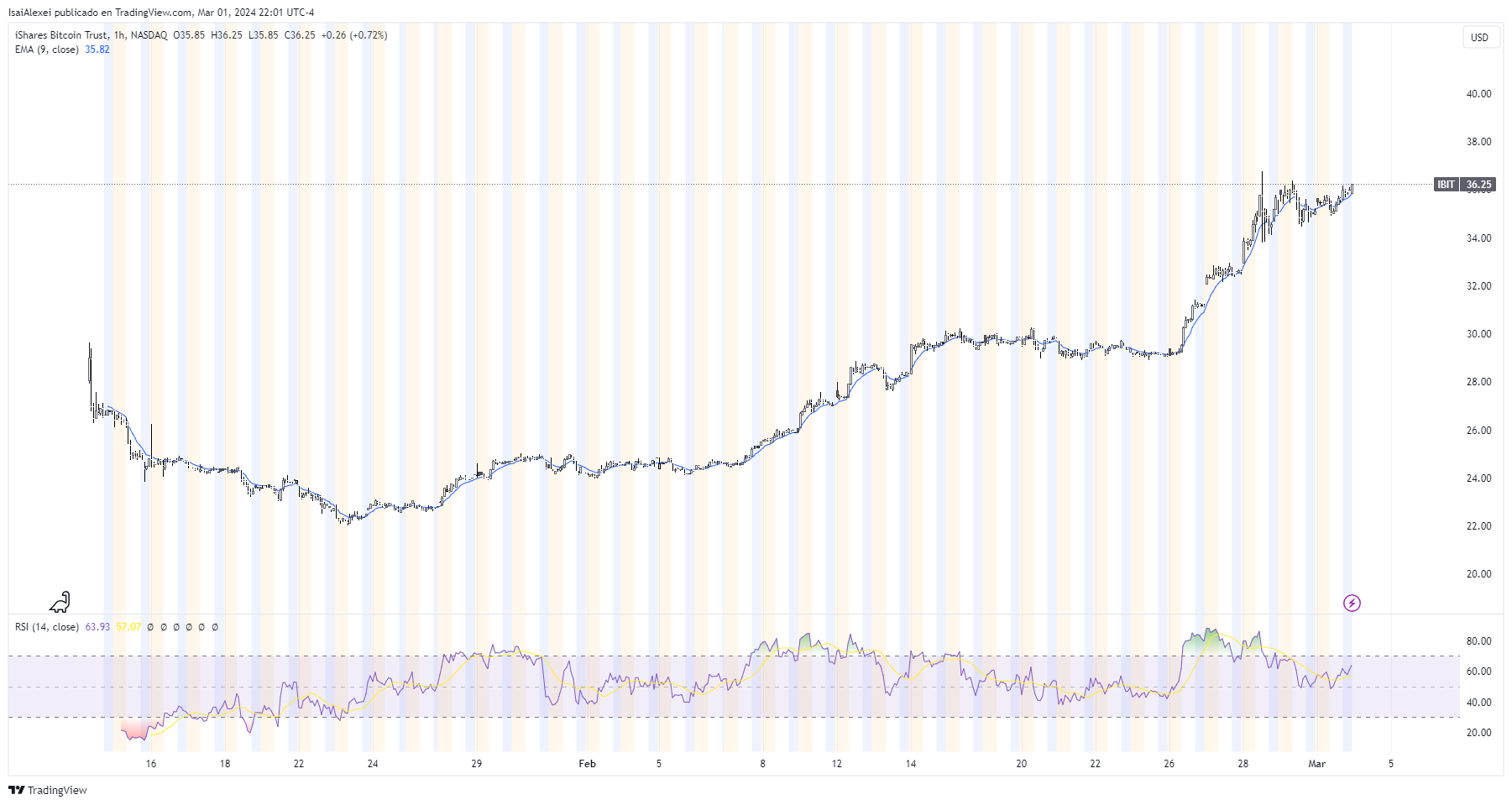

The chart shows that the price of IBIT has been in an uptrend during the visible period. The 9-day EMA (Exponential Moving Average) is below the current price, which is generally a bullish signal. The RSI (Relative Strength Index) is near 60, which indicates some strength in the current trend without being oversold or overbought.

If the uptrend continues and the RSI remains below overbought levels (generally considered above 70), it might be reasonable to expect IBIT’s price to continue to rise. However, if the RSI approaches 70 or the EMA begins to cross above the price, we could anticipate a possible correction or trend reversal.

Disclaimer: I am not a financial advisor and these predictions should not be taken as financial advice. Markets are unpredictable and it is vital to do your own research and consider your appetite for risk before investing.