- Coinbase lists CFTC-approved cash-settled XRP futures, following Bitnomial, offering 10,000-token contracts to institutional traders in North American markets.

- Regulated XRP futures expand hedging tools, boost liquidity depth, and enhance price discovery across spot and derivatives venues.

Coinbase has listed monthly, cash‑settled XRP futures after receiving approval from the U.S. Commodity Futures Trading Commission on 3 April. Each contract represents 10,000 XRP and offers margin trading through the exchange’s derivatives arm. The product follows a similar launch by Bitnomial in mid‑March.

🚀 XRP futures are here! 🚀

Bitnomial is launching the first-ever CFTC-regulated $XRP futures in the U.S. — physically settled for real market impact. Plus, we’ve voluntarily dismissed our case against the SEC as regulatory clarity improves. pic.twitter.com/ARkSanjFNU

— Bitnomial (@Bitnomial) March 19, 2025

Institutional Demand Rises

The new listing provides U.S. institutions with another venue to manage exposure to XRP price moves. Futures allow traders to hedge spot holdings, express directional views, or arbitrage against other markets without needing physical delivery. Because the contracts settle in cash, investors avoid custody concerns tied to on‑chain transfers.

Coinbase Derivatives, LLC now offers CFTC-regulated futures for $XRP. https://t.co/omSNu0aEoC

— Coinbase Institutional 🛡️ (@CoinbaseInsto) April 21, 2025

Growing derivatives activity can increase overall market depth by pairing longer‑term bets with intraday liquidity. As more firms access regulated products, order books tend to tighten, which may lower slippage for large transactions and create additional reference prices for risk models.

Regulatory Backdrop

XRP’s legal status in the United States has narrowed in recent months. Court decisions in 2023 treated secondary‑market sales differently from the original token offering, and the stance was left largely intact on appeal. In parallel, the current administration has spoken favorably about clearer rules for digital assets. This combination has opened the door for exchanges to pursue listings that require CFTC or SEC oversight.

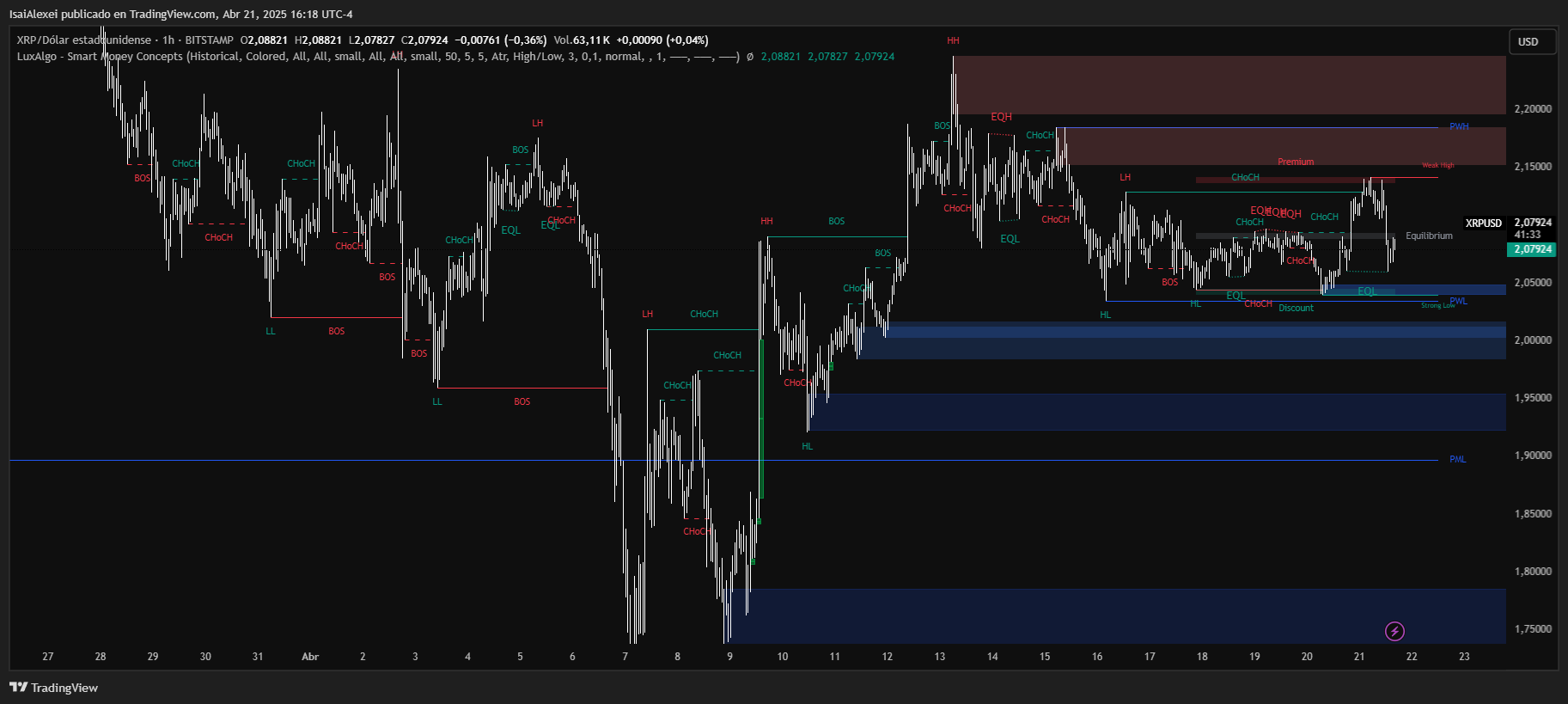

On technical charts, the XRP‑USD pair trades near $1.58 after rebounding from an April low close to $1.30. ETHNews analysts monitoring order flow note a resistance band around $1.77, formed by previous swing highs. A break above that line would put the 2024 peak at $1.95 back in view. Support rests at $1.45; a daily close below it would shift momentum toward sellers.

Impact on Liquidity

Each Coinbase contract aggregates 10,000 XRP into a single unit, concentrating open interest in larger blocks. If volumes grow, futures can act as a price‑discovery hub that influences spot desks worldwide. Should cash‑settled positions expand at a faster pace than token supply, a price‑compression effect—much like a vacuum—may occur as arbitrageurs remove tokens from exchanges to balance books.

XRP (Ripple) is currently trading at $2.08, posting a +1.90% daily gain, and showing signs of consolidation just below the critical resistance zone at $2.20–$2.23. Year-to-date, XRP is up a modest +0.21%, but has delivered an impressive +294% gain over the past 12 months, reflecting strong long-term recovery following its resolution with the SEC. Over the last month, however, XRP has corrected by nearly -10.96%, indicating near-term selling pressure.

Technically, XRP appears to be in an accumulation phase. According to Wyckoff analysis, key phases have been completed, with a potential breakout above $3.40 projected for late May, and a possible extension toward $3.70 by early July.

Currently, XRP is holding support near $2.07, and a breakout above $2.23 with strong volume could push price toward $2.55–$2.70. If support fails, XRP could revisit $1.92–$1.95, which has historically been a key demand zone.

On the fundamental side, institutional interest in XRP continues to rise. In the U.S., the launch of leveraged XRP ETFs from Teucrium and XRP futures ETFs from Bitnomial are already gaining traction, while speculation around a spot XRP ETF grows.

XRP also retains strong appeal as a global payments token, known for its low transaction costs and energy efficiency—key pillars of its utility as a crypto-based settlement solution.