- Ethereum faces sell-off concerns; whales transferred $538.5 million worth of ETH to exchanges like Kraken and Binance.

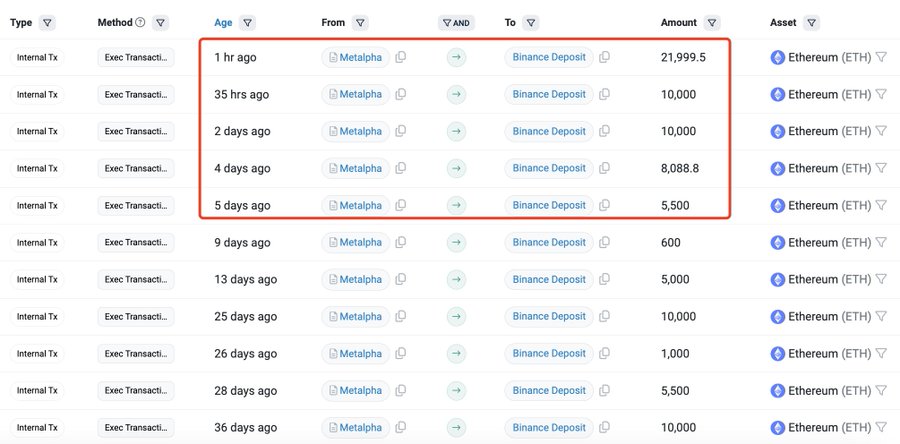

- Large transactions by entities such as Metalpha contribute to potential selling pressure, with $128.7 million deposited on Binance.

Ethereum has recently seen a slight price recovery, trading at $2,366, marking a 1.76% increase over the last 24 hours. Despite this uptick, the cryptocurrency remains below its yearly high, raising concerns among investors about potential volatility due to recent whale activities.

Whale Alert has reported large Ethereum transactions moving to exchanges, suggesting potential sell-offs. The total transferred by whales amounts to approximately $538.5 million, with significant portions going to major exchanges such as Kraken, Binance, Arbitrum, and Coinbase.

For instance, Binance received about $188.6 million in Ethereum, and similar amounts were noted moving to other platforms.

The flurry of these transfers includes actions by Metalpha, a Hong Kong-based firm, which deposited over $128.7 million worth of Ethereum on Binance in just five days.

This pattern of large deposits is often interpreted by the market as preparation for sales, which can increase supply on exchanges and pressure prices downward.

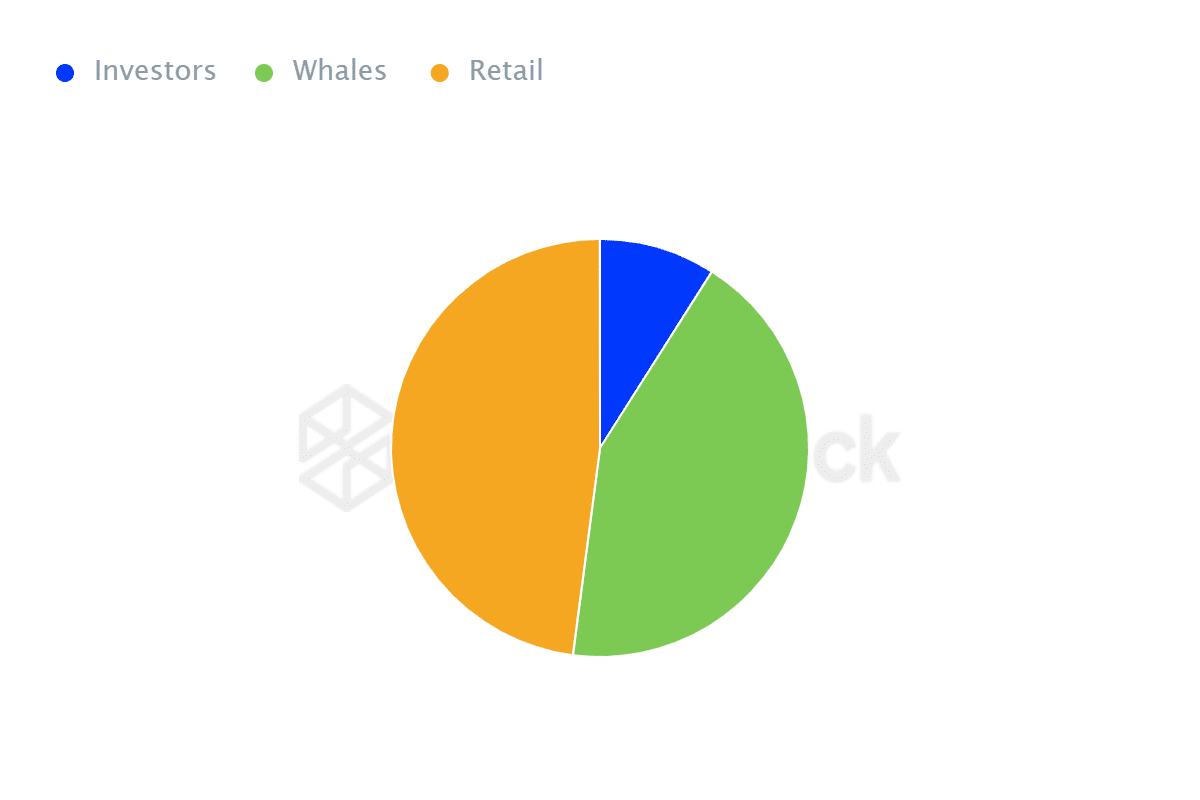

The context of these transactions reveals a broader apprehension within the Ethereum community. Historical data from IntoTheBlock shows that retail traders currently control 47.93% of Ethereum, a higher figure than that controlled by whales, who hold 43.07%.

This shift in market control from large holders to retail traders can lead to increased price sensitivity and potential for rapid sell-offs, as retail traders are generally more prone to emotional trading decisions.

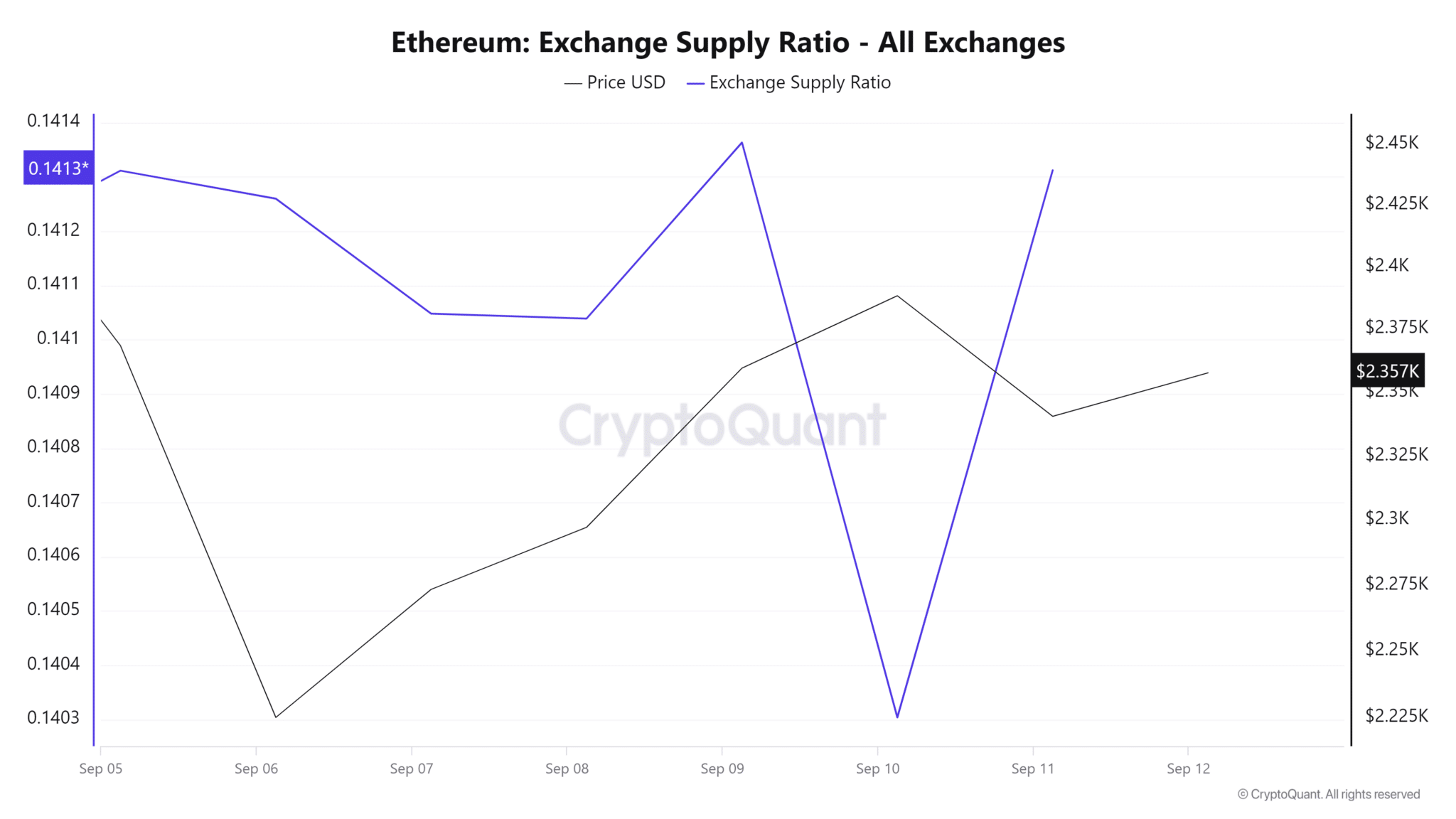

Moreover, the increase in Ethereum’s exchange supply ratio over the past day further compounds the market’s nervousness. An increase in this ratio suggests that more holders are moving their assets to exchanges, typically an indicator of intent to sell in anticipation of declining prices.

The overarching sentiment is cautious, as the influx of Ethereum into exchanges by whales could impact the market. If these large holders proceed with selling their holdings, Ethereum could face substantial selling pressure, potentially pushing prices down further.

ETHNews market analysts and traders will be watching closely to see if this whale activity is a precursor to deeper market corrections or merely a strategic reallocation by large investors.