- Additional FOIA inquiry by Coinbase aims to reveal how regulatory agencies handle and disclose requested information.

- Concurrently, Coinbase challenges the SEC in court, demanding transparency on enforcement actions and digital asset classifications.

On October 18, Coinbase intensified its quest for regulatory clarity in the U.S. cryptocurrency landscape by filing two new Freedom of Information Act (FOIA) requests. These inquiries target the Federal Deposit Insurance Corporation (FDIC) and are prepared by History Associates Incorporated on behalf of Coinbase.

This underscores Coinbase’s ongoing efforts to clarify regulatory measures that impact digital asset companies, particularly concerning a purported 15% deposit cap that affects key financial institutions engaging with the crypto sector.

Paul Grewal, Coinbase’s Chief Legal Officer, specified that these requests aim to shed light on the constraints allegedly applied to banks like Signature Bank and Silvergate Bank among others.

The first is for documents about a digital asset deposit cap @FDICgov and other banking regulators have apparently been imposing on financial institutions. The second is for logs that show how these agencies are handling other FOIA requests. Each is separate from our FOIA filings…

— paulgrewal.eth (@iampaulgrewal) October 21, 2024

The focus is on extracting records of discussions held since June 1, 2022, involving FDIC board members and representatives from other significant regulatory bodies such as the Federal Reserve and the Treasury’s Office of the Comptroller of the Currency (OCC).

Furthermore, Coinbase demands a comprehensive explanation should the FDIC decide to withhold information or apply FOIA exemptions, emphasizing the need for transparency in regulatory practices. This insistence on detailed disclosures reflects Coinbase’s strategy to ensure regulatory actions are both clear and justifiable.

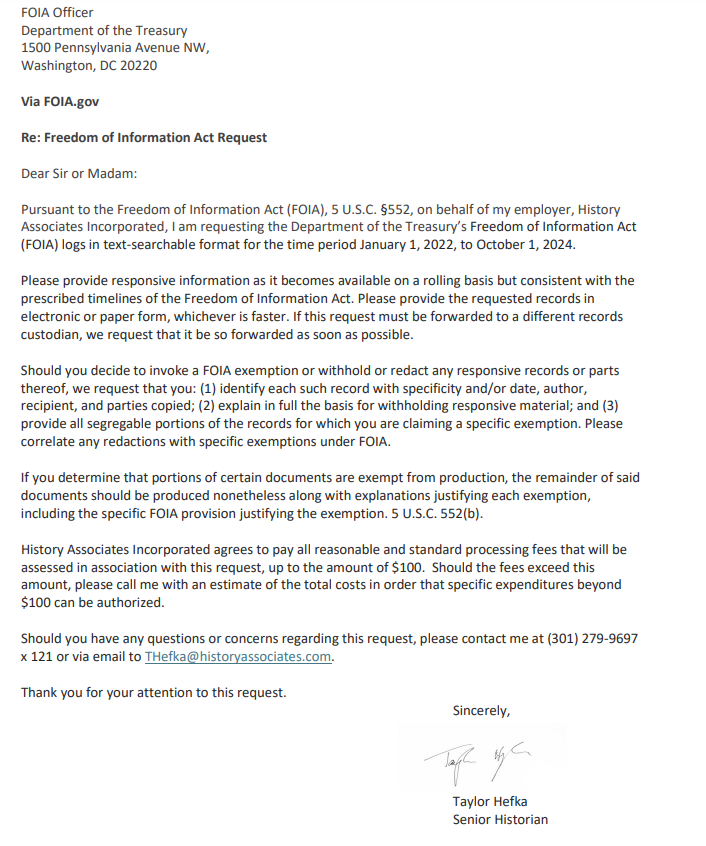

Another layer of these inquiries delves into the administrative handling of FOIA requests themselves. Coinbase has requested the FDIC and OCC to provide access to FOIA logs from January 1, 2022, to October 1, 2024. These logs are to be presented in a text-searchable format, facilitating easier review and underscoring the importance of transparent regulatory interactions.

Should you decide to invoke a FOIA exemption or withhold or redact any responsive records or parts thereof, we request that you: (1) identify each such record with specificity and/or date, author, recipient, and parties copied; (2) explain in full the basis for withholding responsive material; and (3) provide all segregable portions of the records for which you are claiming a specific exemption. Please correlate any redactions with specific exemptions under FOIA

This initiative does not just aim to gather specific regulatory insights but also to map out the broader administrative patterns that might influence digital asset regulations. Through analyzing the flow and treatment of past FOIA requests, Coinbase intends to identify any consistent tendencies in how information related to crypto regulations is managed or withheld by financial authorities.

In a related expression of industry frustration, Caitlyn Long, CEO of Custodia Bank, commented on the ongoing challenges faced by U.S. banks serving crypto clients, criticizing the regulatory ambiguities that continue to plague the sector.

In addition to these efforts, Coinbase continues its legal challenge against the Securities and Exchange Commission (SEC), seeking essential documents through a motion for partial summary judgment filed simultaneously with the FOIA requests.

This legal action highlights Coinbase’s broader campaign to clarify how U.S. securities laws apply to cryptocurrencies, signaling a pivotal moment in the ongoing dialogue between the crypto industry and regulatory bodies.