- More than 81,000 traders have lost leveraged positions, totaling losses of $220 million in the last day.

- A quick drop to $66,000 in Bitcoin was due to an unexpected improvement in U.S. manufacturing activity.

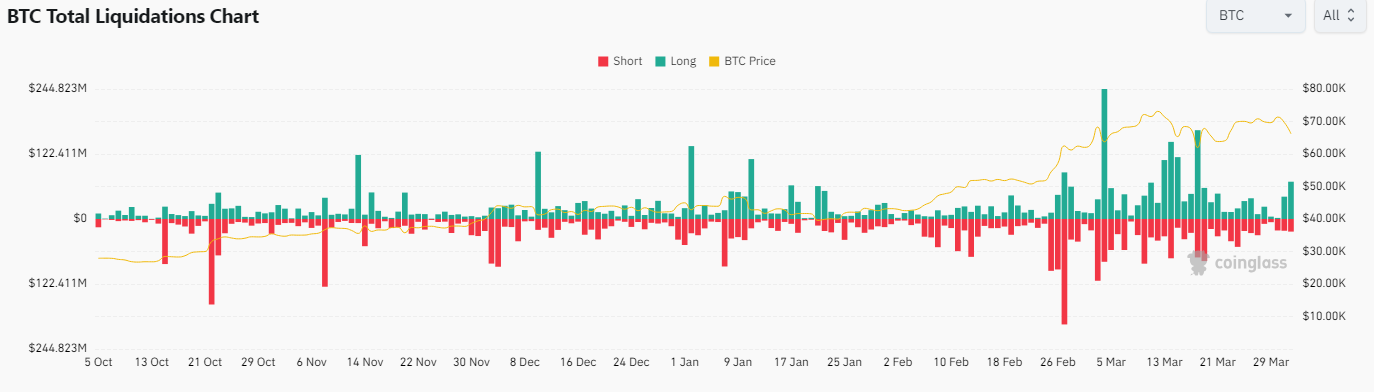

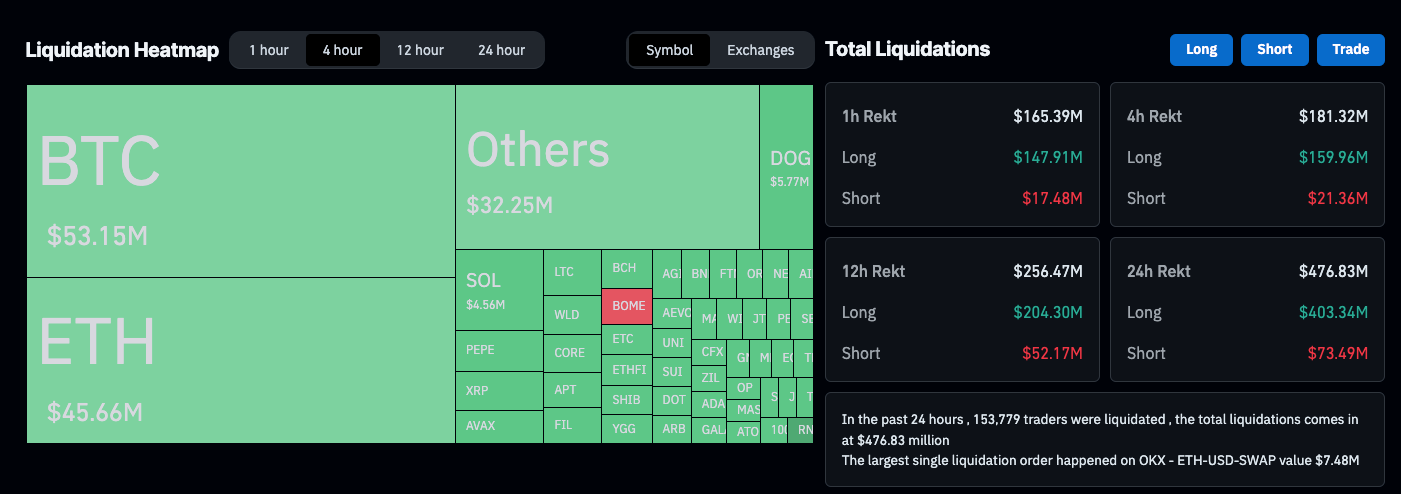

$500 million has been liquidated due to a 5.5% drop in the price of Bitcoin (BTC). Of this amount, $414 million corresponded to liquidations of long positions and $85 million to short positions. In particular, Bitcoin liquidations totaled $66 million, while the rest came from other cryptocurrencies.

According to Coinglass data, activity in the options market shows interest in selling call options and buying puts for both Bitcoin and Ethereum (ETH), which has put pressure on spot prices and kept implied volatility levels elevated, especially in ETH.

$500M liquidated as #Bitcoin drops 5.5%!

Options market heats up with heavy put calls, suggesting bearish sentiment.

Meme coins face strong selling pressure too.

Is it fear of upcoming #BTC halving or broader market correction?

I believe the price will continue to… pic.twitter.com/pDhoZTxAeH

— Marcel Knobloch aka Collin Brown (@CollinBrownXRP) April 2, 2024

Over the past day, more than 81,000 traders have lost their leveraged positions, totaling losses of $220 million. Most of these liquidations, 85.64% in the last 12 hours, correspond to traders in long positions. On shorter time frames, these long positions also accounted for the majority of liquidations.

But at the same time, the fall has encouraged a high level of leverage among traders, reaching $165 million according to Coinglass data.

Related: Bitwise predicts Bitcoin to get $1 trillion from institutions in current bull market

Currently, the Bitcoin price is facing resistance at $69,500, registering a 1.1% drop over the past day. After a quick drop to $66,000, due to the unexpected improvement in U.S. manufacturing activity in March, the market recorded more than $250 million in settlements in the last 12 hours.

The move led some analysts to reassess their expectations for the Bitcoin market, considering the possible influence of the Federal Reserve’s interest rate policies.

The GMCI 30 index, which represents a selection of the top 30 cryptocurrencies, fell 9.6% to 143.40 in the past 24 hours.

Ethereum, the second largest cryptocurrency, experienced a 6.5% decline to $3,319.

Analysts at a cryptocurrency trading firm noted that the options market anticipated this move. Settlements were led primarily by exchanges with a large retail investor base.

The options market provided early warning of a sharp move to the downside, particularly the negative skew in risk reversals.

You can read: Bitcoin and Ether ETNs to begin trading on the London Stock Exchange in May

The swiftness of the move was due to large liquidations on exchanges with many retail investors such as Binance, which saw perpetual funding rates go from as high as 77% to flat.

On the Bitcoin futures order book at Binance, there are buy bids for more than $500 million sitting in an approximate price range between $65,000 and $66,000, just below the current price.

The current price of Bitcoin (BTC-USD) is approximately $65,925.71, which represents a decrease of $3,551.75 or 5.11% since it was last recorded. The price range on the day has ranged from $65,843.14 to $69,694.05.

In the last year, Bitcoin has had a price range from $24,797.17 to $73,750.07. Bitcoin currently has a market capitalization of about $1.297 trillion and a trading volume of $42.60 billion inthe last 24 hours.