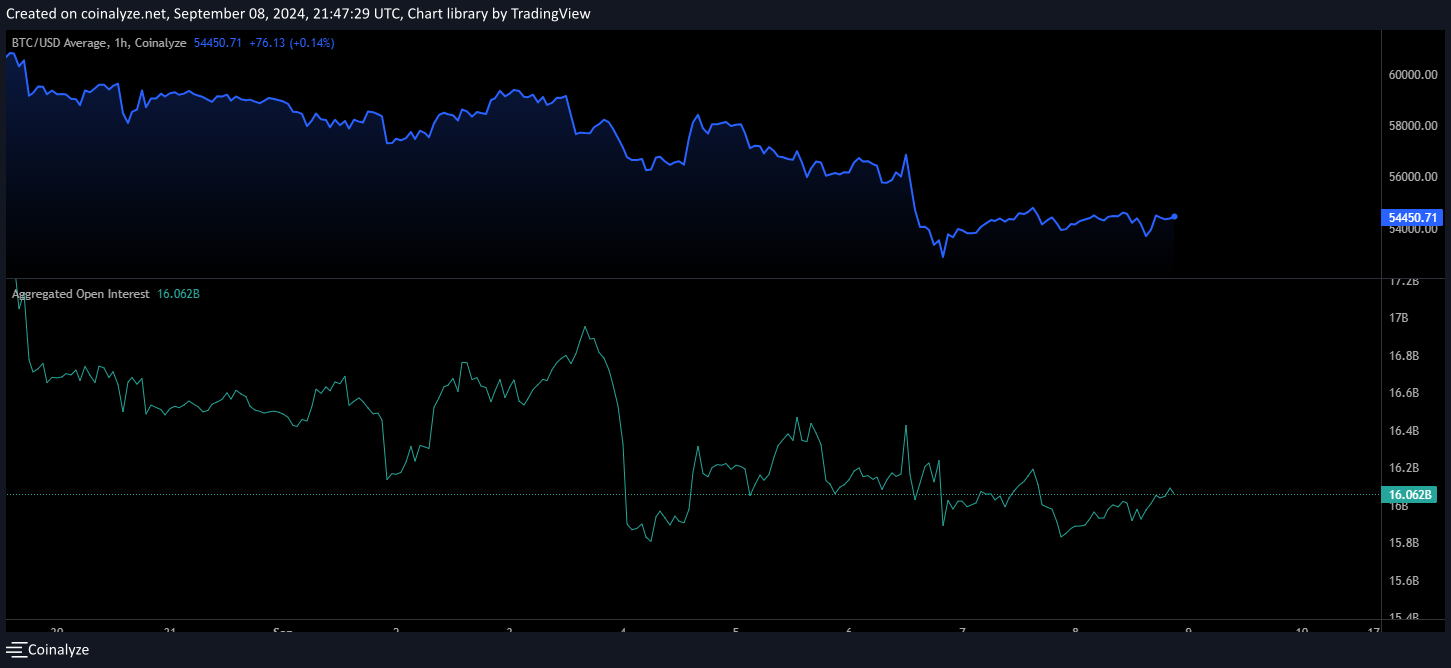

- Bitcoin’s value dropped 10.85% last month, with a significant decrease in trading volume to $16.1 billion.

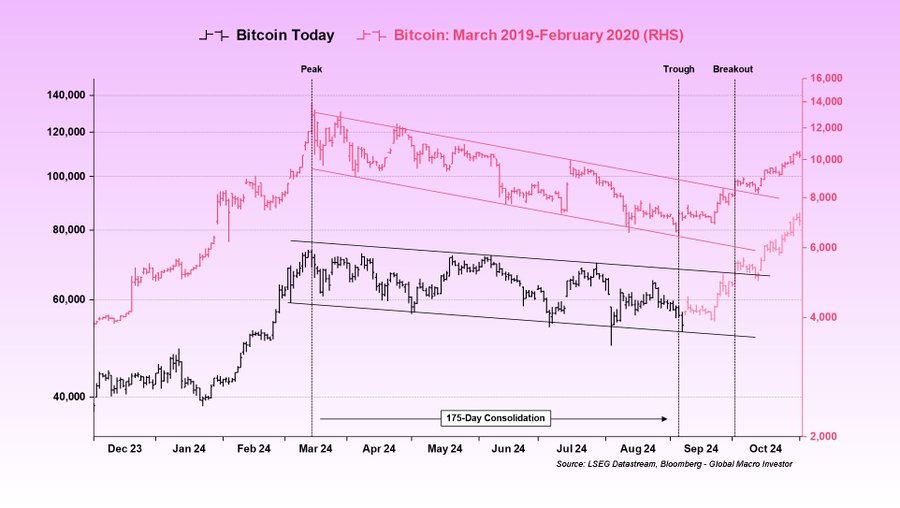

- Analyst Bittel Julien predicts a rally, comparing current market behavior to the 2019 consolidation phase.

In recent weeks, Bitcoin (BTC) has experienced a notable downturn, with its value dropping by 10.85% over the last month and trading volumes plummeting by 65.23% to $16.1 billion. Despite these declines, market analysts by ETHNews remain optimistic, predicting an impending rally for BTC, much like the recovery seen in 2019.

At present, BTC is trading at $54,439, having decreased by 6.5% in the past seven days. This recent performance marks a significant pullback, but according to crypto analyst Bittel Julien, it is part of a broader pattern of consolidation that Bitcoin has historically overcome.

ETHNews points out that the current consolidation phase, lasting 175 days, closely resembles the one from 2019, which was followed by a substantial price increase from $7,200 to $10,000 in 2020.

Although there was a subsequent drop attributed to the global pandemic, the pattern suggests a potential for recovery.

ETHNews’s optimism is mirrored by other indicators observed in the market

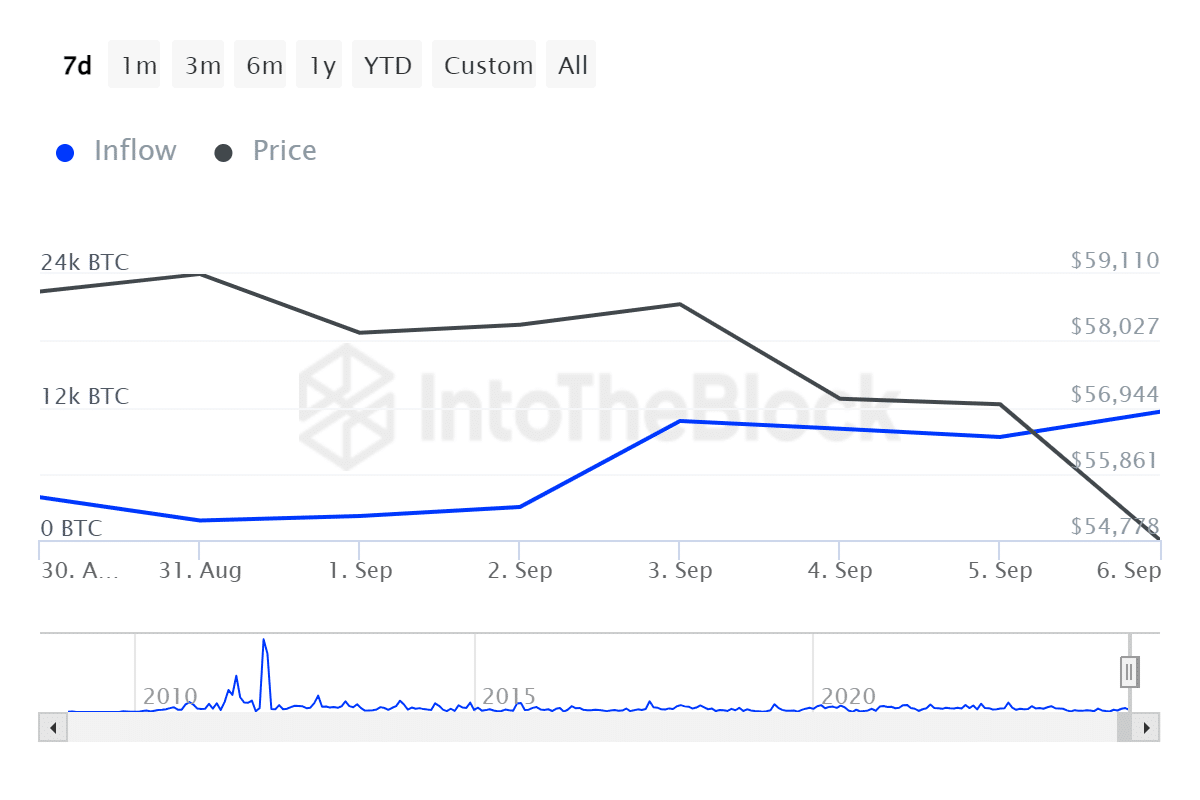

There has been a steady increase in large holder inflows, with figures rising from 1.76k to 11.57k recently. This indicates that investors are actively buying during the dip, a strategy known as “buying the dip” suggesting confidence in Bitcoin’s price recovery.

Such behavior is typically a bullish signal, as it reflects a general expectation of future price increases and can create upward pressure on prices through increased demand.

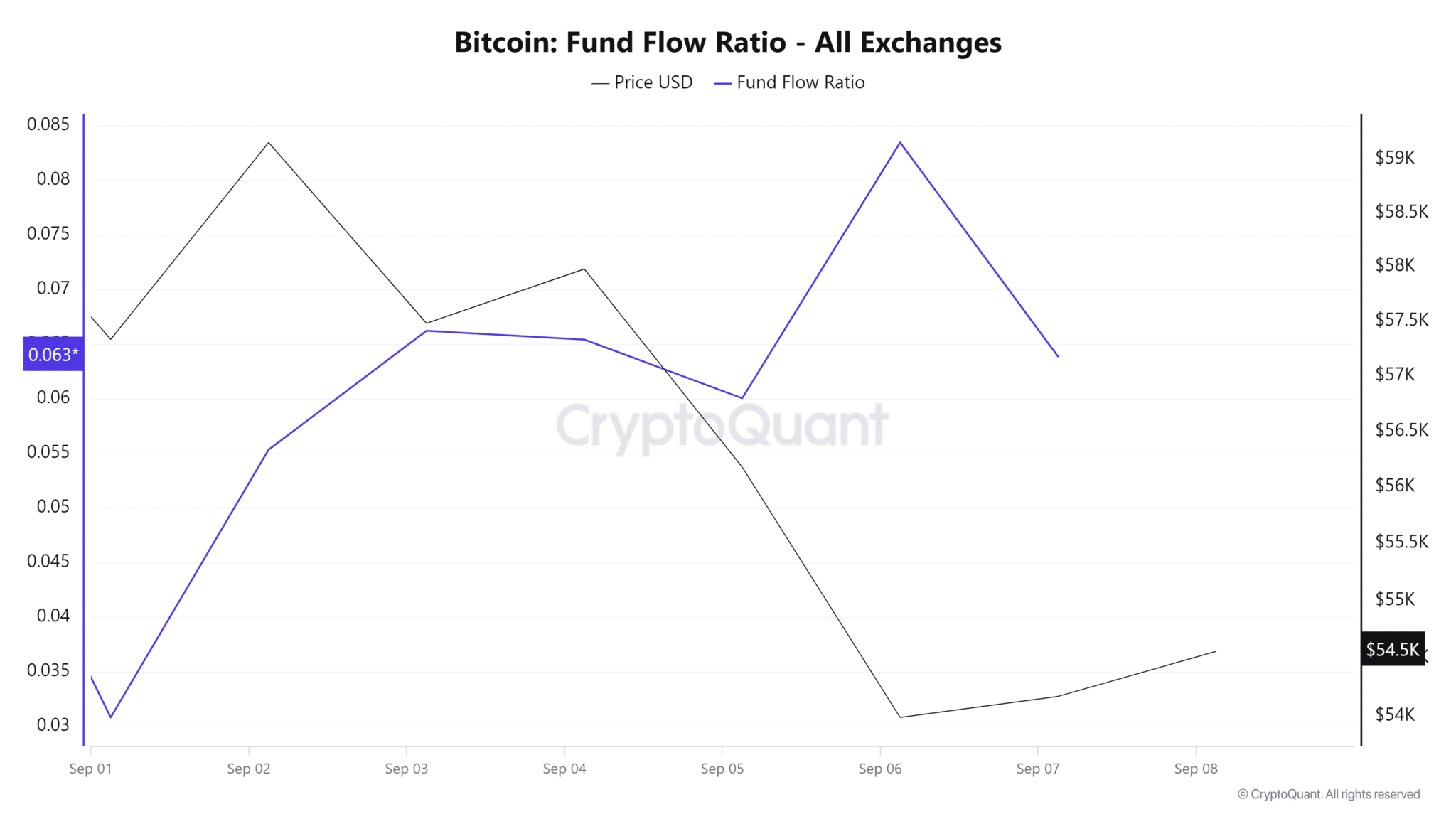

Furthermore, the fund flow ratio, which measures the inflow of capital compared to outflow, has also seen an increase.

This metric provides insight into the overall market sentiment; a higher inflow than outflow generally signals that buying activity is outpacing selling, potentially leading to a price increase.

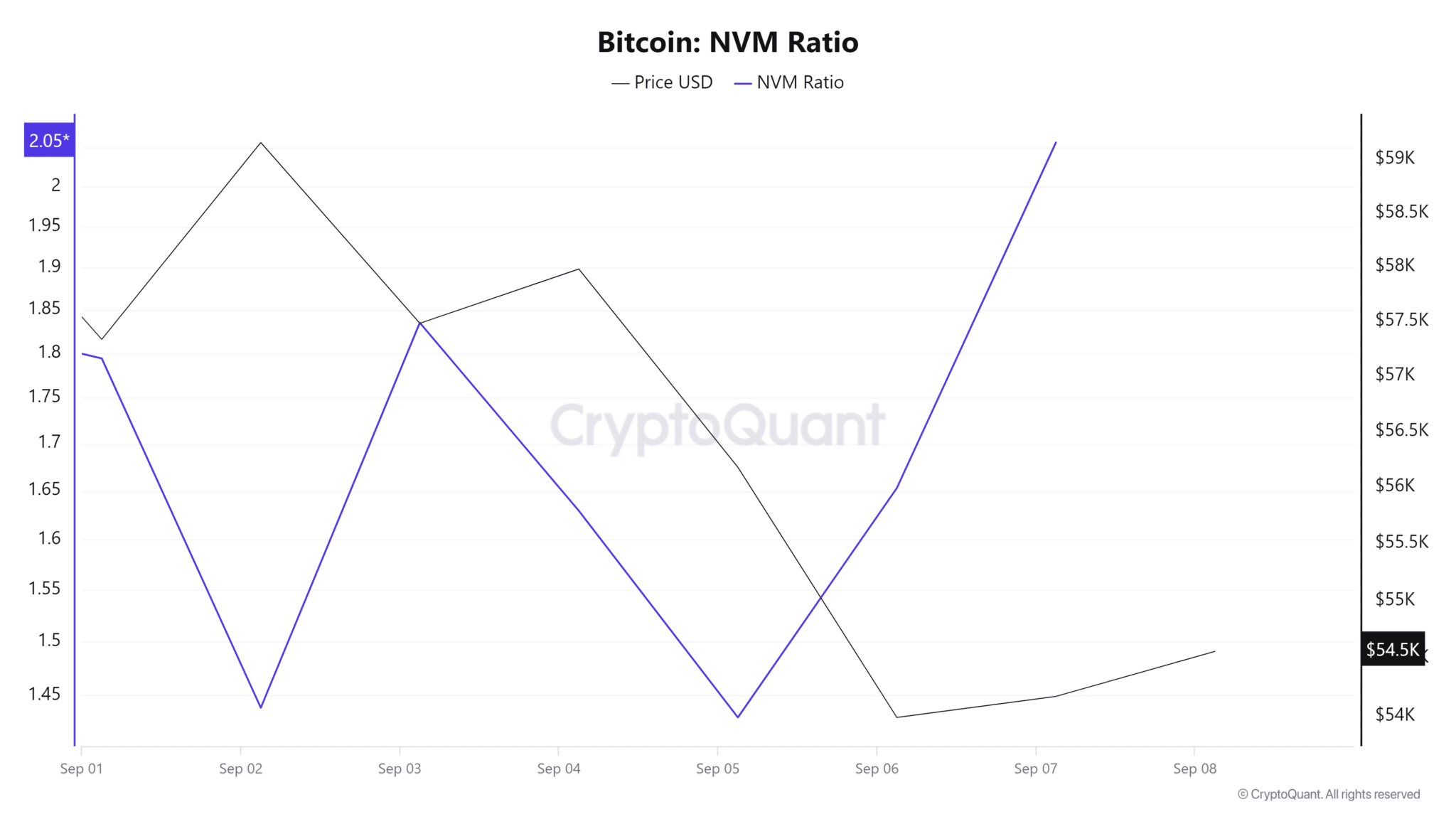

Another positive sign comes from the Network Value to Metcalfe (NVM) ratio, which has risen from 1.4 to 2.05 over the past week. This increase indicates that long-term holders are maintaining their positions despite the downturn, underscoring their belief in Bitcoin’s enduring value.

Collectively, these metrics not only highlight optimism among investors but also suggest that Bitcoin could be poised for a rebound if it continues to follow historical patterns of post-consolidation rallies.

[mcrypto id=”12344″]

In the last 24 hours, Bitcoin (BTC) has seen a slight upward movement, with its price currently at $54,362.89 USD, reflecting an increase of 0.42%.

During this period, Bitcoin’s price fluctuated between a low of $53,692.29 and a high of $54,662.98. The 24-hour trading volume was $15.90 billion USD, indicating steady market activity.