- BNB tests $616 resistance amid staking upgrades; TRX consolidates at $0.24 support as SUI surges 12% post-breakout.

- BNB eyes $635 breakout; TRX’s ETF rumors clash with SUI’s May token unlock volatility risks.

- BNB’s -13% YTD contrasts TRX’s 119% annual gain; SUI targets $2.79 on bullish RSI signals.

BNB Chain’s (BNB) is testing the $616–$620 resistance zone, buoyed by ecosystem upgrades and staking incentives, while Tron (TRX) consolidates near $0.24–$0.25 support amid surging stablecoin activity and ETF speculation.

Meanwhile, SUI’s +12% surge to $2.46 follows a breakout from an inverse head-and-shoulders pattern, targeting $2.90–$3.10 if bullish momentum persists. Despite BNB’s -13% YTD deficit and SUI’s looming May token unlock, technical indicators suggest neutral-to-bullish setups across all three assets.

Traders eye BNB’s $635 target, TRX’s $0.278 breakout potential, and SUI’s $2.79 projection, balancing protocol catalysts against macro volatility risks.

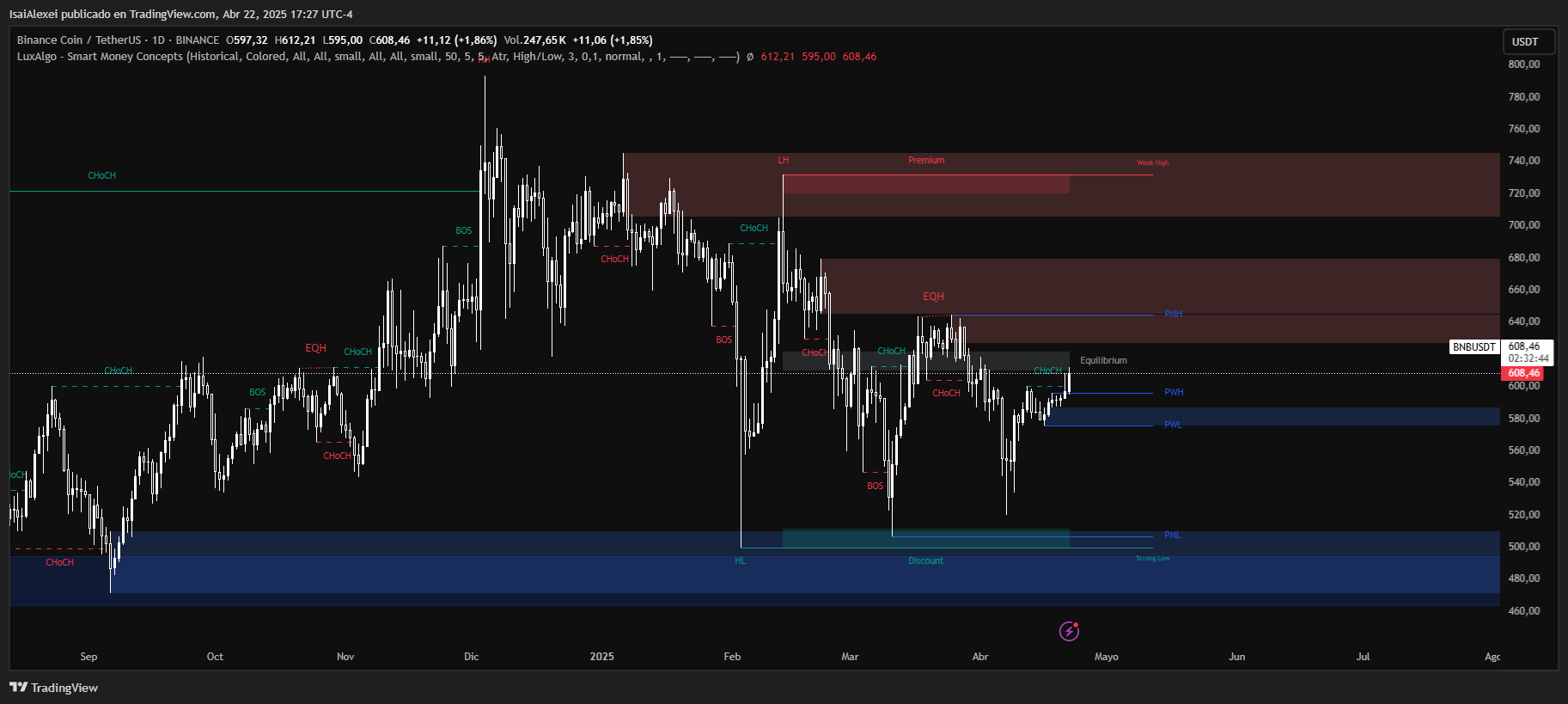

BNB (Binance Coin) is currently trading at $607.30, registering a solid +1.69% gain in the last 24 hours, and building on a 3.83% weekly increase. Despite this short-term bullish momentum, BNB remains in a broader corrective trend with a -13.43% loss year-to-date and a -3.13% decline over the past month. Still, the asset is up 4.72% over the last 12 months, showing it continues to hold strength compared to many altcoins.

Technically, BNB is attempting to break above the key resistance zone at $616–$620. A successful breakout and daily close above this level could trigger a move toward $635–$650, where the next cluster of selling pressure is likely to emerge.

If BNB faces rejection here, it may pull back to test support around $585–$570, both of which have historically served as demand zones. Moving averages and oscillators are showing neutral-to-bullish trends, while volume is picking up, hinting at renewed interest.

Fundamentally, Binance continues to dominate the centralized exchange space, and BNB benefits directly from this ecosystem integration. Recent news includes an upcoming keynote at TOKEN2049 (April 30 – May 1), and the token is also gaining traction due to new staking initiatives aimed at unifying DeFi liquidity on the BNB Chain.

These developments, along with the token’s use for trading discounts and gas fees, help sustain long-term demand despite market volatility.

If BNB clears the $620 resistance with strong volume, it is projected to reach $648 within the next 4–5 days, fueled by bullish continuation and ecosystem-driven demand.

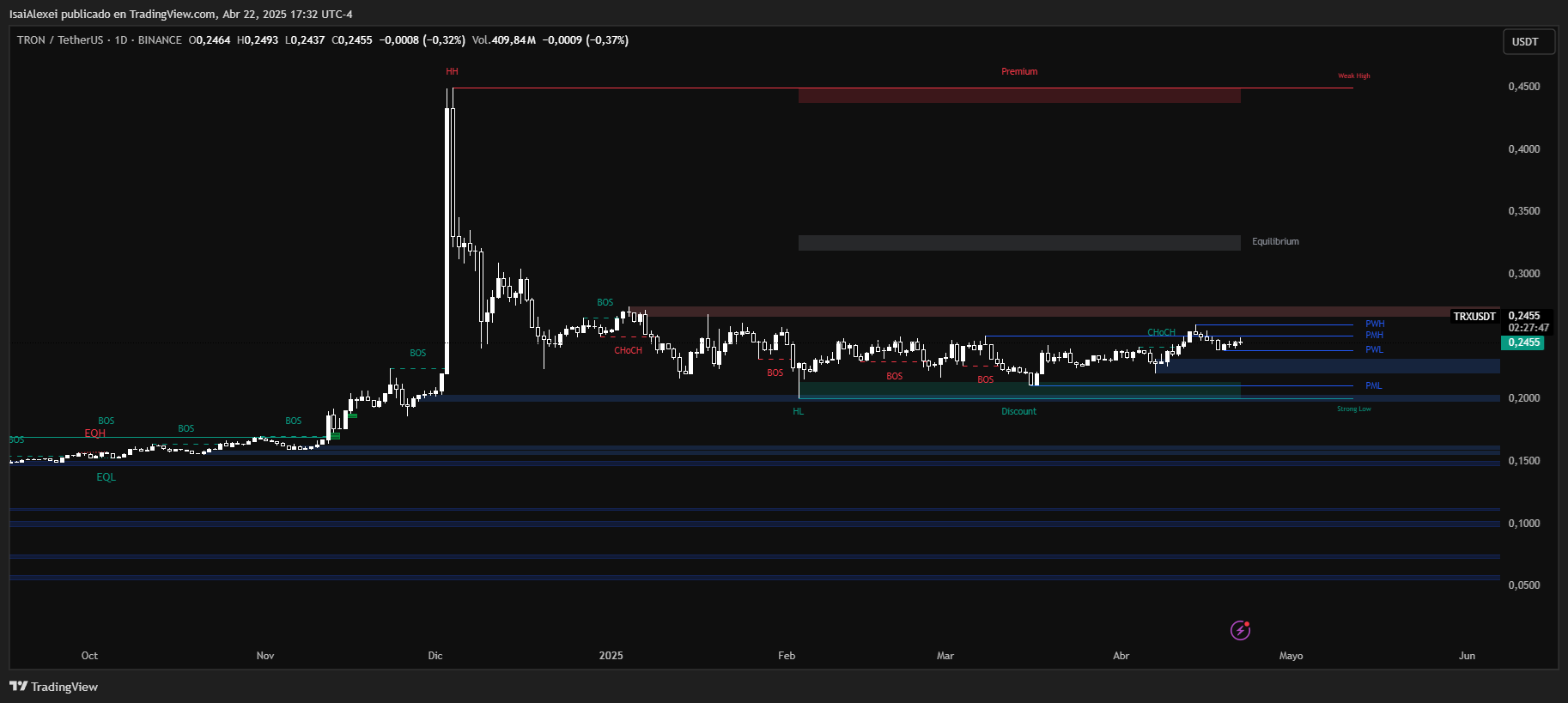

Tron (TRX) is currently trading at $0.2453, with a slight -0.56% dip on the day, continuing a modest downtrend after a -2.73% loss over the past week. However, zooming out, TRX is still up 3.42% over the last month and has gained a substantial 119.60% year-over-year, placing it among the top-performing Layer 1 assets over the longer term.

With a market cap of over $23.3 billion and a circulating supply of 94.94 billion TRX, the token remains deeply integrated in global stablecoin settlement flows and DeFi infrastructure.

Technically, TRX is showing signs of consolidation around the $0.24–$0.25 support zone, while facing resistance at the $0.26–$0.267 area. A confirmed breakout above $0.267 could open the path toward $0.278 and $0.295, while a failure to hold $0.24 may lead to a retracement toward $0.22.

Indicators suggest a neutral-to-bullish setup, and TRX recently broke out of a falling wedge pattern, signaling potential for a bullish continuation if volume supports the move.

On the fundamentals, TRX continues to gain momentum thanks to high on-chain activity and strategic positioning. Tron is leading in stablecoin settlement, and recent headlines report the minting of $1 billion USDT on the Tron network.

In addition, speculation around a staked TRX ETF is building, with filings from Canary Capital and social support from founder Justin Sun, who has publicly projected a new all-time high for TRX in Q2 2025.

If TRX reclaims and holds above $0.267, it is projected to reach $0.281 within the next 5 days, supported by strong network fundamentals and ETF-driven sentiment.

SUI is currently trading at $2.46, marking a significant +12.04% gain in the last 24 hours, and extending its bullish streak to +12.25% over the past week. While the token is still down -40.18% year-to-date, it has climbed 24.56% in the past 6 months and is up 79.43% over the past year, signaling a strong rebound from its previous lows.

The current market cap stands at approximately $8 billion, supported by a robust $1.12 billion in 24-hour trading volume—a clear indicator of active market participation.

Technically, SUI has broken above several key resistance levels, including the psychological $2.40 zone, and is now eyeing the next target between $2.55–$2.65. If it sustains this breakout, a further move toward $2.90–$3.10 is feasible in the short term.

On the downside, if price fails to hold above $2.30, a retracement back to $2.10–$2.00 could be triggered. Market sentiment is turning bullish, and analysts on TradingView highlight an inverse head-and-shoulders pattern, a common reversal formation, that could support continuation to the upside.

Fundamentally, SUI remains one of the more active smart contract platforms, ranking 5th in DEX volume, though some reports suggest it lacks trend strength to sustain rallies. A key upcoming catalyst is the AMA scheduled for April 17th, which may offer updates on protocol developments or community incentives.

However, concerns around supply inflation remain due to a 2.28% token unlock scheduled for May 1st, which could introduce short-term volatility.

If bullish momentum continues and $2.50 holds as support, SUI is projected to reach $2.79 within the next 4–5 days, driven by technical breakout strength and increasing market confidence.