- CRO gained after U.S. regulatory closure but struggles with token reissue risks and long-term price recovery.

- OM collapsed amid insider sell-off claims, eroding trust despite upcoming platform updates and high trading volume.

- RNDR rises on AI demand yet remains below peak, balancing technical progress with market skepticism over sustainability.

CRO rose briefly after U.S. regulators ended an inquiry into the exchange. However, its value remains lower than earlier levels, partly due to plans to reintroduce tokens previously removed from circulation. OM dropped sharply after reports suggested insiders may have sold holdings unexpectedly. RNDR, which connects blockchain technology with artificial intelligence applications, has seen gains over the past month but still trades well below its highest price.

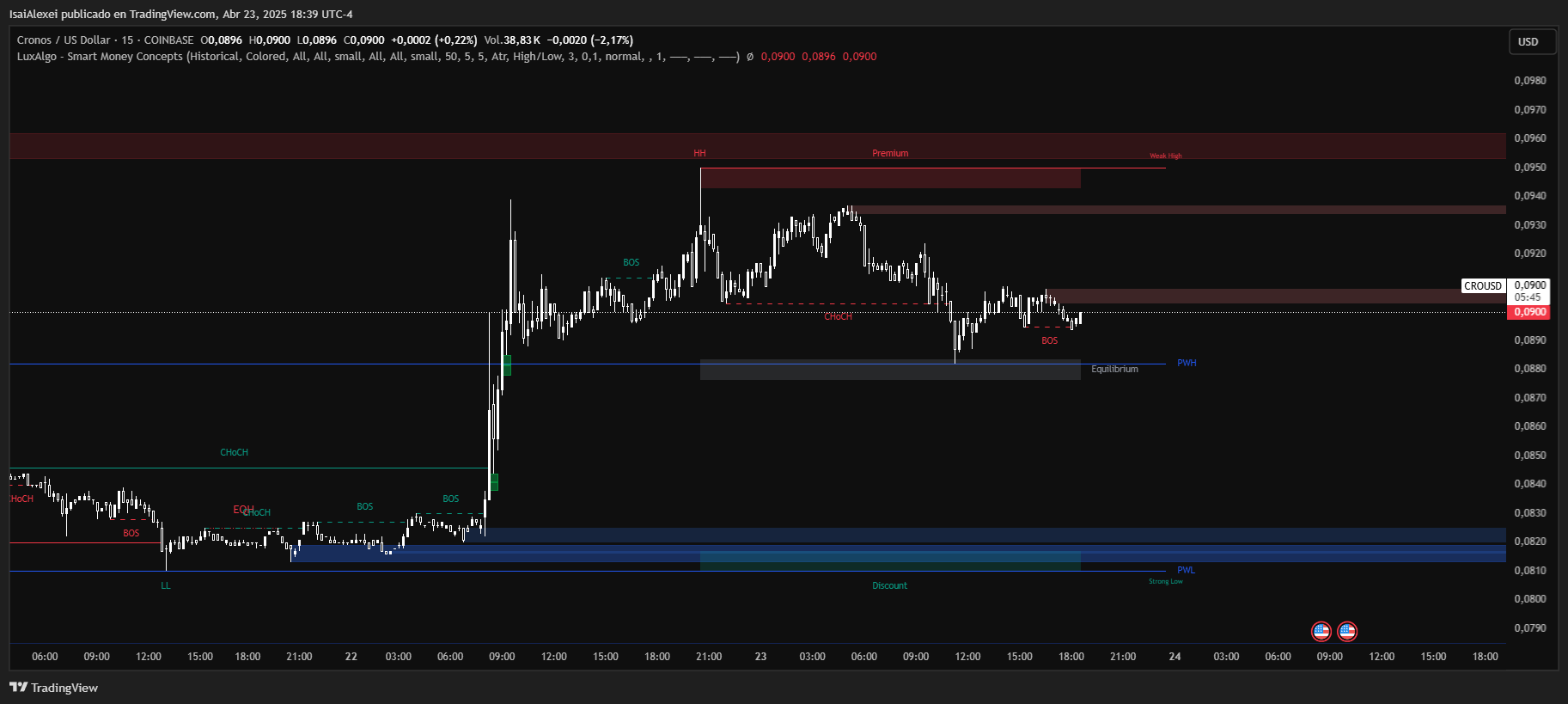

Cronos (CRO) is currently trading at $0.0897, reflecting a daily decline of -2.50%, despite showing a +8.60% gain over the past week and a +10.88% increase over the last month.

While these short-term moves suggest some bullish recovery, CRO is still down -36.20% year-to-date and -32.35% over the past year, indicating that it remains in a broader downtrend. From its all-time high of $0.9889, the token is still down nearly 90%, though there are signs of improving sentiment and liquidity.

Technically, CRO is hovering just below the $0.09 psychological level, with immediate resistance at $0.092–$0.095. A breakout above this range could trigger a move toward $0.105 and $0.12, where previous price action found rejection.

Support is forming around $0.085, and losing this level could lead to a retest of the $0.078–$0.075 region. Market indicators remain neutral to slightly bullish, with traders watching for confirmation of a trend reversal after the recent rally.

On the fundamental side, CRO has seen increased visibility following several key catalysts. Notably, the SEC officially closed its investigation into Crypto.com, removing regulatory uncertainty.

Additionally, a partnership between Trump Media and Crypto.com to launch “Made in America” ETFs sparked a price surge, while the upcoming zkEVM upgrades and token burns aim to support long-term ecosystem growth.

However, concerns linger about the controversial approval to reissue 70 billion previously burned tokens, which could dilute supply and pressure price.

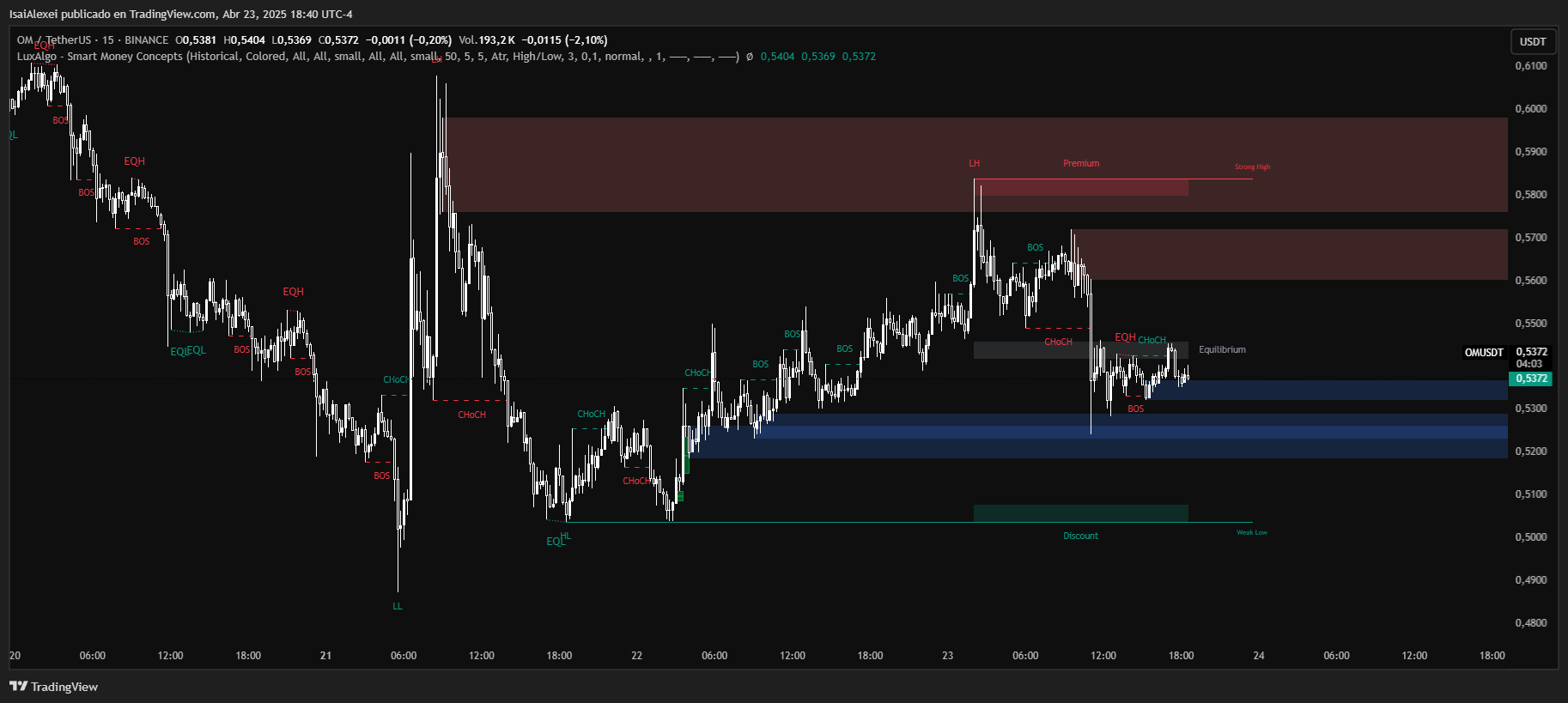

MANTRA (OM) is currently trading at $0.5365, with a -2.24% decline on the day, and a dramatic -32.87% weekly loss, reflecting high volatility and recent selling pressure. Over the past month, OM has crashed -91.68%, the result of a massive price collapse from over $7 to below $0.70, driven by what many analysts believe was a rug pull or internal liquidity dump, as reported by on-chain analytics from Glassnode and market commentary.

From a technical standpoint, OM is trying to stabilize around the $0.50–$0.55 range, which is now acting as a psychological support zone. The next key resistance levels to watch lie around $0.64–$0.70, though the recovery path is uncertain given the token’s recent collapse.

If the $0.50 level fails to hold, OM may retest $0.42–$0.38, where temporary support could emerge. Indicators remain in a strongly oversold state, which could open the door for a technical bounce, but sentiment is fragile.

Fundamentally, MANTRA is scheduled to launch its OM Dashboard V1 on April 19, a key milestone in the project’s roadmap. However, the recent price crash, allegations of internal token dumping, and comparisons to the LUNA collapse have severely damaged investor confidence. Despite a 24h trading volume exceeding $274 million, the overall market view is extremely cautious. Until transparency improves, traders are treating this asset as high risk.

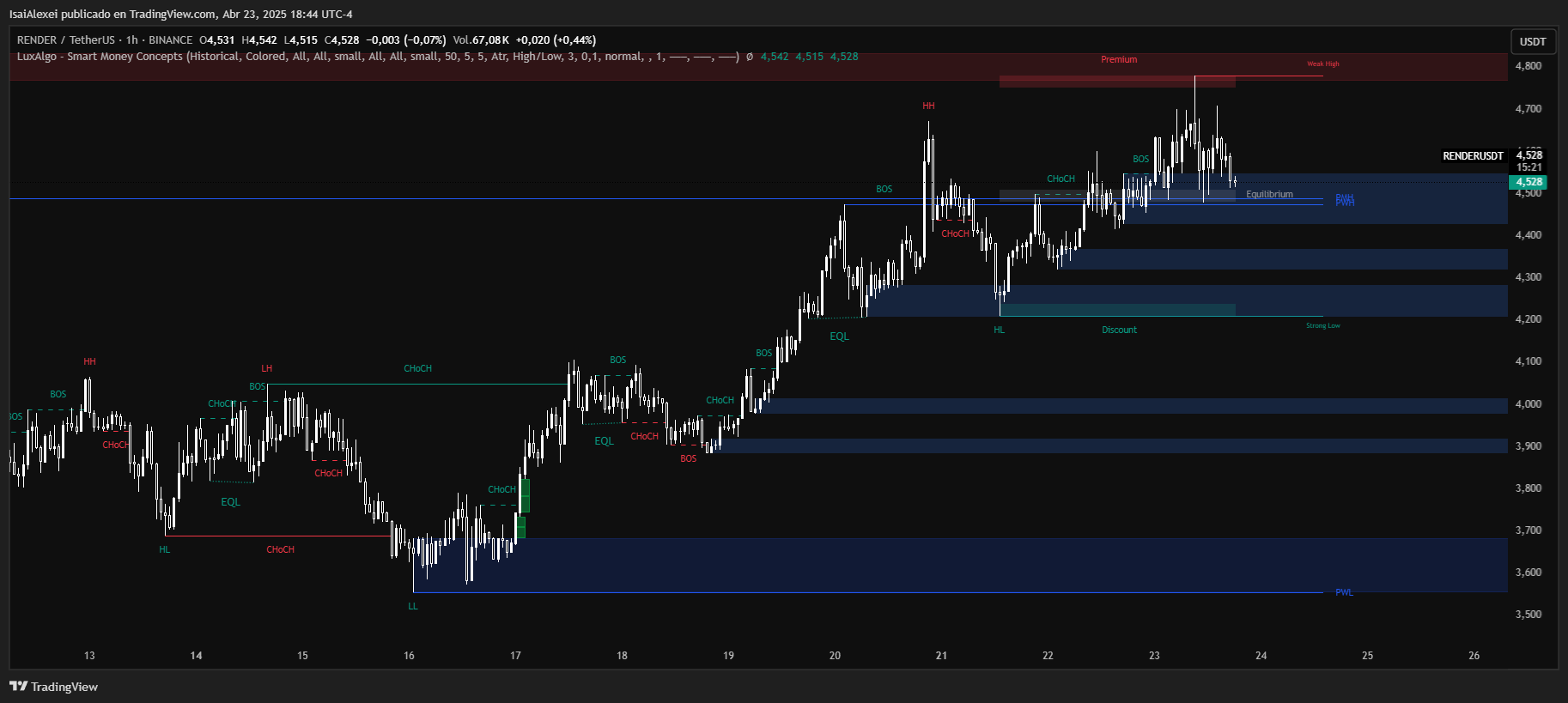

Render Token (RNDR) is currently trading at $4.499, posting a minor daily decline of -0.23%, but with significant upside momentum in the broader timeframe—up +20.99% over the past week and +29.47% over the past month.

Despite these strong short-term gains, RNDR remains down 33.69% year-to-date and over 51% below its all-time high of $13.62. The token is still widely followed due to its central role in the AI and decentralized GPU rendering narrative.

From a technical perspective, RNDR has reclaimed the $4.30–$4.50 support zone, and is now consolidating just below $4.60–$4.80, a key resistance band that must be cleared to enable a breakout toward $5.30 and $6.00.

The current market structure suggests the possibility of a cup-and-handle formation, which is typically bullish if confirmed with volume. On the downside, strong support is found at $4.00, and a failure to hold this level could trigger a drop toward $3.50.

Fundamentally, Render is benefiting from increasing AI adoption and demand for decentralized GPU computing. The project recently participated in several major events—including ETHDenver, Solana AI Summit, and GTC 2025—positioning itself as a key infrastructure layer in the Web3 + AI convergence.

Updates to Render’s AI tools suite, as well as growing institutional and NFT-based GPU use cases, further enhance the token’s narrative appeal.