- BounceBit democratizes high-yield Bitcoin opportunities for individual investors by combining CeFi and DeFi to form CeDeFi.

- The 2024 road map of BounceBit is centered on improving infrastructure and CeDeFi devices to increase Bitcoin utility.

The pioneering Bitcoin restaking chain BounceBit, with Binance’s support, has published its extensive 2024 roadmap. Through the introduction of a new paradigm, CeDeFi, this ambitious initiative seeks to unite the domains of centralized finance (CeFi) and decentralized finance (DeFi).

The roadmap outlines BounceBit’s goal of opening up high-yield possibilities that are now only available to affluent financial institutions.

The Emergence of CeDeFi: Bringing the Finest Features of Both Worlds

The fundamental idea of BounceBit is to combine the structure and security of CeFi with the creativity and openness of DeFi. Through this integration, the billion-dollar traditional finance market for fixed income prospects in the cryptocurrency realm is aimed at being addressed.

Projects like Ethena have advanced the use of synthetic dollars to provide steady payouts, in line with what ETHNews previously disclosed; BounceBit seeks to go one step further by integrating the advantages of CeFi and DeFi.

A major factor in giving the cryptocurrency market structure and accessibility have been centralised exchanges (CEXs) such as Binance and Coinbase. For millions of people switching from fiat to digital assets, they offer effective trading and liquidity options.

But CEXs also have to deal with issues that go against to the fundamental principles of sovereignty, openness, and decentralization of cryptocurrency.

By contrast, DeFi provides direct, middle-man-free access to financial markets. It still struggles with problems like scalability, regulatory ambiguity, and the security of smart contracts.

The CeDeFi strategy of BounceBit seeks to get beyond these obstacles by combining the strong points of both financial domains, therefore promoting widespread adoption.

Main Ideas and Goals

With BounceBit, the wheel is refined and improved rather than invented. The goal of the project is to provide high-yield prospects within the Bitcoin asset class that were previously only available to leading asset management companies to individual investors.

Neither is BounceBit trying to invent the wheel. Rather, the firm said:

“We want to offer a new viewpoint by combining the best features of CeFi with the creative potential of DeFi.”

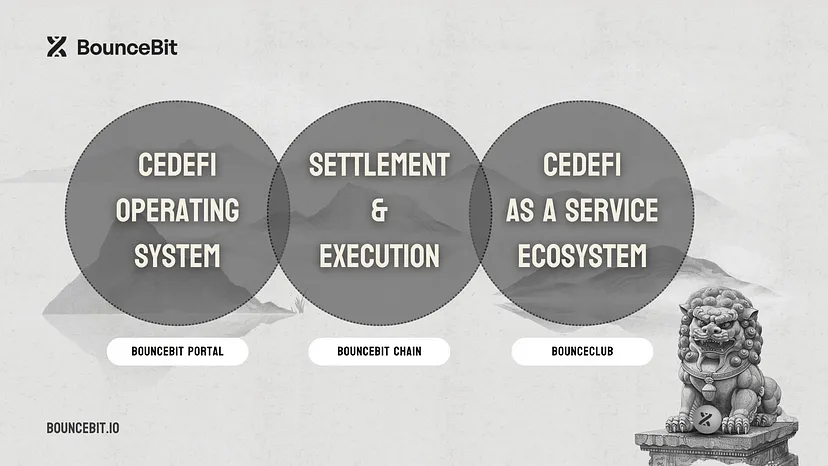

Through the bridge it builds between CeFi and DeFi, BounceBit aims to make these financial prospects more accessible to everyone. These are the main components of BounceBit’s ecosystem:

- BounceBit Portal: Functions as the operating system and offers a user interface for simple interaction with different CeDeFi products.

- BounceBit Chain: Acts as the layer of settlement and execution to guarantee effective and transparent on-chain transactions.

- BounceClub: A CeDeFi service and ecosystem building platform that enables customers to use BounceBit’s infrastructure to launch their goods.

While other projects try to be a Layer 2 or sidechain to the Bitcoin network, BounceBit concentrates on improving Bitcoin’s functionality without changing its fundamental technology. Three primary goals drive the BounceBit Chain:

- CeDeFi Settlement and Record-Keeping: Ensures secure and immutable on-chain settlement and record-keeping.

- Dual-Token PoS Structure: Enables users to earn staking rewards in BB by securing the chain with BBTC or BB tokens, enhancing network security, and incentivizing participation.

- Yield Opportunities: Offers diverse on-chain yield opportunities, including swaps, meme token issuance, and DeFi derivative trading.

Liquid Custody Token: The Bridge to CeDeFi Wonderland

Liquid Custody Token (LCT) are a fundamental part of the BounceBit architecture. These tokens act as a bridge to the CeDeFi ecosystem and are 1:1 backed by comparable assets in custody.

LCT lets users engage in Bitcoin staking and on-chain farming and receive real interest from CeFi. To holders of Bitcoin, this integrated ecosystem provides three kinds of yield:

- CeFi Yield: Earned from funding rate arbitrage and over-collateralized lending and borrowing.

- Staking Rewards: Earned from node operations by staking Bitcoin on the BounceBit chain.

- Opportunity Yield: Generated from various activities within the BounceBit chain ecosystem.