- Cardano falls below $0.60, liquidating 60% of leveraged longs as derivatives data signals rising sell-side pressure.

- Open Interest drops 18% to $571M, reflecting unwinding bets; high leverage risks further squeezes if demand lags.

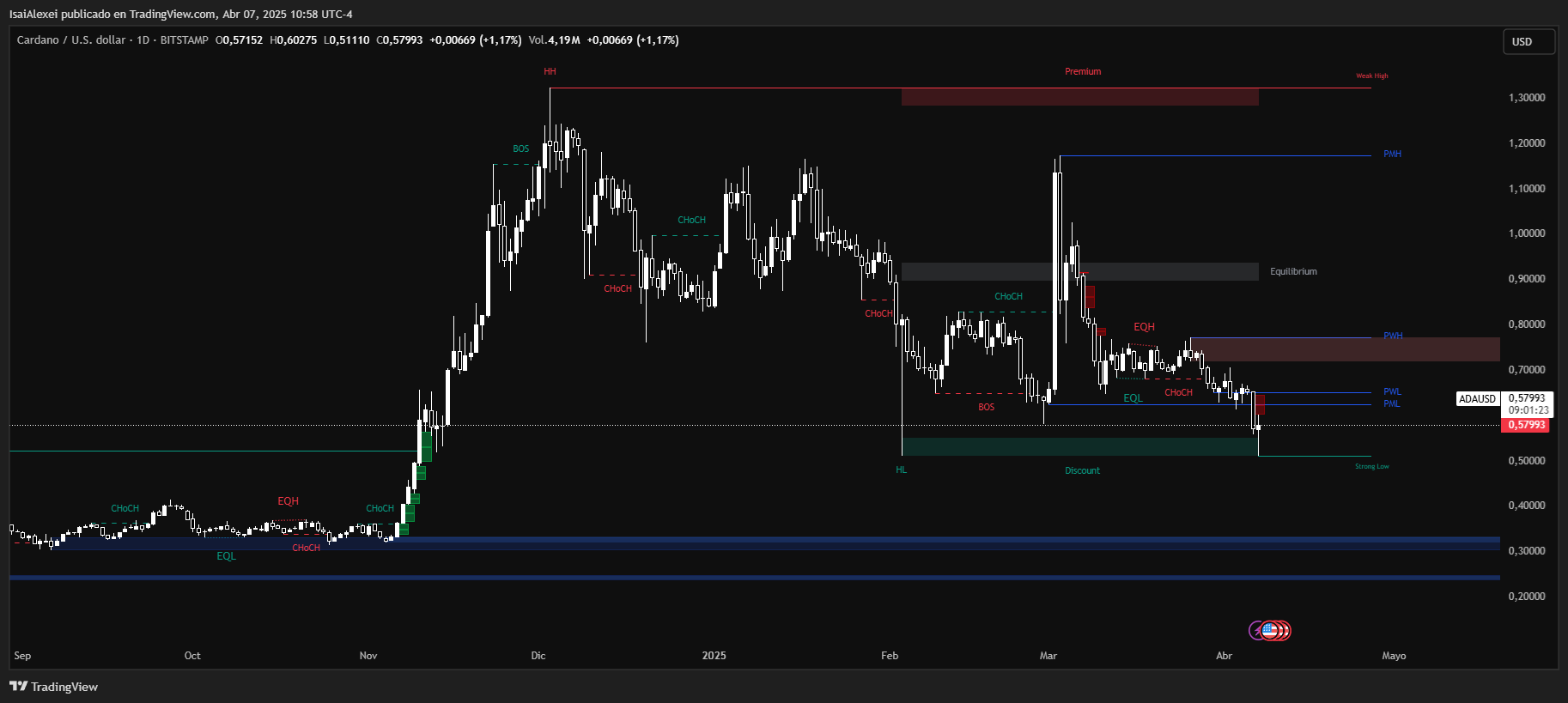

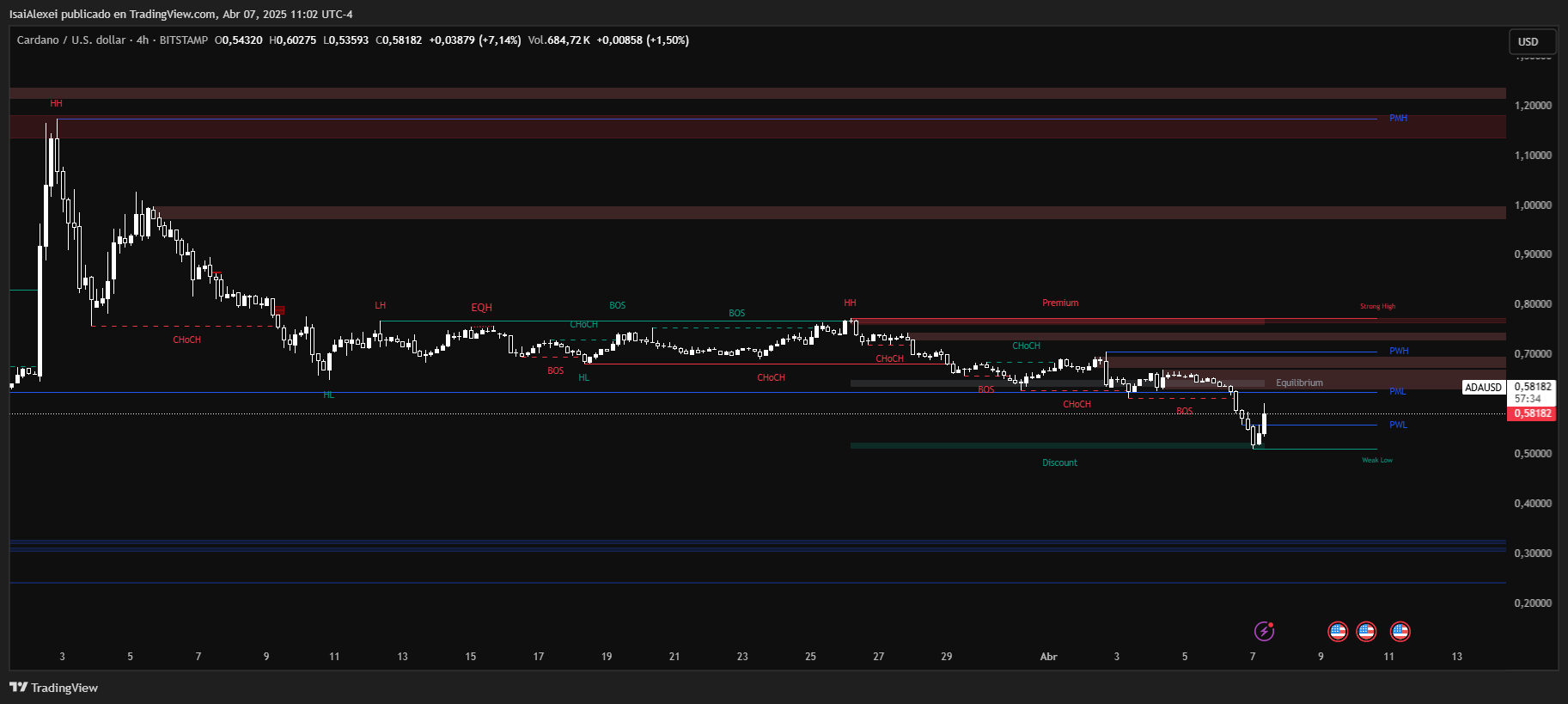

Cardano (ADA) dropped below $0.60 this week, erasing gains for most leveraged buyers. The token’s 15% decline triggered liquidations affecting six out of ten long-positioned traders, according to exchange data. Derivatives markets show rising pressure: Open Interest, which tracks active contracts, fell 18% to $571 million as traders closed positions.

Leverage and Liquidation Risks Mount

On April 6, ADA’s price fell 12% in 24 hours, coinciding with a high concentration of long bets on Binance Futures. Bitcoin’s simultaneous drop below key levels worsened the sell-off, wiping out $12.7 million in ADA long contracts. While some exchanges still report skewed long positions—WhiteBIT shows 92% bullish bets—the broader trend hints at caution.

Data from March reveals a pattern. ADA briefly touched $1.14 early that month but stalled, ending flat. Persistent selling since then has pushed prices lower, with derivatives amplifying losses. Analysts note that elevated leverage raises risks: if buying demand stays weak, further liquidations could follow.

Whales Accumulate as Retail Traders Retreat

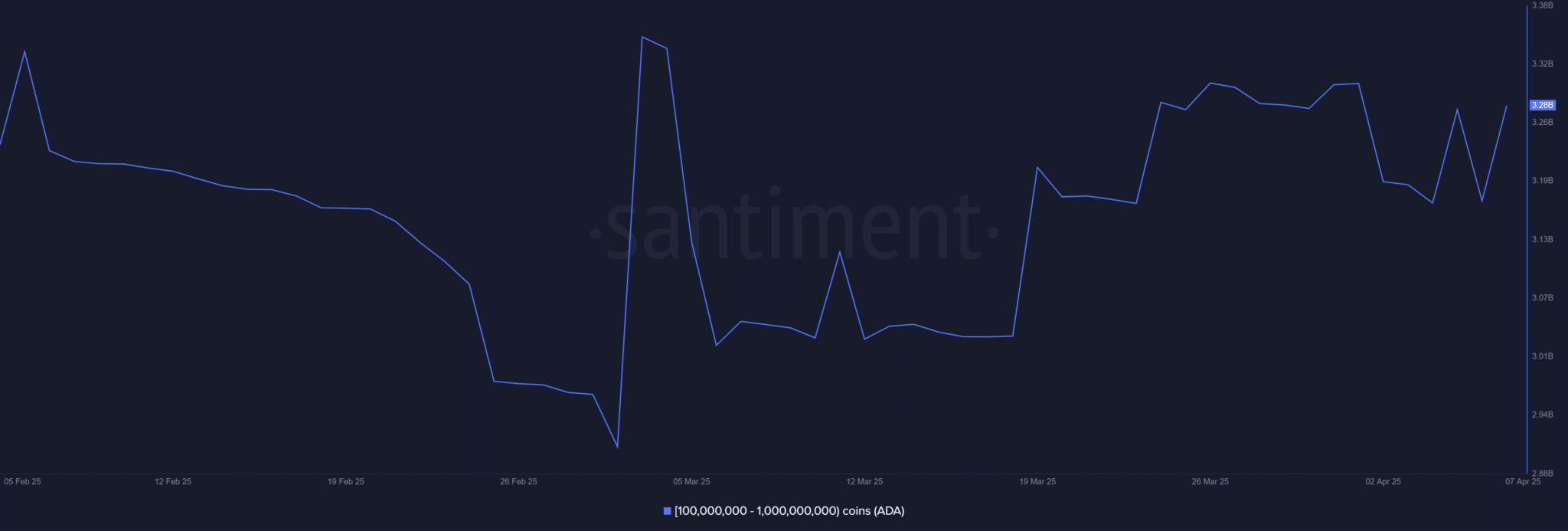

Investor behavior splits by size. Retail holders, facing breakeven pressures, may sell to avoid losses. However, large ADA holders acquired 120 million tokens after the April 6 drop, signaling potential confidence in a price floor near $0.50. This divergence highlights a tug-of-war: panic selling versus strategic accumulation.

Since November 2024, ADA remains 53% above its pre-election price of $0.33. Yet current volatility tests resolve. If whale buying persists, a rebound toward $0.60 could materialize. Conversely, a break below $0.50 may trigger automated sell-offs, dragging prices lower.

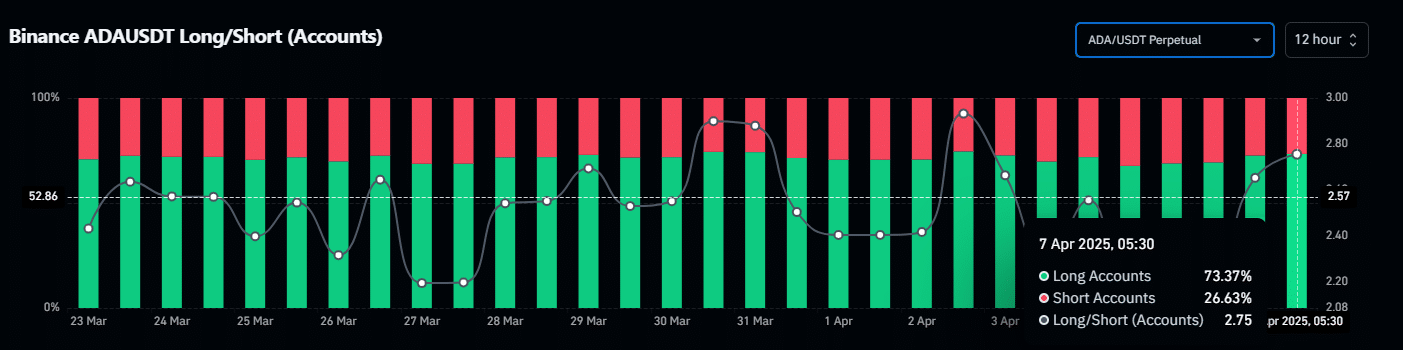

First, whale activity must counter retail exits. Second, derivatives markets need balance. Binance Futures’ 73% long ratio leaves ADA exposed to sudden swings. Historically, similar conditions lead to extended consolidation before clarity emerges.

For now, traders face uncertainty. Cardano’s path hinges on cold metrics—supply absorption versus liquidation cascades. While hope persists for a rebound, the data underscores a fragile equilibrium. Patience remains key as the market seeks its next direction.

Cardano (ADA) is trading at $0.5780 USD, showing a modest daily increase of +0.84%. This small bounce comes after several weeks of bearish momentum, during which ADA has lost −12.85% over the past week and −29.52% in the last month. Year-to-date, the token is down −31.65%, reflecting the broader downturn in the altcoin market as investor sentiment continues to cool.

Despite these losses, ADA has still gained over 67% in the last six months, which speaks to the strength of its late-2024 rally. However, the current price action suggests that the momentum has largely faded.

ADA is now consolidating below previous support zones, and technical patterns indicate the possibility of further downside unless the $0.60 level is reclaimed decisively. ETHNews analysts are watching for a potential breakdown toward $0.42, especially if Bitcoin weakness continues to weigh on the entire market.

Interestingly, over 67% of Binance Futures traders holding open ADA positions are bullish, which could suggest a potential rebound if sentiment materializes into real volume. Whale activity has also picked up slightly, following news of a 686,567 ADA donation to the project’s ecosystem fund.