- Mt. Gox and U.S. government poised to release substantial Bitcoin holdings, potentially impacting market prices.

- Kaiko analysis: Bitcoin’s oversupply may persist, challenging the cryptocurrency’s ability to surpass the $63,000 resistance level.

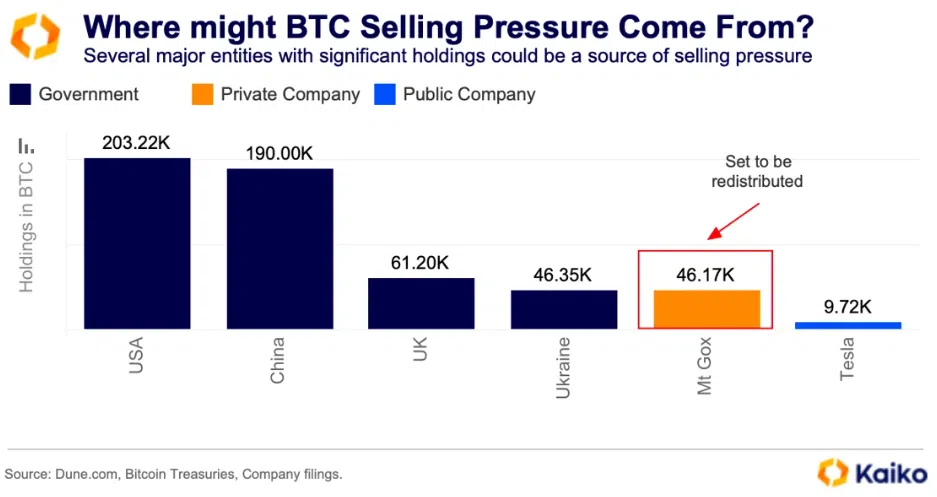

The cryptocurrency market is bracing for potential shifts as both the remnants of the Mt. Gox estate and the U.S. government prepare to possibly sell off substantial Bitcoin holdings. This potential influx of supply could pressurize Bitcoin prices, especially given the existing market conditions dominated by a supply surplus.

Recent analysis by ETHNews and the financial research firm Kaiko highlights these concerns, noting that the dissolved exchange Mt. Gox and the U.S. government together hold an amount of Bitcoin, which could influence the market.

The Mt. Gox estate is expected to return approximately $2.72 billion worth of Bitcoin (about 46,170 BTC) to creditors, alongside the U.S. government’s 203,000 BTC stash. Combined, these holdings represent a substantial financial influence.

Despite concerns, historical responses to similar payouts from Mt. Gox suggest that the immediate impact on the market may be less severe than anticipated. Most creditors who have received their Bitcoin thus far have chosen not to sell, opting instead to hold onto their assets, possibly waiting for more favorable market conditions or further price appreciation.

Moreover, Galaxy, a major issuer of crypto asset funds including ETFs, has indicated that any further reimbursements from Mt. Gox might extend into the next year, potentially spreading out any market impact.

However, Kaiko speculates that additional payments could occur within this year, although they may not exert as strong a market pressure as some fear.

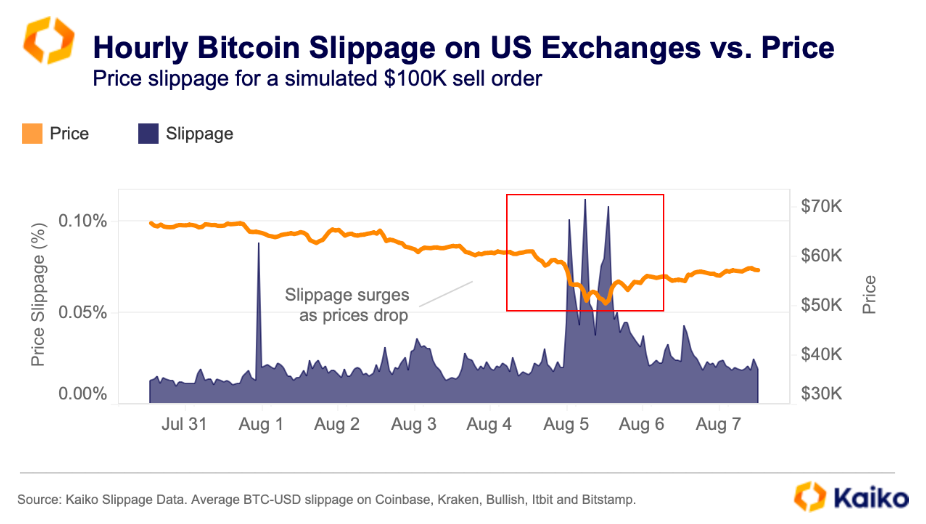

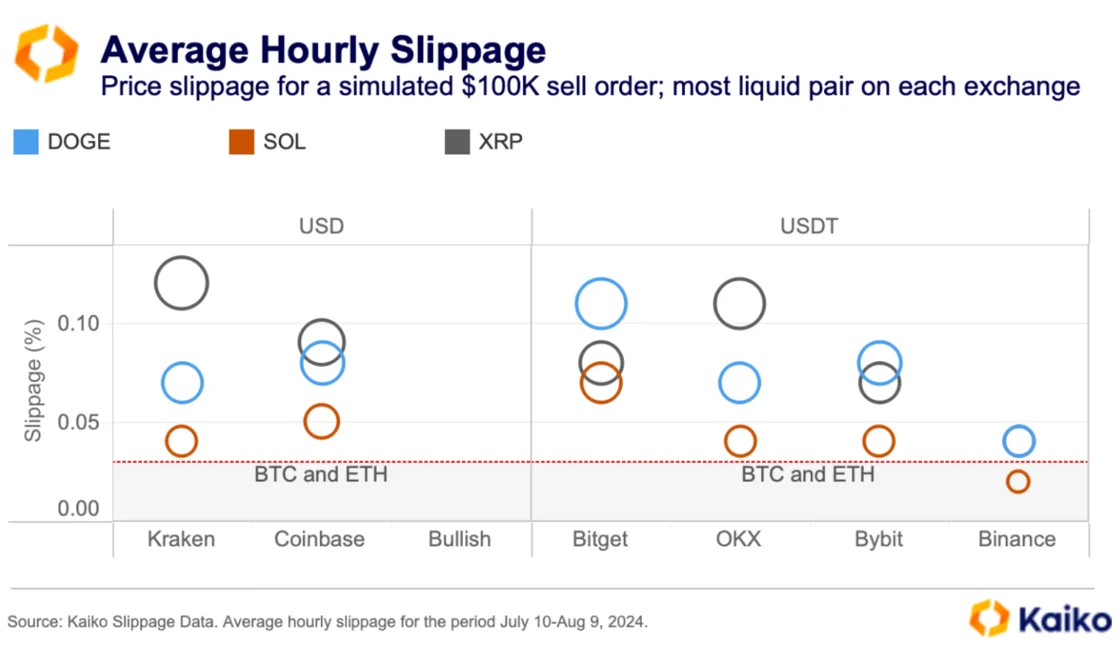

What will it look like? We know that the state works with Kraken on redeployments. Its liquidity profile suggests that any additional selling pressure from Mt. Gox redemptions is unlikely to cause structural problems. However, it is important to use several metrics in combination with each other, as different events affect different indicators.

Kaiko report.

The situation could become more complex with the U.S. government’s involvement. With the upcoming presidential elections and the potential for a new administration in January 2025, the U.S. might decide to liquidate its Bitcoin holdings earlier, which could introduce a new wave of supply to the market.

Managing Mt. Gox Bitcoin Redistributions

The Mt. Gox estate has the responsibility of returning approximately $2.72 billion worth of Bitcoin to its creditors within the next year. This distribution is being managed through the Kraken trading platform.

Kraken’s handling of Bitcoin Exchange Traded Fund (ETF) flows has demonstrated that significant transactions can be executed with minimal impact on market stability, as evidenced by only slight price fluctuations at the close of U.S. markets. This suggests that Kraken’s liquidity is sufficient to absorb substantial sales without disrupting the overall Bitcoin market.

Monitoring Market Metrics for Stability

Looking ahead, it will be essential to monitor a range of market metrics to effectively gauge liquidity. This comprehensive monitoring is necessary because different events may influence various market indicators. By integrating multiple metrics, a more complete understanding of market liquidity can be achieved, aiding in the anticipation of potential effects from large-scale redistributions or sales.