- Ethereum reserves on exchanges hit an eight-year low, potentially setting up a significant price surge due to scarcity.

- Market indicators show Ethereum below key moving averages, with a bearish sentiment possibly leading to further price declines.

Ethereum’s reserves on cryptocurrency exchanges have dipped to their lowest level in eight years, a situation that historically precedes a significant price movement. This reduction in available supply on exchanges could foreshadow a price surge, especially with the anticipated launch of Ethereum’s spot ETFs which might introduce a supply shock to the market.

Analyzing Current Market Indicators

Despite the low reserve levels that hint at a possible price increase, current market indicators suggest a cautious approach. Ethereum’s price is trending downward, sitting below both the 50-period and the 200-period moving averages—an alignment that typically suggests bearish market conditions.

The Relative Strength Index (RSI) stands at 43, below the neutral threshold of 50 but not yet indicating oversold conditions, which occur below 30. That suggests there may still be room for further price declines before a potential rebound.

Investor Sentiment and Market Sector

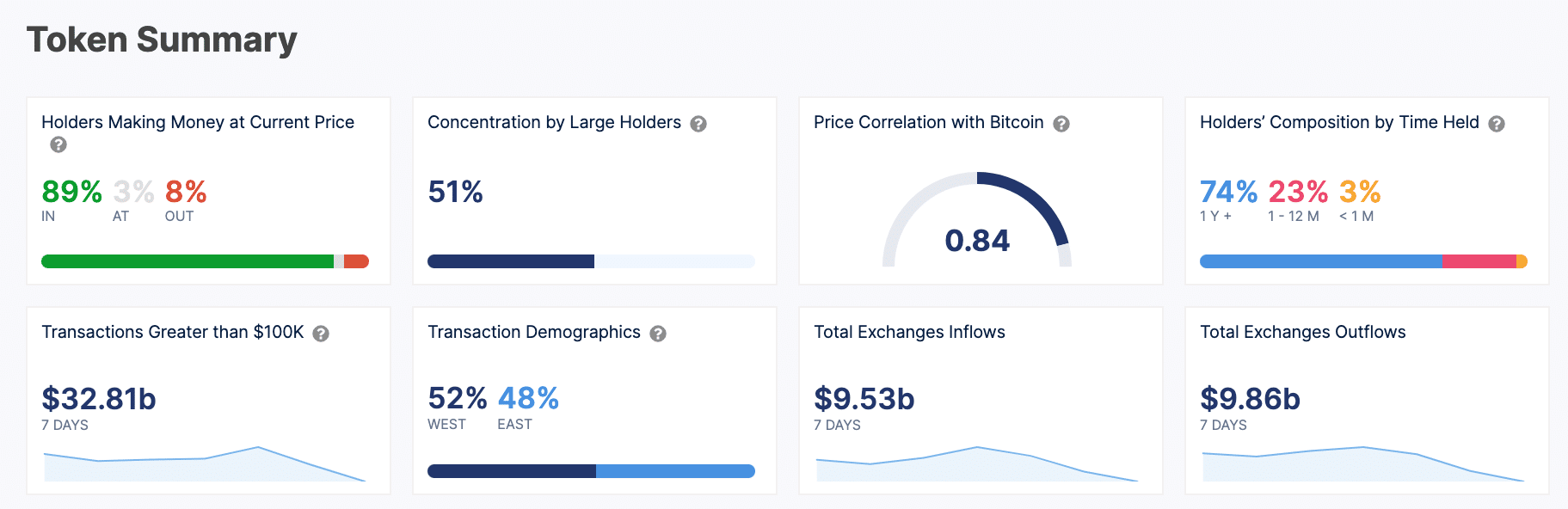

The Ethereum market shows a significant level of ownership concentration, with 51% of Ethereum held by whales. This indicates that a small number of wallets control a large portion of the supply, which can lead to high volatility in price movements due to concentrated decision-making.

Additionally, the high volume of large transactions, those exceeding $100,000, totaling $32.81 billion over the past week, underscores significant activity from institutional or large-scale investors. The level of activity often reflects a bullish outlook among these major players, despite the broader market’s current downward trend.

Market Valuation and Future Outlook

The Market Value to Realized Value (MVRV) ratio, which helps indicate when an asset is over or undervalued, shows Ethereum trending towards a zone that might be considered undervalued. The adjustment could mean that the market is experiencing a healthy correction, setting a more sustainable base price from which future bull runs could initiate.

[mcrypto id=”12523″]

Looking ahead, Ethereum’s immediate challenge is to maintain its position above the recent support level of $3,670. Should it manage to do so and subsequently break through the resistance at $3,733, the next notable target would be the psychological level of $3,800.

A breach above this resistance could catalyze further upward momentum, aligning with the potential influx of demand if the spot ETFs are well-received.