- XRP’s Mean Dollar Invested Age Indicates Potential for Price Increase; Recent Activity Suggests Movement Towards $0.50.

- Despite a 22.62% Decline Over 90 Days, XRP Shows Signs of Recovery with Positive On-Chain Metrics.

XRP is showing signs of a potential price increase, despite a recent decrease in blockchain transactions and ongoing low demand from new investors. According to analysis from ETHNews, there is a possibility that XRP could revisit or surpass the $0.50 mark soon.

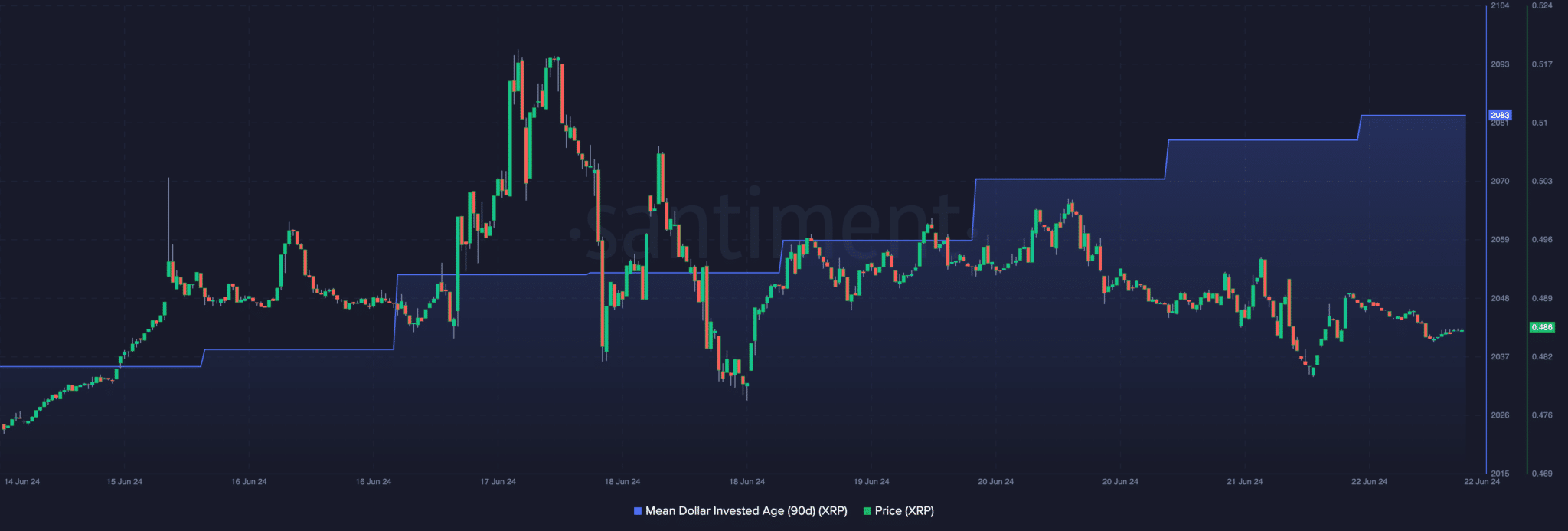

The Mean Dollar Invested Age (MDIA), a crucial metric that helps gauge the movement of tokens within the market by weighing the average age of tokens against their purchase prices, has provided insights into this potential upturn.

A decrease in the MDIA suggests increased token circulation, indicating active trading, while an increase points to holding behavior among investors.

Currently, XRP’s 90-day MDIA has risen to 2083, suggesting a decrease in transaction activity on the blockchain. This could be interpreted as a buildup of potential energy in the market, priming XRP for upward movement in its pricing.

At the time of analysis, XRP was trading at $0.48, marking a 22.62% decline over the last 90 days. Despite this downturn, the indicators suggest that a significant price correction may not be imminent.

Additionally, the ongoing legal battle between Ripple and the SEC continues to cast a shadow over the cryptocurrency’s future. The outcome of this lawsuit, particularly if it results in a favorable ruling for Ripple without heavy penalties, could significantly boost XRP’s market value.

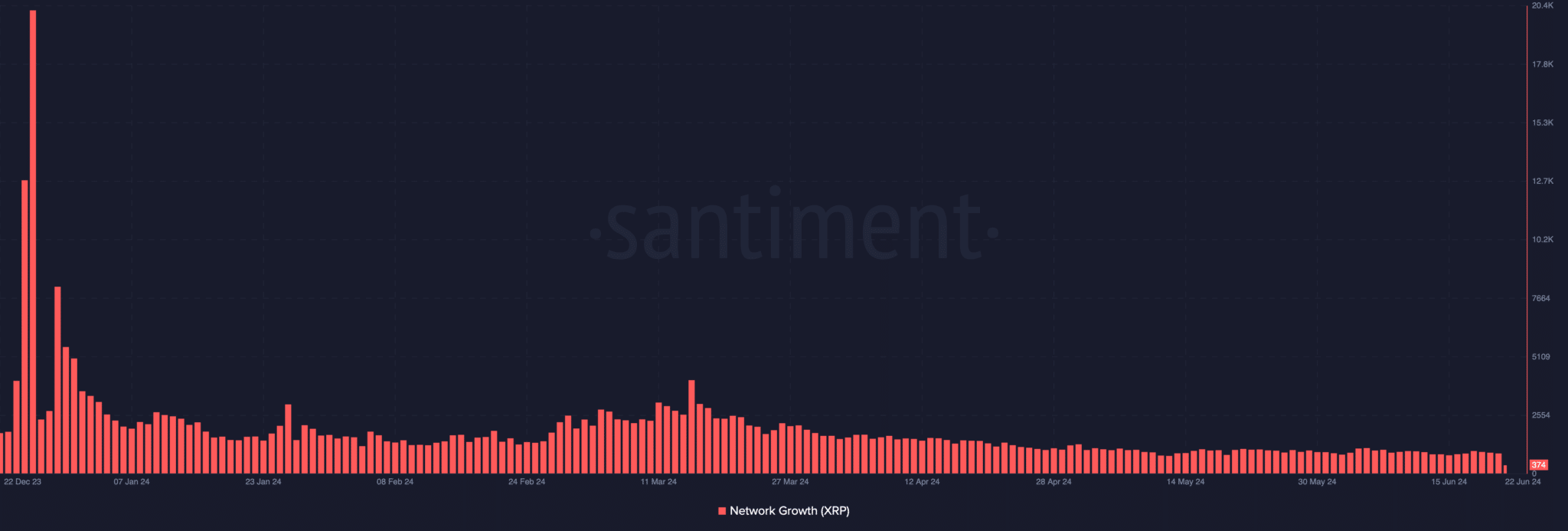

Despite potential positive price movements, Ripple’s Network Growth—a metric measuring new addresses interacting with XRP’s blockchain—has not shown increases. This lack of new adopters indicates challenges in broader market acceptance and could dampen the bullish outlook unless reversed.

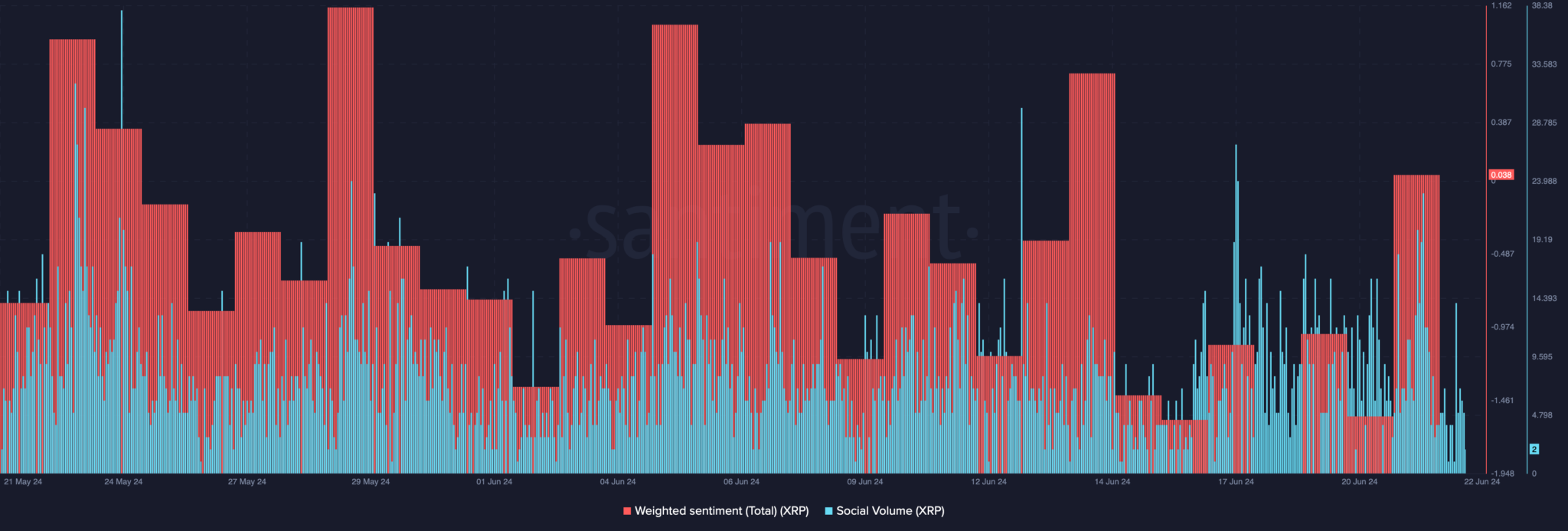

However, the sentiment around XRP has improved. According to ETHNews, which analyzed online comments about the cryptocurrency, the Weighted Sentiment has shifted from negative to positive. This change suggests an increasing optimism among the community and potential investors, which could drive demand and, subsequently, the price of XRP.

While XRP seems poised for a value increase, this forecast remains contingent on broader market dynamics and the resolution of legal challenges facing Ripple. Investors and observers alike are advised to watch these developments closely, as they will play critical roles in determining XRP’s trajectory in the near term.

[mcrypto id=”12299″]

Ripple (XRP) is currently trading at 0.48202 USDT, down 0.92% from the previous day. Over the past week, XRP has decreased by 1.44%, 8.56% over the past month, and 25.41% over the past six months, with a year-to-date decrease of 21.89% and a 2.55% decline over the past year. XRP is sitting around a support zone, which has shown maintained, it could target $0.55.

The volume indicates typical market behavior with fluctuations. In the short term, XRP could see a bullish movement if it holds the current support level; otherwise, it might test lower support levels around $0.43. Long-term potential positive market developments could push XRP towards $0.55.