- Despite a temporary bearish sentiment in early August, Ethereum’s market has shown recovery signs, pushing towards $3K.

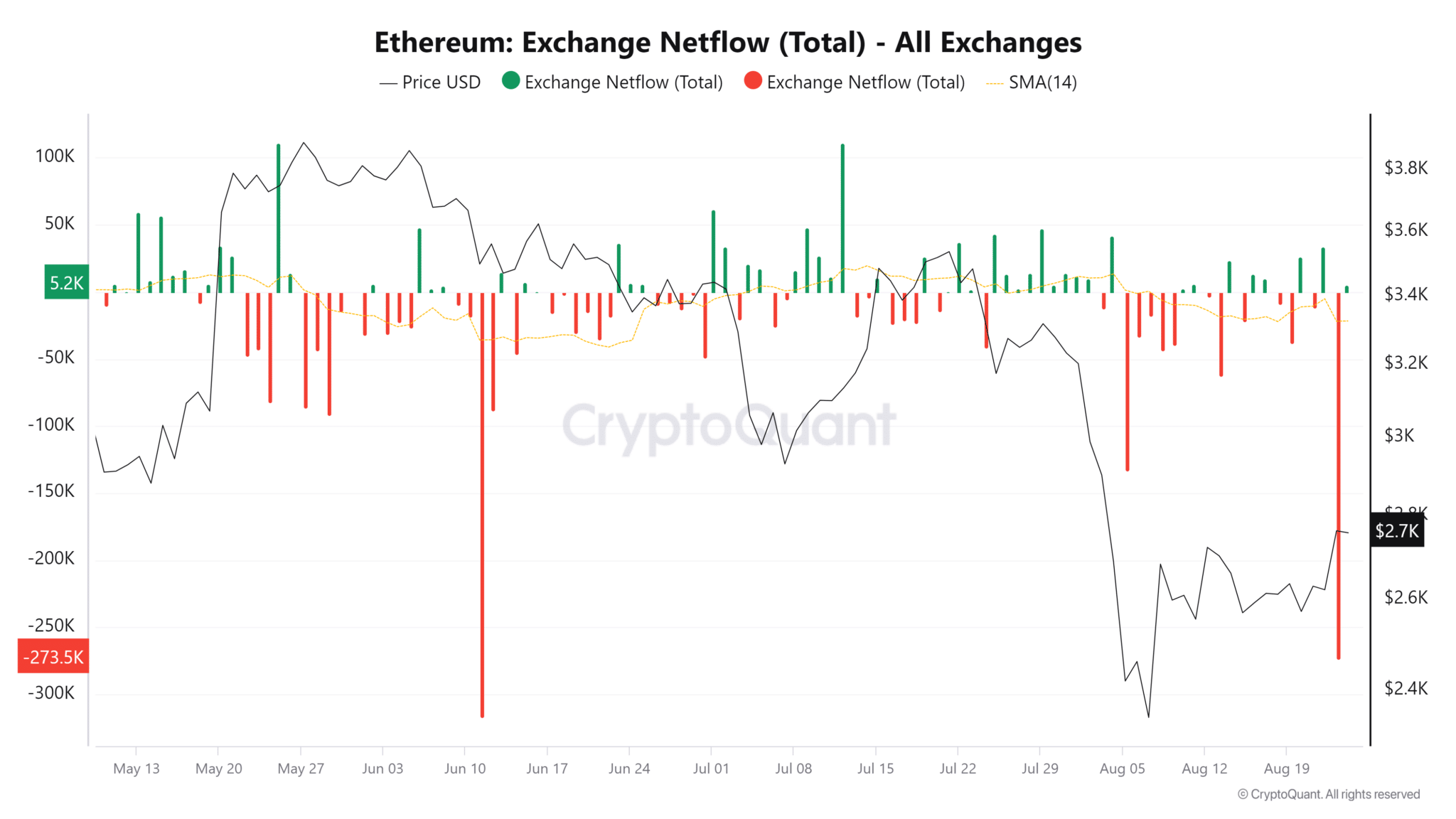

- Ethereum’s recent outflows from exchanges suggest active accumulation, possibly driving the price towards the resistance zone.

Ethereum’s on-chain data indicates a potential rise to the $3,000 mark, driven by an increase in buying interest and significant cryptocurrency movements.

The digital asset has demonstrated fluctuations that suggest both an accumulation by buyers and a readiness for sellers to capitalize on price increases.

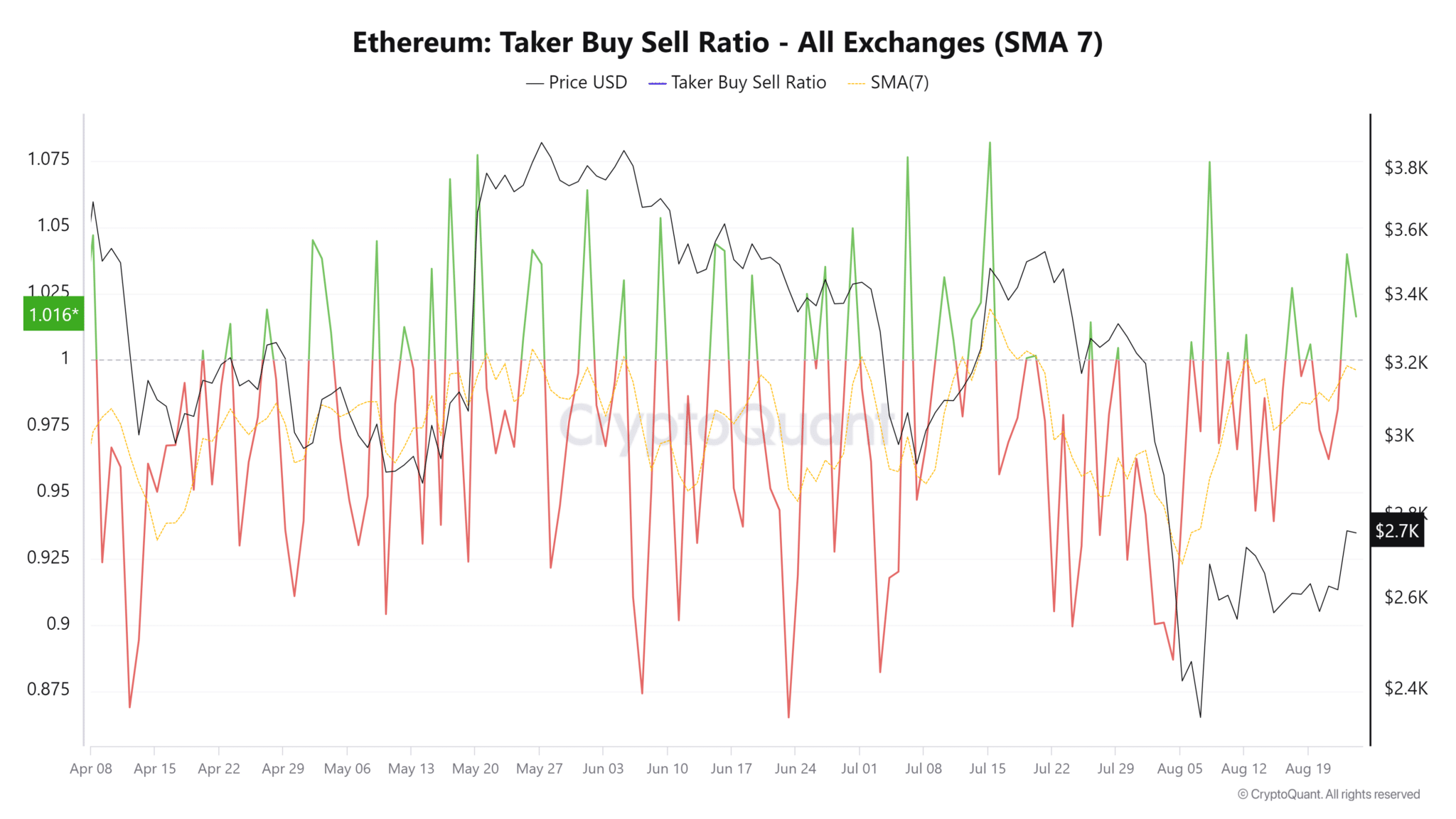

On August 23, a substantial outflow of Ethereum from exchanges was noted, typically a sign of investors pulling their assets off the market for potential long-term holding. This coincides with an increase in the taker buy/sell ratio over recent days.

This ratio, which measures immediate market order executions, has surged, reflecting heightened buying activity compared to selling. When this ratio exceeds 1, it generally points to a prevailing buying interest among traders.

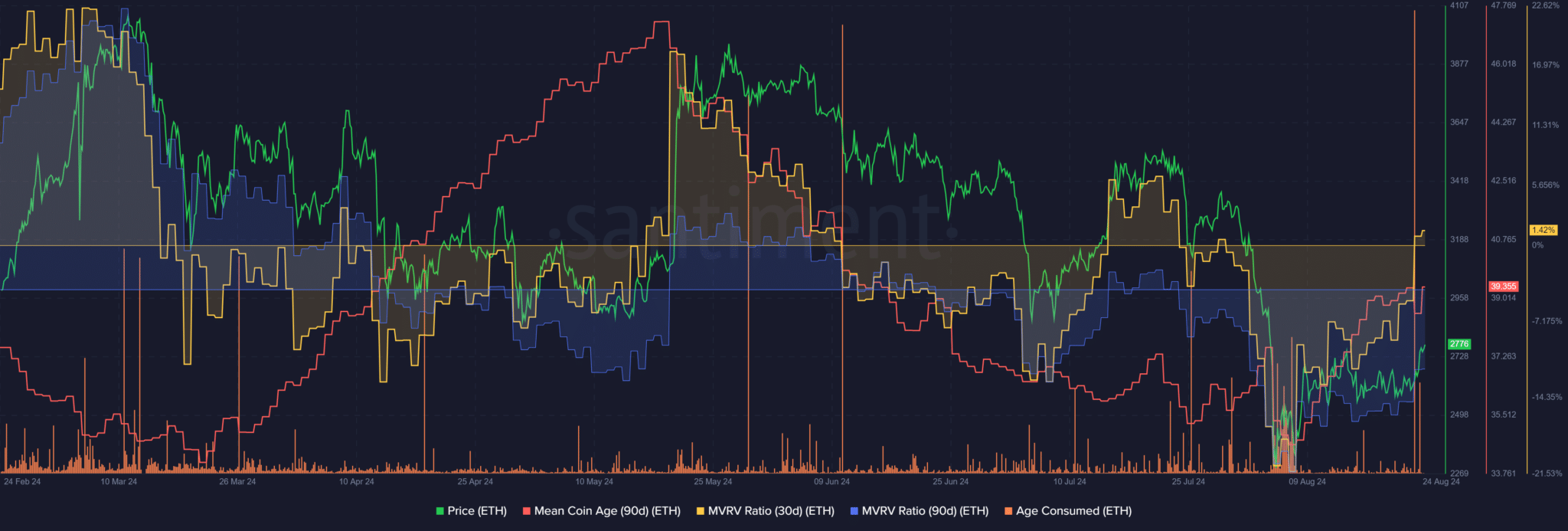

Conversely, the age consumed metric, which tracks the movement of older coins, also surged. Such increases often signal that long-held coins are being moved, which can precede selling pressure and introduce price volatility.

The dual-signal of increased purchases and potential sales injects a degree of uncertainty into market predictions.

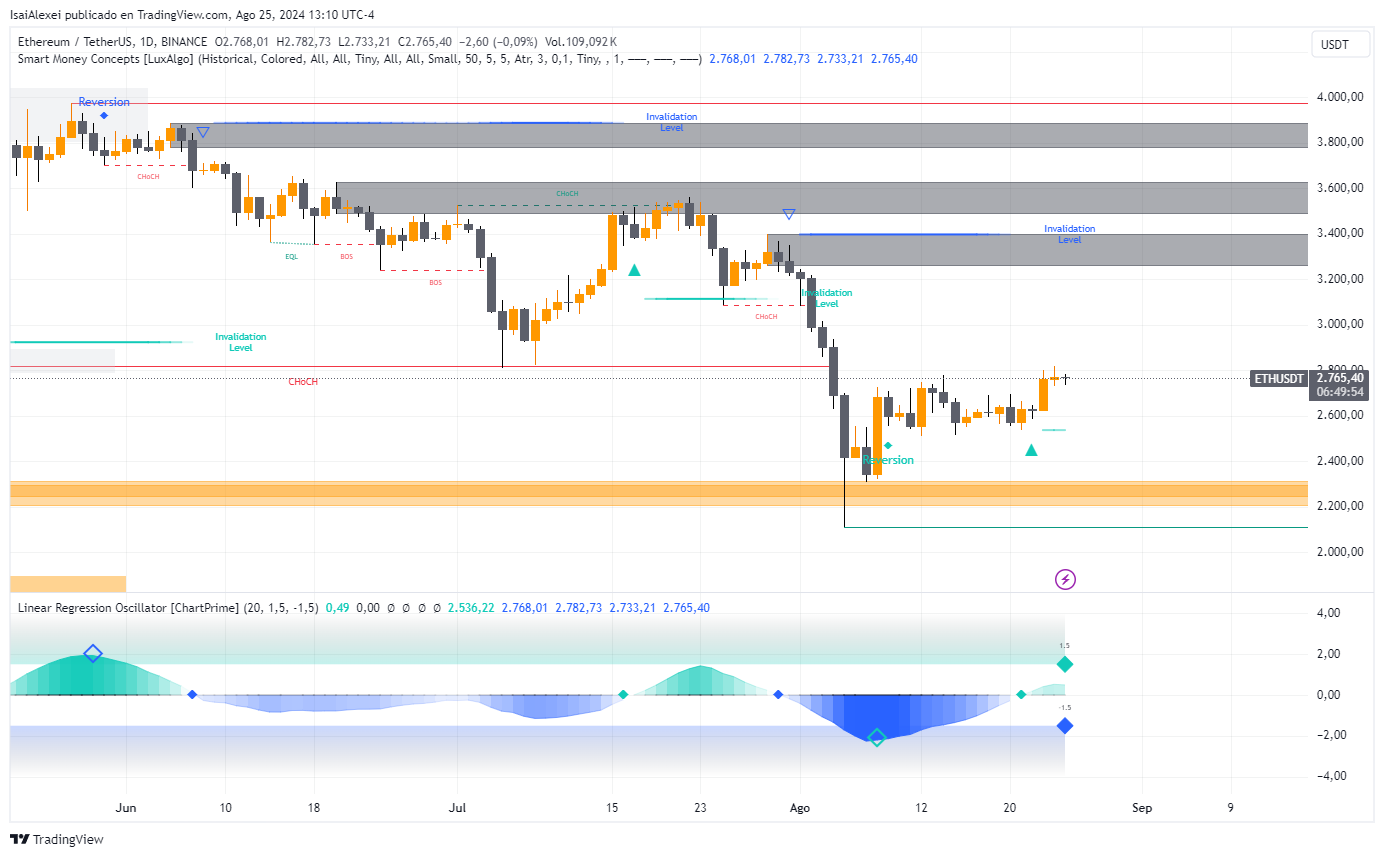

The price of Ethereum is currently challenging the resistance level around $3,000, a significant barrier based on recent trading patterns. Monitoring this level could be key to understanding the next major price move.

The 14-day simple moving average suggests a downtrend, while the 30-day Market Value to Realized Value (MVRV) ratio has moved into positive territory, indicating that short-term holders might currently see a profit.

However, the longer-term outlook via the 90-day MVRV is still negative, suggesting that older investors may not have recovered their investments yet. This discrepancy between short and long-term holder profitability may influence the likelihood of a sustained price increase.

Finally, network activity, as evidenced by a record number of transactions on Ethereum’s Layer 2 solutions, underscores the blockchain’s expanding utility and adoption.

Yet, traders must remain cautious. The presence of large volumes of old coins and the potential for increased sell orders could counteract the current buying momentum.

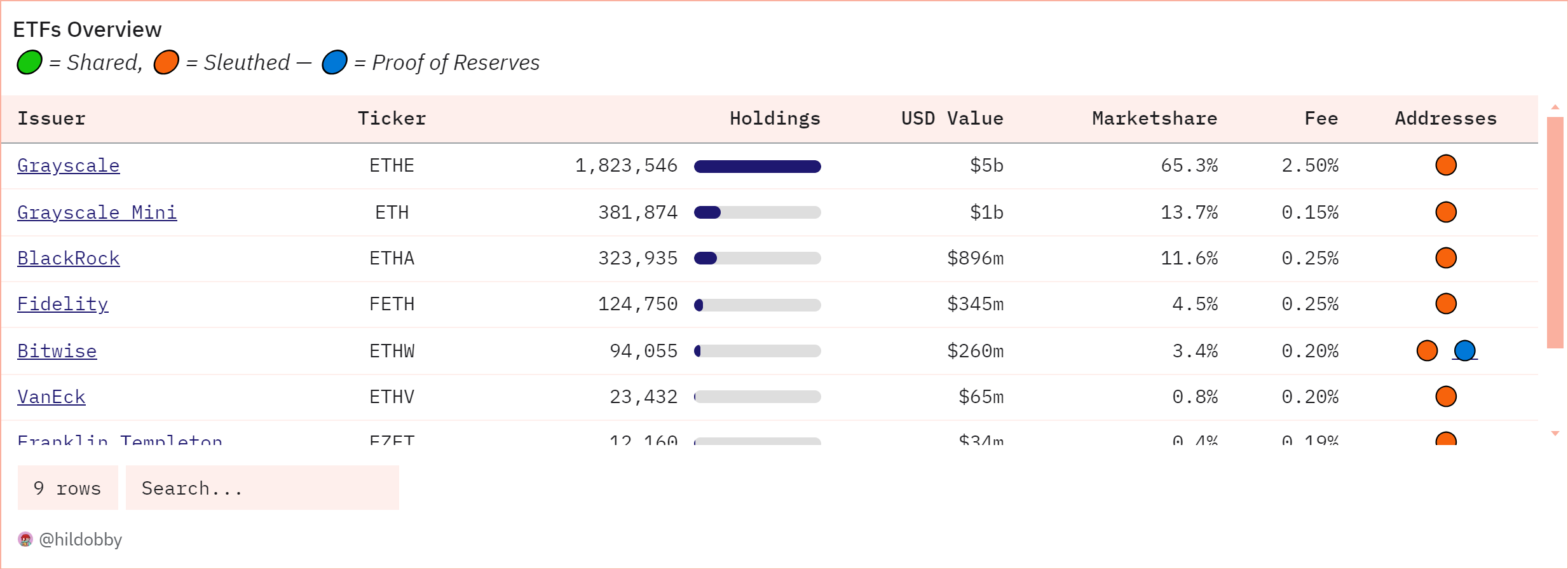

ETF Providers’ Performance

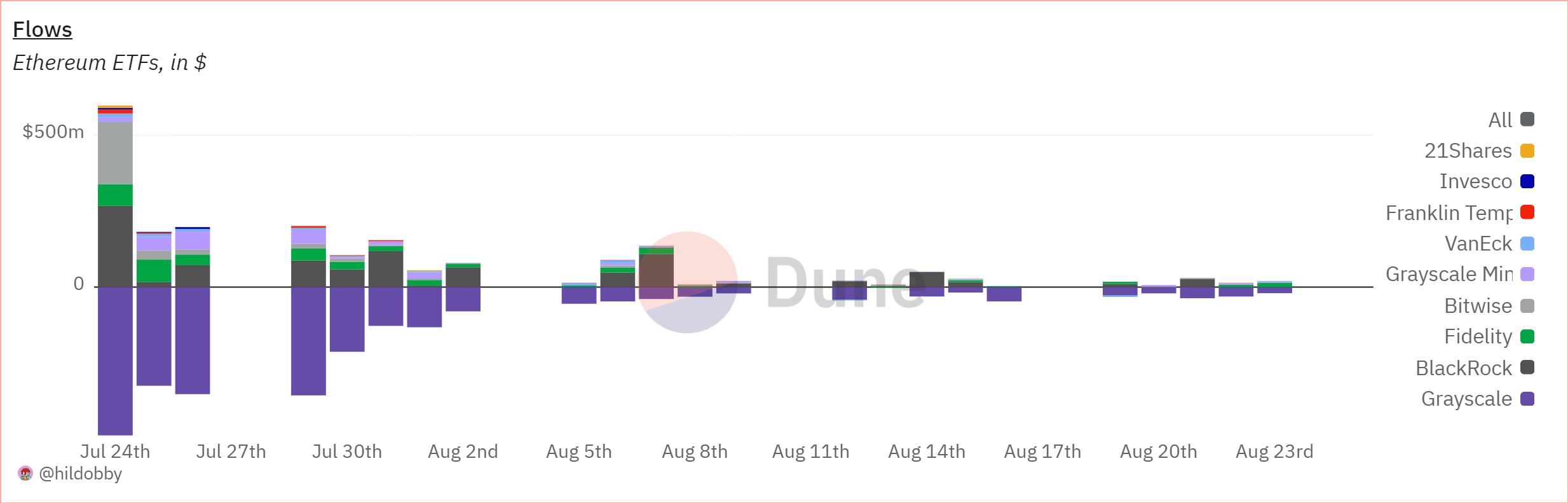

The chart by DUNE shows Ethereum ETF flows from July 24th to August 23rd, highlighting a period dominated by net outflows, particularly around late July, indicating selling pressure and bearish sentiment in the market.

Grayscale led in volume, suggesting it is a key vehicle for institutional trading. Following the heavy outflows, there was a period of stabilization with reduced volatility and minor inflows, which could signal a potential accumulation phase or cautious market sentiment awaiting further economic or Ethereum-specific catalysts.

Overall, the chart reflects a risk-off environment with cautious positioning by market participants, as evidenced by the mixed activity among major ETF providers like BlackRock, Fidelity, and VanEck.