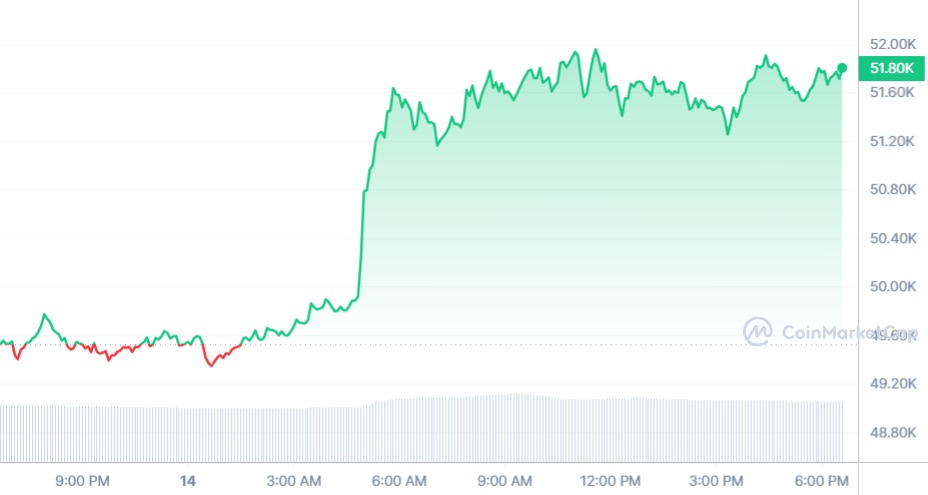

- Bitcoin’s rise in price to $52,000 and its market capitalization reflect growing confidence in Bitcoin ETFs.

- Court approval for Genesis to sell GBTC shares injects liquidity into the market, potentially altering supply and demand dynamics.

For Bitcoin ETFs, the recent rise in Bitcoin’s price to $52,000 and restoration of its market value to $1 trillion marks a significant development that demonstrates an increase in confidence and interest toward Bitcoin-linked investment products.

The court decision allowing Genesis to sell its shares in the $1.3 billion Grayscale Bitcoin Trust (GBTC) highlights changes in the cryptoasset market and how legal rulings can affect the availability and liquidity of assets.

Wednesday’s rally also lifted BTC’s market value above $1 trillion, surpassing this milestone for the first time since December 2021. Bitcoin experienced a 4.7% increase in the past 24 hours, the same magnitude of advance as the broad market index.

Altcoins likewise experienced a recovery, with Cardano’s ADA (ADA) and the popular meme token dogecoin (DOGE) increasing 6% over the course of the day.

Ether (ETH) also rose more than 5% to $2,750, its highest price since May 2022.

Steady Rise and Demand for Bitcoin ETFs

Bitcoin’s rising price and growing interest in Bitcoin ETFs, especially with capital inflows into funds such as BlackRock’s IBIT, indicate an optimistic mood regarding cryptoassets.

The growth in demand for spot Bitcoin ETF products signals an investor preference for regulated and more accessible investment vehicles to participate in the Bitcoin market without the need to directly acquire cryptoassets.

Effects of the GBTC Share Sale

The authorization for Genesis to liquidate its shares in GBTC could inject an amount of liquidity into the market, which could alter the supply and demand dynamics of Bitcoin and, consequently, its price.

While it is possible that redemptions could accelerate, positive market sentiment and support through significant investments in Bitcoin ETFs could mitigate any resulting selling pressure.

This backdrop highlights the role of Bitcoin ETFs in the crypto sector, providing an attractive alternative for institutional and retail investors seeking exposure to Bitcoin in a regulated environment.

As the Bitcoin market continues to develop, Bitcoin ETFs are cementing their place as key enablers for the incorporation of cryptoassets into the traditional financial system, opening avenues for new segments of interested investors who prefer more traditional investment vehicles.

Bitcoin ETFs are encouraging, characterized by growing interest and demand, as well as legal and market developments that could influence their future acceptance. The ability of these products to attract investment highlights their role as links between crypto and traditional financial markets, offering diversified and regulated Bitcoin investment opportunities.

At the time ofthis writing, Bitcoin is trading at $51,723.84