- NEAR, ALGO, ARB surge 23-30% weekly amid bullish RSI divergences, pattern breakouts despite 77-93% ATH gaps.

- Layer-1 (NEAR, ALGO) and Layer-2 (ARB) innovations drive ecosystem expansion, Python integration, and DeFi adoption.

NEAR, ALGO, and ARB are gaining attention following weeks of sharp rallies (+23% to +30%), defying their prolonged downtrends. Despite still trading 77% to 93% below their all-time highs, this technical recovery—supported by signals like bullish RSI divergences (NEAR), continuation patterns (ALGO), and breakouts from bearish formations (ARB)—reflects a narrative shift: investors are reevaluating perceived undervalued assets, betting on their potential in a possible bullish cycle.

Is this a temporary bounce or the start of a sustained reversal? The answer may lie in their ability to consolidate above key resistance levels and capitalize on fundamental advancements.

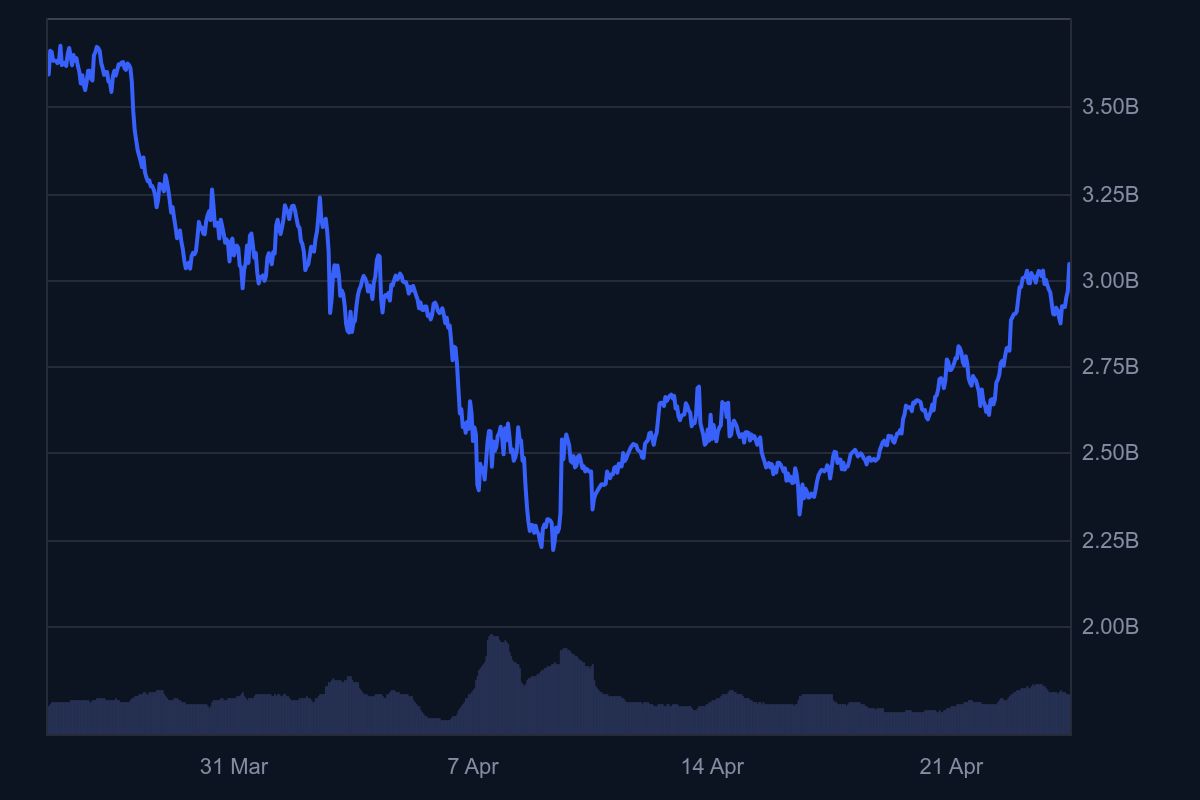

NEAR Protocol (NEAR) is currently trading at $2.57, showing a solid +4.05% daily gain, and an impressive +30.50% increase over the past week, indicating strong bullish momentum.

Despite this recent strength, NEAR remains down -12.18% over the last month, -47.55% year-to-date, and has lost 62.75% over the past 12 months, clearly reflecting a long-term downtrend from its all-time high of $9.00. NEAR’s current market cap stands at $3.10 billion, with a circulating supply of approximately 1.21 billion tokens and $196.88 million in 24h trading volume.

Technically, NEAR is recovering from a major breakdown and seems to be forming a bottoming structure. The $2.40 level has now flipped into short-term support, and the next key resistance zones to monitor lie around $2.75–$3.00. A confirmed breakout above $3.00 could trigger a larger move toward $3.60–$4.00, aligning with former distribution zones.

However, if NEAR fails to hold above $2.40, it may slide back toward $2.15–$2.00, which acted as previous demand. Indicators are leaning bullish, with multiple analysts identifying a bullish divergence on RSI, supporting the current recovery trend.

On the fundamental side, NEAR has gained attention for its scalable, developer-friendly Layer 1 architecture, using sharding (“Nightshade”) and its unique consensus mechanism (“Doomslug”).

Upcoming ecosystem events like governance talks, DeFi integrations, and recent infrastructure expansion via Nuffle Labs (now rebranded as MoreMarkets) add to investor interest. With NEAR’s smart contract platform aiming to rival Ethereum in terms of usability and transaction costs, sentiment is improving.

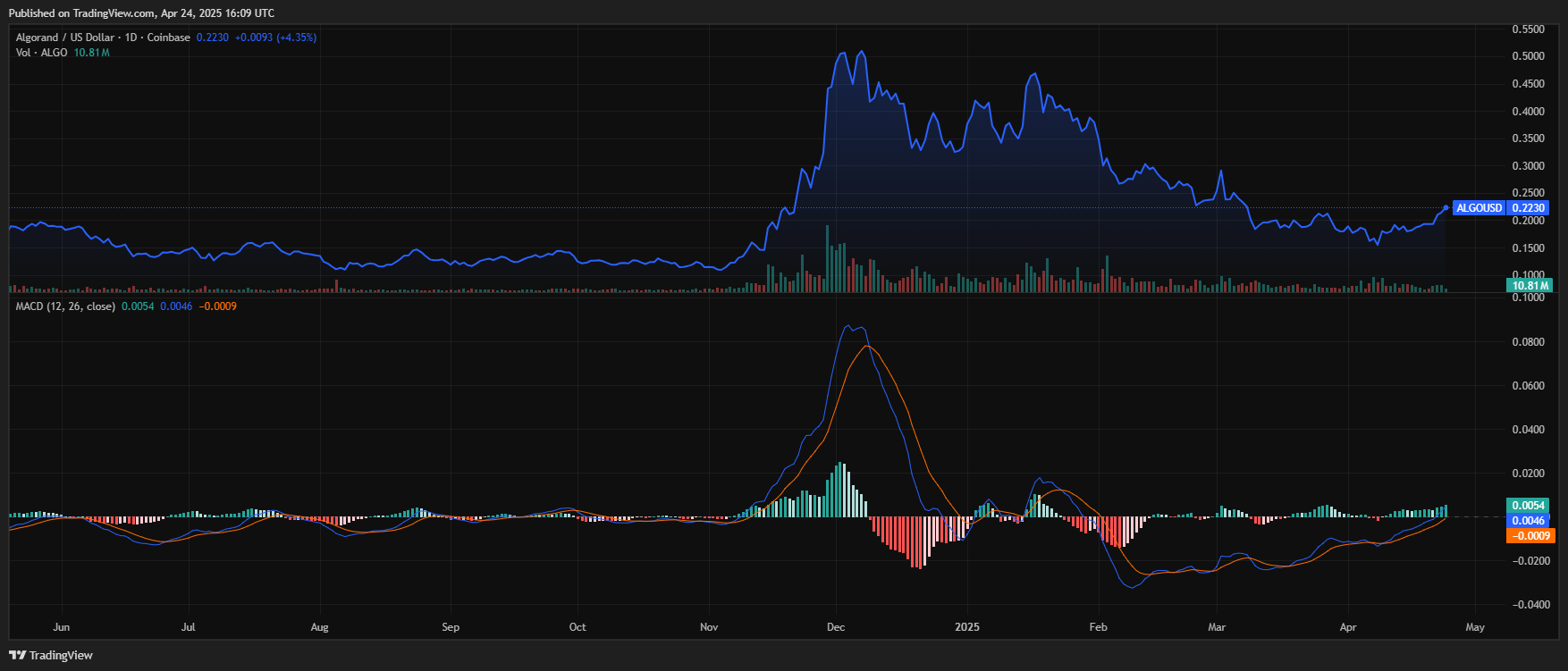

Algorand (ALGO) is currently trading at $0.2248, marking a strong +5.19% daily gain, with a significant +24.06% increase over the past week and +10.58% growth over the past month.

Despite the recent upside, ALGO remains down -32.63% year-to-date, and is still trading over 93% below its all-time high of $3.27. However, its long-term performance has turned slightly positive, up +16% over the last 12 months, as it continues to recover from historic lows.

From a technical perspective, ALGO is bouncing off long-term support and appears to be forming a bullish continuation pattern, possibly a bullish wedge or flag, based on recent chart formations.

If momentum continues, the next resistance zones lie at $0.245 and $0.275, and a breakout above these could target $0.30–$0.34. If support fails at $0.21, a drop back to $0.19–$0.175 remains possible. Traders are watching the 50-day moving average and RSI, both of which are trending higher—suggesting a favorable momentum shift.

On the fundamental side, Algorand continues to position itself as a green, scalable Layer 1 blockchain, with an MIT pedigree through founder Silvio Micali. While it suffered negative press in 2024 due to Tether discontinuing USDT minting on Algorand, the network has since rebounded by surpassing 2 billion transactions, integrating new programming languages like Python, and enhancing developer tools. Its low-fee model and rapid settlement remain attractive for DeFi and enterprise partnerships.

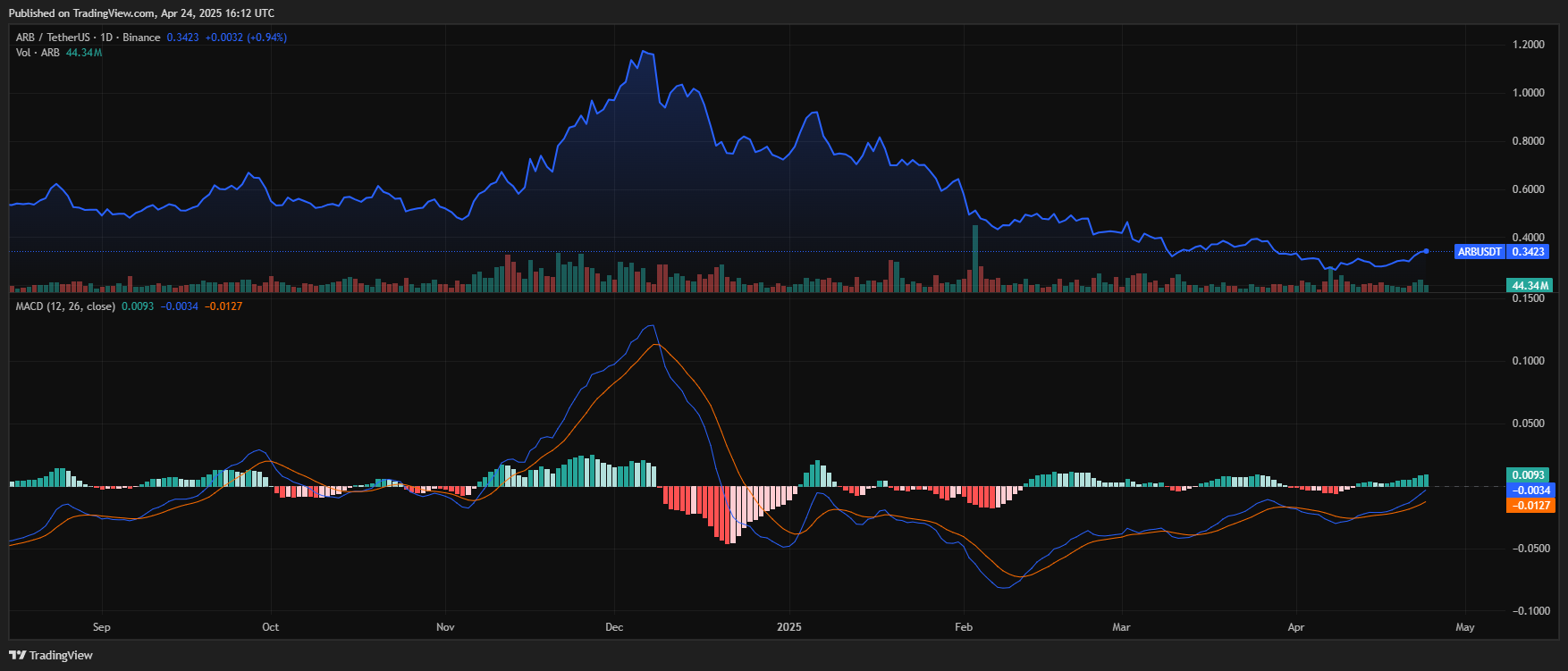

Arbitrum (ARB) is currently trading at $0.3437, reflecting a +1.33% daily gain, and showcasing an impressive +23.25% rally over the past week. However, the token remains deeply corrected when viewed across broader timeframes: -12.10% in the last month, -32.11% over the last 6 months, and -52.32% year-to-date.

ARB is still down nearly 77% from its all-time high of $2.40. The current market cap is approximately $1.63 billion, with a circulating supply of 4.76 billion tokens and a strong 24-hour trading volume of $187 million.

From a technical standpoint, ARB is attempting to reverse from deeply oversold conditions. The price action has recently confirmed a bullish falling wedge breakout, which is a typical reversal signal. Key resistance levels to watch next are $0.38 and $0.42—if broken, ARB could target a mid-term rally toward $0.50–$0.60.

On the downside, strong support sits at $0.32, and a breakdown below that level could reintroduce selling pressure toward $0.28. Indicators like RSI are recovering from oversold zones, supporting the bullish case.

Fundamentally, Arbitrum remains the leading Layer 2 scaling solution on Ethereum, and its ecosystem continues to evolve. Despite strong ecosystem fundamentals, the token price has lagged.

Investor interest is expected to increase with the upcoming 2.01% token unlock on May 16, which could introduce temporary volatility. Meanwhile, the Security Council Election (March–May 2025) and participation in global events like the Hong Kong Web3 Festival signal continued governance activity and developer engagement.