- David Sacks sold over $200 million in crypto assets, including Bitcoin, before taking his White House role.

- The move raises questions as other officials, including Donald Trump, still hold crypto investments.

Former PayPal executive and venture capitalist David Sacks has been making headlines with his massive crypto sell-off in the run-up to his recent White House AI and Crypto Czar appointment for President Donald Trump.

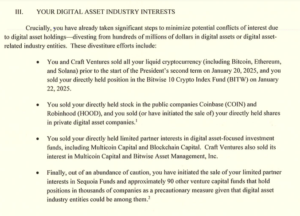

Sacks sold more than $200 million worth of cryptocurrencies including Bitcoin, Ethereum, and Solana, at least $85 million of which came directly from his personal holdings. The remainder was from his firm, Craft Ventures.

A White House memo revealed the extent of such divestments, including his withdrawal from various crypto-based investments.

Along with selling his direct crypto investments, Sacks also sold his stakes in the Bitwise 10 Crypto Index Fund, Coinbase, Robinhood, and certain venture funds like Multicoin Capital and Blockchain Capital.

Along with this, Craft Ventures also exited investments in Bitwise Asset Management and Multicoin Capital. It was described as a precautionary step to avoid any potential conflict of interest as Sacks assumes a regulatory role in crypto policymaking.

Despite the sell-off, the liquidation is reported to represent only a small percentage of his net worth, around 1%. However, the timing of the move has raised eyebrows because other senior administration officials like Commerce Secretary Howard Lutnick and even President Trump himself also have crypto investments.

The contrast has led to debates regarding whether the action of Sacks was exclusively ethical in purpose or was one of many financial strategies.

Regulatory Fears Grow as Sacks Liquidates Crypto Holdings

The divestment of Sacks takes place amidst heightened volatility in the crypto market. Both Bitcoin and major cryptocurrencies such as Ethereum have witnessed price volatility, and this has been accompanied by controversy around regulatory issues in the industry.

The fact that he sold his stakes before he took office has also raised concerns about inside information and whether stronger regulations are on the way.

The sell-off is being regarded as a wise decision by some investors as it brings transparency and avoids potential conflicts of interest. Others consider it to be a sign of losing confidence in the crypto market.

The sale of such a large amount of his holdings prior to becoming part of a policy making role has raised speculation about future regulatory action that would impact the crypto market.

David Sacks Rejects 0.01% Crypto Tax

Following his crypto exit, Sacks addressed various financial topics during a recent appearance on the All In podcast. He talked about economic policies, market conduct, and government regulations with a particular focus on cryptocurrencies.

Throughout the conversation, podcast host Jason Calacanis suggested imposing a 0.01% tax on every crypto transaction as government revenue. Sacks vehemently opposed the idea because such measures would slow down innovation and discourage crypto adoption.

The conversation touched on broader economic shifts like tariffs, taxation systems, and funding for tech start-ups. Sacks articulated his perspective on growth vs. regulation with an emphasis on supportive rather than stifling policies for new industries.

The opposition to further crypto taxation has been welcomed by some industry players as cementing his position as being strongly supportive of financial innovation.