- Buterin proposes replacing Ethereum Virtual Machine with open‑source RISC‑V architecture, targeting streamlined smart‑contract execution and modularity for scalability.

- He estimates RISC‑V integration could deliver up to one‑hundred‑fold performance improvements, especially benefiting zero‑knowledge rollup verification workloads costs.

Vitalik Buterin has put forward a plan to swap the network’s current execution engine, the Ethereum Virtual Machine, for RISC‑V, an open‑source instruction set used across hardware and software design. The proposal, published on the Ethereum Magicians forum, frames RISC‑V as a leaner alternative that could ease bottlenecks in smart‑contract processing and trim verification costs for zero‑knowledge applications.

The EVM has powered Ethereum since 2015, yet its custom design carries overhead that becomes clear when complex workloads or ZK rollups enter the picture. Buterin argues that a move to RISC‑V is “the only realistic path” to lighten the execution layer and make room for next‑generation use cases. He estimates that throughput could improve by as much as one hundred times for projects that rely on ZK‑EVM systems—setups that today burn heavy computation merely to confirm batches of transactions.

Three integration routes are on the table. First, Ethereum could allow native deployment of both EVM and RISC‑V contracts, giving developers a choice. Second, the chain could introduce a RISC‑V interpreter that runs EVM bytecode. Third, interpreters could become a formal element of the protocol, letting the network add or swap engines as technology evolves. Each path carries trade‑offs in complexity, tooling effort, and backward compatibility.

Moreover, zero‑knowledge rollups stand to benefit first if RISC‑V takes hold, because lower verification costs could widen margins for layer‑two operators. Consequently, gas fees on the base chain might ease, improving user experience in areas such as on‑chain trading and stablecoin transfers.

Still, governance hurdles remain. Any change of this scale requires broad agreement among core developers, client teams, and node operators. Furthermore, tooling and security audits would need to match the reliability level reached by the EVM after nearly a decade in production.

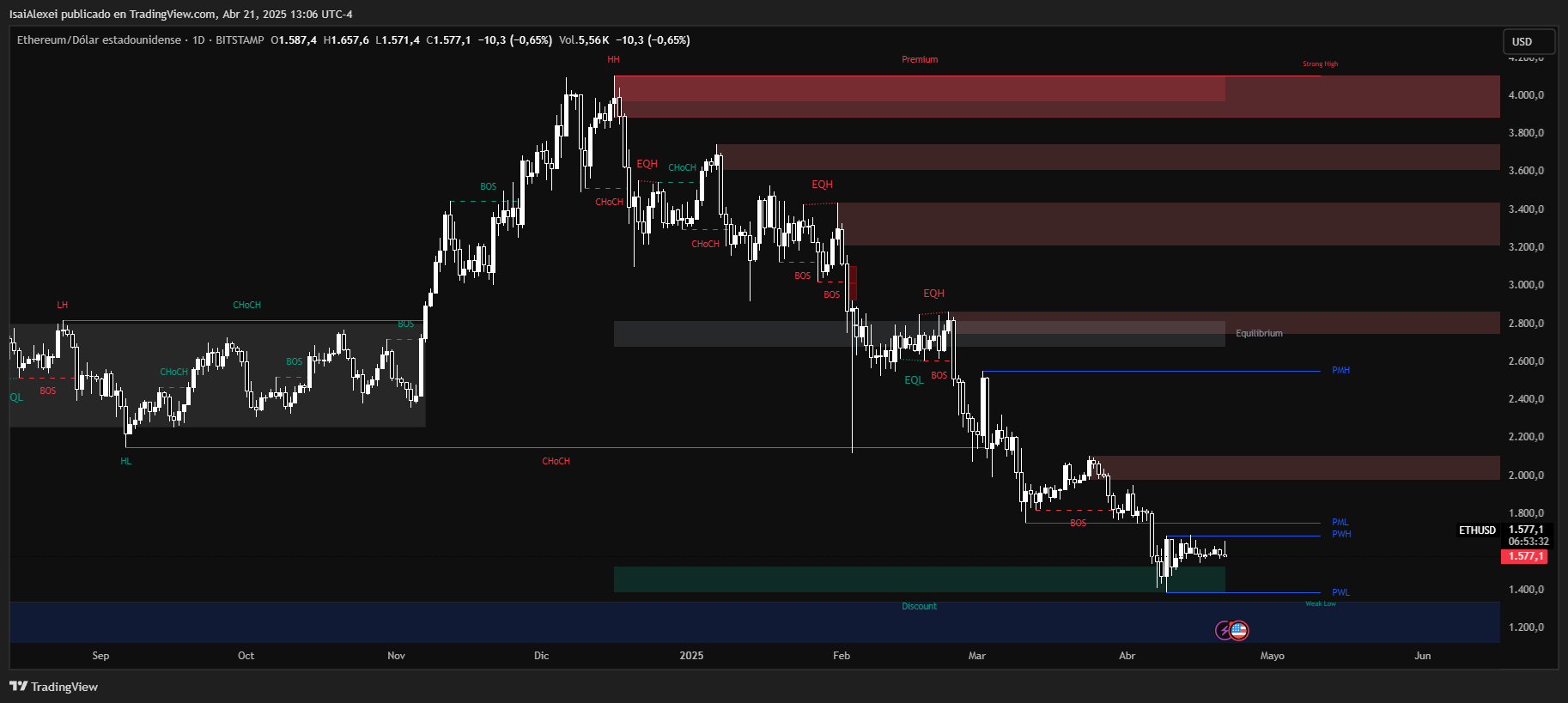

Ethereum (ETH) is currently trading near $1,623, with modest fluctuations reflecting a consolidation phase following its recent rebound. Over the past week, ETH has shown gradual strength after defending key support around $1,580, but remains in a broader bearish trend, with a ~50% year-to-date loss and continued underperformance relative to Bitcoin. Still, ETH’s resilience at these levels suggests growing interest as it prepares for key ecosystem upgrades.

Technically, ETH is hovering just below the $1,675–$1,700 resistance zone. A clear breakout above this range could send ETH toward $1,770–$1,850, aligning with previous supply zones and the 50-day moving average.

Momentum indicators such as RSI and MACD are neutral, but beginning to tilt bullish, indicating early stages of a potential breakout if volume increases. On the downside, failure to hold the $1,600–$1,580 support could trigger a move toward $1,450, where strong buyer interest was last seen.