- Strong resistance at $5.7 could lead to short-term volatility; a bullish recovery might be challenging without clear buyer momentum.

- Bearish trends confirmed by MACD and EMA crossovers, with UNI nearing a nine-month low in a low liquidity zone.

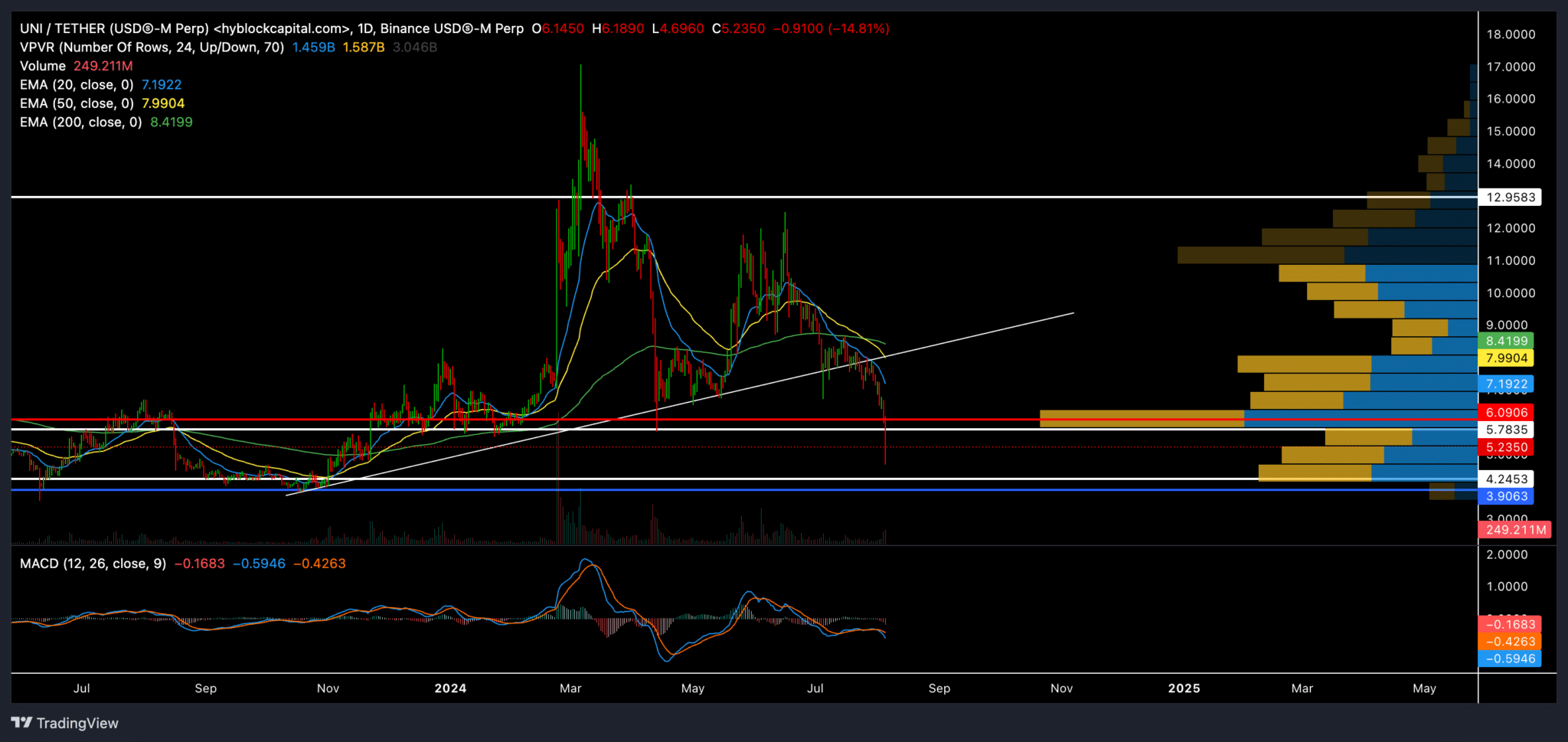

Uniswap (UNI) has recently experienced a decline, falling below critical support levels and long-term Exponential Moving Averages (EMAs), highlighting a period of intense bearish momentum in the cryptocurrency market. At present, UNI is trading at $5.2, reflecting a drop of over 31% in the past week.

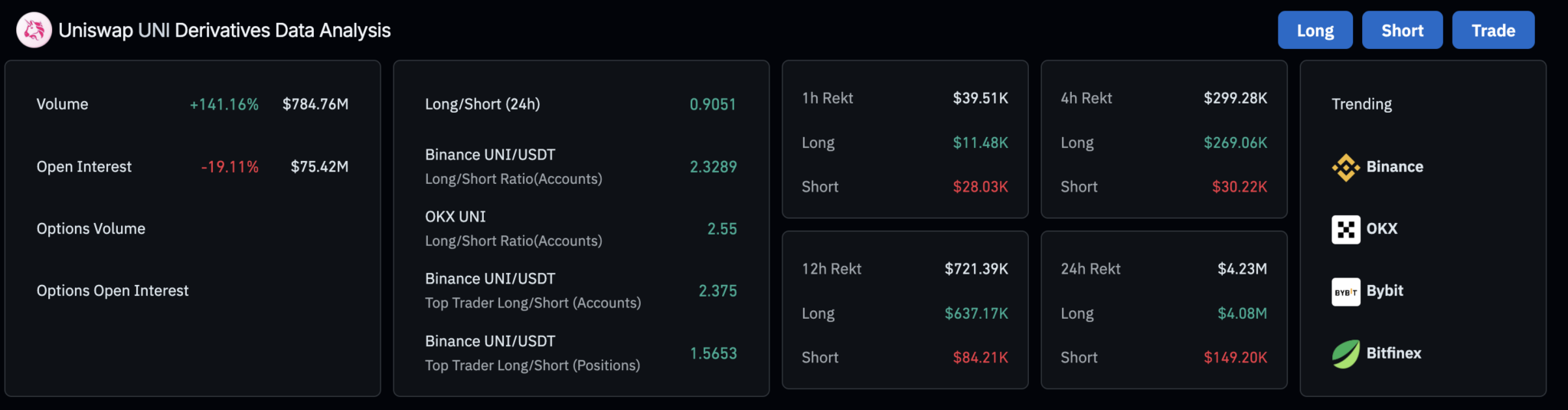

The crypto derivative data suggests a bearish outlook, although there remains a slight possibility for buyer intervention. The recent downturn has pushed UNI into a zone of relatively low liquidity, where it is currently struggling to find firm footing.

[mcrypto id=”46921″]ETHNews analysts are closely watching the $5.7 resistance level. If this level continues to hold against buyer pressure, UNI might experience short-term volatility before any potential bullish recovery. The Crypto Fear and Greed Index has also indicated a strong bearish sentiment, adding to the challenges faced by bulls in reversing the current downtrend.

From a technical perspective, UNI has undergone a series of red candles, signaling sustained selling pressure. The coin witnessed a substantial reversal starting from a high of around $13 in early April to its current levels. Despite the overarching downtrend, UNI initially found some support near the nine-month trendline, which previously acted as resistance and then as support.

Moreover, a bearish crossover was observed as the 20-day and 50-day EMAs moved below the 200-day EMA. According to the Volume Profile Visible Range (VPVR) indicator, the price action is now within a low liquidity zone.

Looking ahead, if market conditions show signs of improvement, buyers might attempt to retest the Point of Control (POC) near the $6 mark on the VPVR. However, crossing this level might prove challenging without a distinct bullish advantage.

Conversely, should the bearish market sentiment persist, UNI could potentially decline towards the $3.9 to $4.2 support range in upcoming trading sessions. The Moving Average Convergence Divergence (MACD) indicator continues its downtrend and has recently shown a bearish cross below the equilibrium, suggesting ongoing selling pressure.

Furthermore, a reduction in open interest alongside an increase in trading volume indicates that many traders are choosing to close their positions amidst the current volatility, possibly to take profits or minimize losses.

Despite these bearish indicators, the long/short ratios on platforms like Binance and OKX demonstrate strong bullish sentiment among top traders, hinting at a potential divergence between general market sentiment and the views of leading traders.