- Despite the market correction, ETH, SOL, XRP, and DOGE show technical signals and network strength hinting at potential April rebounds.

- Liquidations top $450M and volume drops 10%, yet strong address activity and legal clarity could drive selective crypto recoveries.

As the crypto market faces another correction, several high-profile tokens are trading at lower prices. Market volatility has created conditions that some traders view as an opportunity for short-term accumulation. With total liquidations exceeding $450 million and daily trading volume down by 10%, market sentiment remains cautious.

Nevertheless, technical data and recent network activity around key tokens suggest there could be potential for upward movement in April. Four assets, Ethereum (ETH), Solana (SOL), Ripple (XRP), and Dogecoin (DOGE), stand out for their positioning in the current decline phase.

Broader Market Context

As noted in our previous post, the crypto market cap has fallen by 1.94% in the last 24 hours to $2.71 trillion. Bitcoin remains stable, holding around the $83,000 mark.

Overall volume has decreased to $77.15 billion, displaying investor caution following a wave of liquidations. These factors point to a market briefly under pressure but not without opportunity. Analysts point to several tokens with strong network metrics or favorable chart patterns that could display resilience in April.

Ethereum (ETH) Eyes Recovery Post-Liquidation

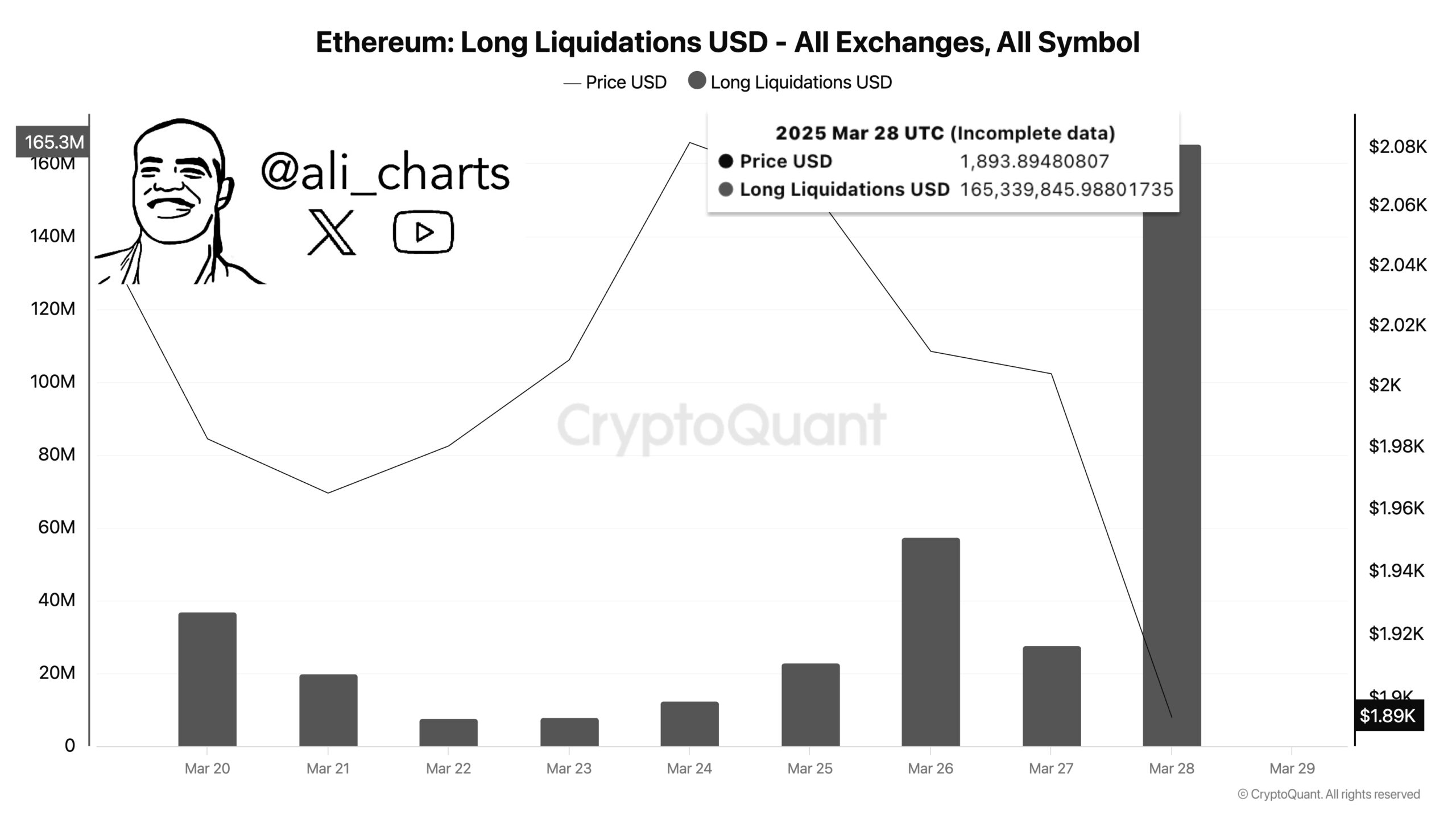

Ethereum recorded a decline in long positions on the day, with approximately $165 million in liquidations. The asset is now priced at $1,881 under the support level. However, short-term price action shows a 2% intraday gain, indicating some recovery.

Historically, large-scale liquidations often follow market resets where long-term investors reenter at lower valuations. Ethereum’s upcoming upgrades and continued high usage across decentralized applications may help stabilize its price over the next few weeks.

Solana (SOL) Signals Strong User Activity

Solana has dropped to $126, falling below its $130 support line, reflecting a 3% daily loss. Still, blockchain data shows increased active addresses, now at over 11.12 million. This surge in network participation suggests strong community interest despite price weakness.

Solana has previously shown the ability to rebound quickly, and sustained usage could become a price catalyst as April unfolds.

XRP Poised for Movement Following Legal Progress

Ripple’s XRP is trading just under $2.15, showing a 3.67% decline in the past 24 hours. However, the token has posted a 250% gain over the past 12 months. With the U.S. Securities and Exchange Commission ending its case against Ripple, market observers are watching for a possible relief rally. Legal clarity tends to boost investor confidence, and positive shifts could support upward price action in the short term.

Dogecoin (DOGE) Shows Signs of Reversal

Dogecoin is down 4%, now trading at $0.1694 after failing to hold above $0.18165. It recently exited a descending channel, signaling a bearish trend. Despite this, analysts point to a bullish divergence in the Relative Strength Index (RSI), which may point to a near-term bottom. Short-term traders may see an opportunity if DOGE breaks resistance and finds support in the coming sessions.