- Bitcoin faces uncertainty as analysts predict 2026 for its next rally, with historical charts supporting this view.

- Bitcoin’s current market pullback aligns with past cycles, suggesting a potential rebound and continued upward movement.

Bitcoin is currently testing major resistance levels, with its price trading around $85,000 amid market volatility. As traders brace for the Federal Reserve’s next decision on interest rates, there is growing uncertainty over the market’s direction. While some analysts predict that a bull run could happen by mid-2025, a historic 150-year-old chart points to 2026 as the year for Bitcoin’s next rally.

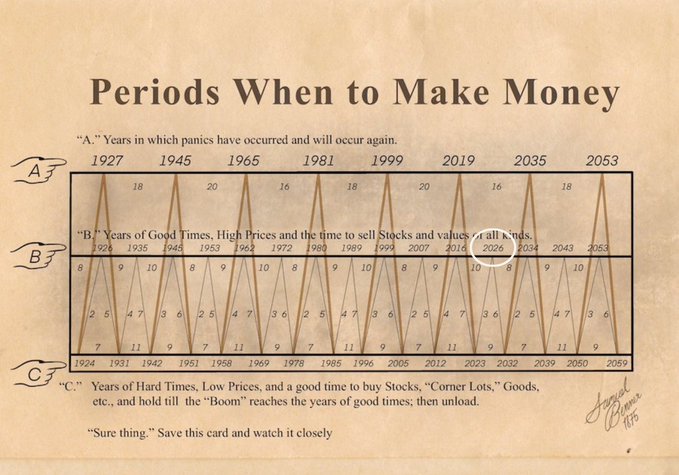

The chart, originally created by an Ohio farmer, tracks market cycles over the past century and a half. Dividing market conditions into three categories—good times, hard times, and “panic year—” the chart gives insights on the best times for buying and selling assets.

Lark Dewis, a Bitcoin investor, recently referenced this chart, suggesting that 2026 will be a year of good times for Bitcoin, pointing to a strong period for selling and taking profits.

150 years ago, a farmer from Ohio published this chart on when to make money

This chart has proven to be remarkably accurate in the past

It told us to exit the markets in 2007, right before the 2008 crash

Now, it's indicating that 2026 will be the "year of good times" and… pic.twitter.com/r4orqoHuoQ

— Lark Davis (@TheCryptoLark) March 18, 2025

Historically, the chart has proven accurate, including its foresight of the 2008 market crash. The chart identifies good times as periods when markets see high asset prices, suggesting that these are the years to sell. Hard times are marked by lower prices, giving opportunities for acquisition.

Meanwhile, panic years often mark market downturns. Dewis highlights that the chart points to 2026 as a likely candidate for a market resurgence, suggesting Bitcoin could experience growth during this period.

Bitcoin’s Current Market and Analyst Opinions

Bitcoin’s market behavior has created a divide among analysts. While some predict that the bull run will continue into 2025, others, like Ki Young Ju, CEO of CryptoQuant, believe the current cycle may be nearing its end.

Ju suggests that Bitcoin’s price might either move slowly or experience further declines over the next six to twelve months. This view contrasts with the belief held by others, who foresee Bitcoin reaching new all-time highs by June 2025.

#Bitcoin bull cycle is over, expecting 6–12 months of bearish or sideways price action. pic.twitter.com/f80bnNhjy4

— Ki Young Ju (@ki_young_ju) March 17, 2025

Technically, Bitcoin is following a rising wedge pattern on its chart, a signal of future volatility. ETHNews pointed out that if Bitcoin manages to break out of this wedge, it could lead to a price surge. However, a rejection at this point could lead to further declines.

Adding to the ongoing analysis, Rekt Capital, a crypto analyst, weighs in on Bitcoin’s current pullback. He points out that the recent drop of nearly 30% is one of the deeper retraces in this cycle.

However, Rekt Capital argues that such pullbacks are not unprecedented, noting similar declines in previous cycles, such as the post-halving corrections in 2021 and 2017.

According to Rekt, the market’s behavior reflects a historical pattern, suggesting that Bitcoin could rebound as it has in the past. In his analysis, Rekt Capital noted that Bitcoin has experienced deeper retracements in previous bull markets, such as a 32% drop following the 2021 halving.

These historical pullbacks don’t signal the end of the bull run; rather, they are part of Bitcoin’s cyclical behavior. Rekt’s insights suggest that despite the recent downturns, Bitcoin could still be on track for another upward move in the near future.