- Ethereum surpassed range highs with close at $2659 on February 12, indicating an increase in investor confidence.

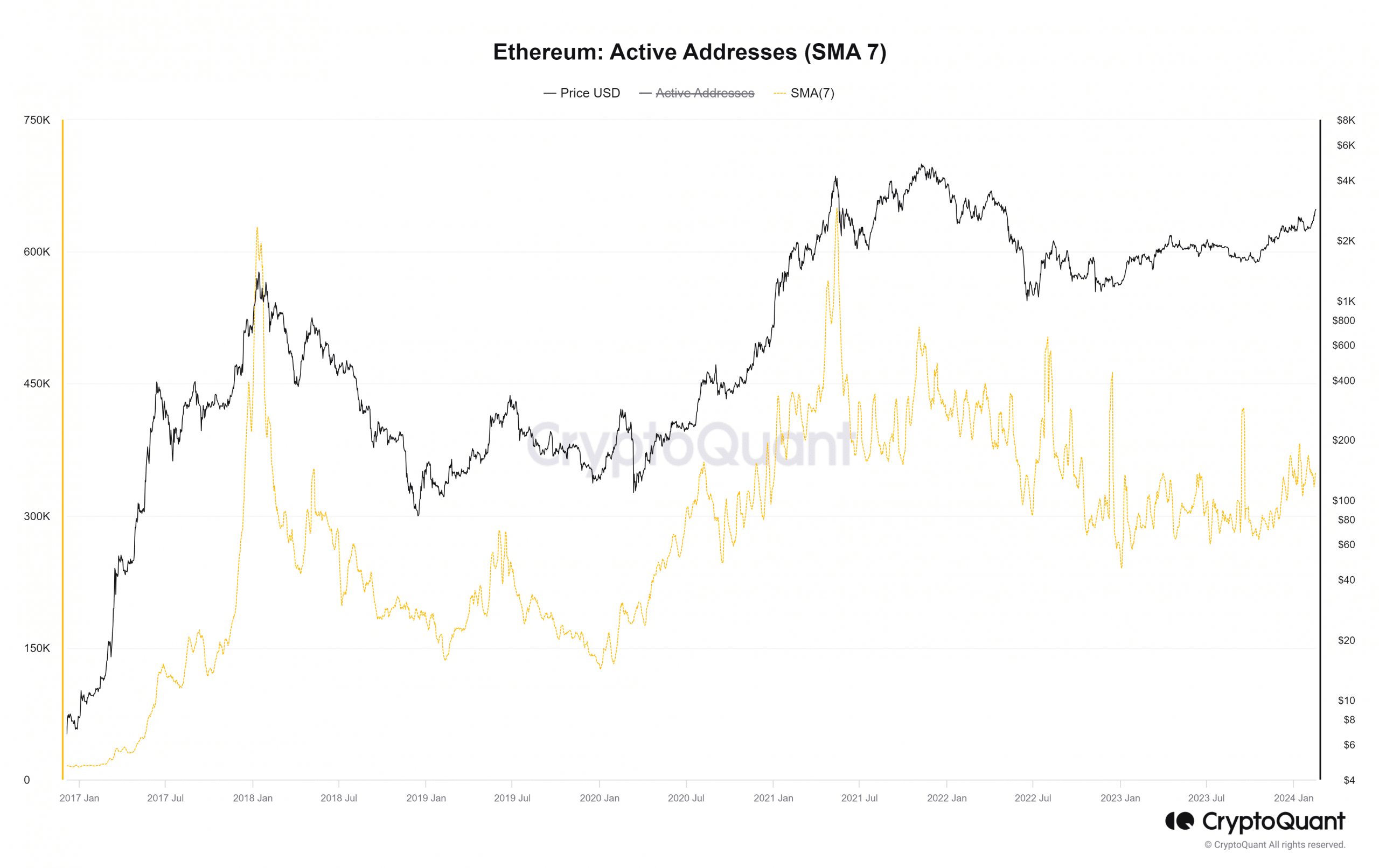

- Despite the decline in active directions post-November 2021, the price of ETH reached its highest since May 2022.

Ethereum [ETH] has maintained its value in a specific range since mid-December, fluctuating between $2116 and $2614, with a mid-level of $2365 acting as a horizontal reference over the past ten weeks.

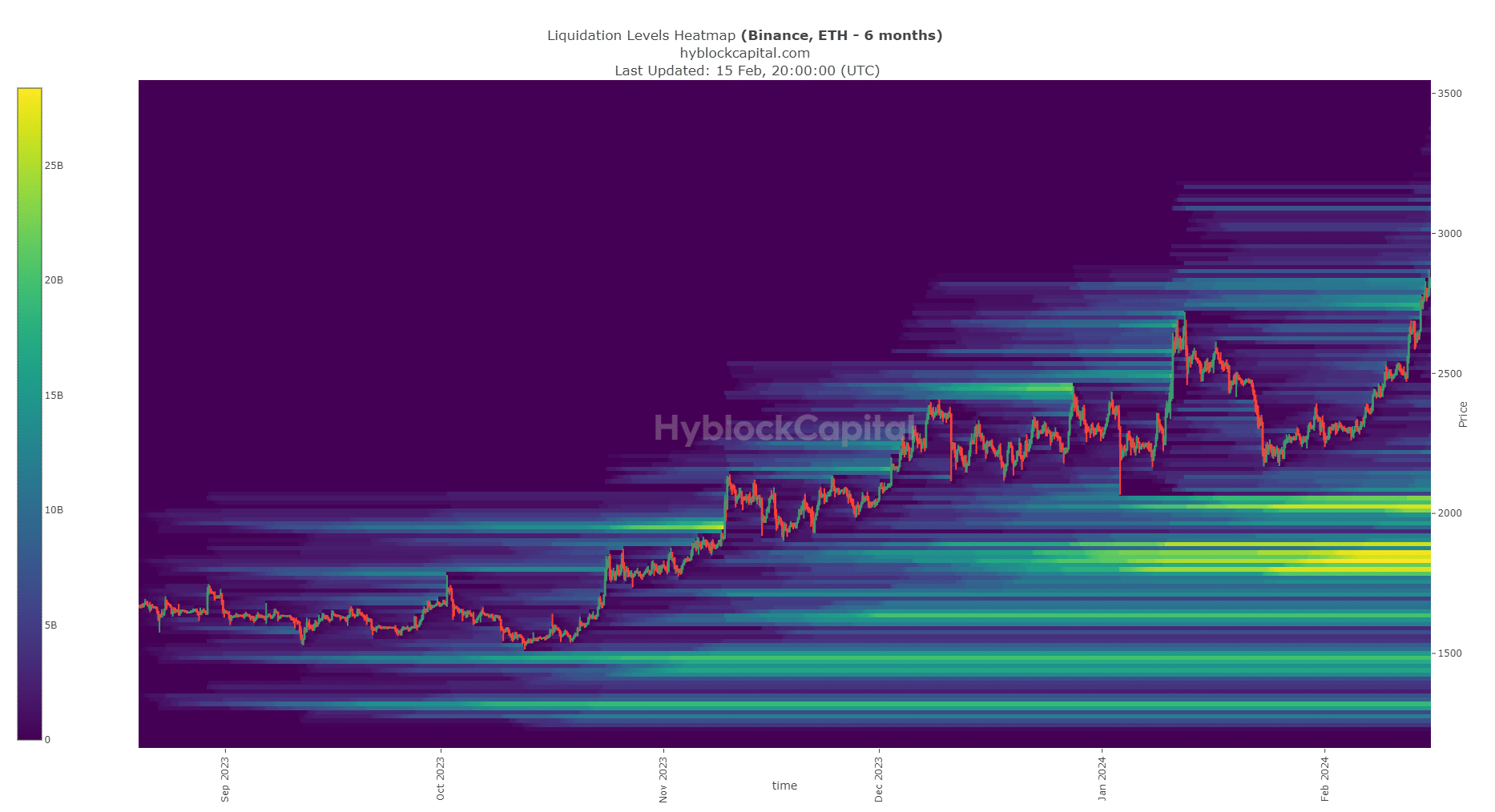

On February 12 ,Ethereum’s value closed the trading day at $2659, exceeding the upper limits of the previously mentioned range. From this point on, the number of liquidated short positions began to increase as the price continued to rise.

In both 2017 and 2020-21, significant growth in the number of unique active addresses was observed, coinciding with notable increases in market value. However, after November 2021, despite a decline in these numbers, there were efforts to break the $4k barrier, which were unsuccessful.

This uptrend we witnessed with Ethereum dates back to October 2023. The 7-day simple moving average on the number of active addresses indicates a progressive increase, according to CryptoQuant data.

However, over the past two years, this metric has not shown a sequence of rising lows and highs, indicating that a consolidated uptrend over time for the number of active addresses has not yet been defined.

The price of ETH has managed to reach levels not seen since May 2022. This could suggest that, in the coming months and years, the Ethereum network will experience an increase in the number of users and, therefore, in the demand and value of the token.

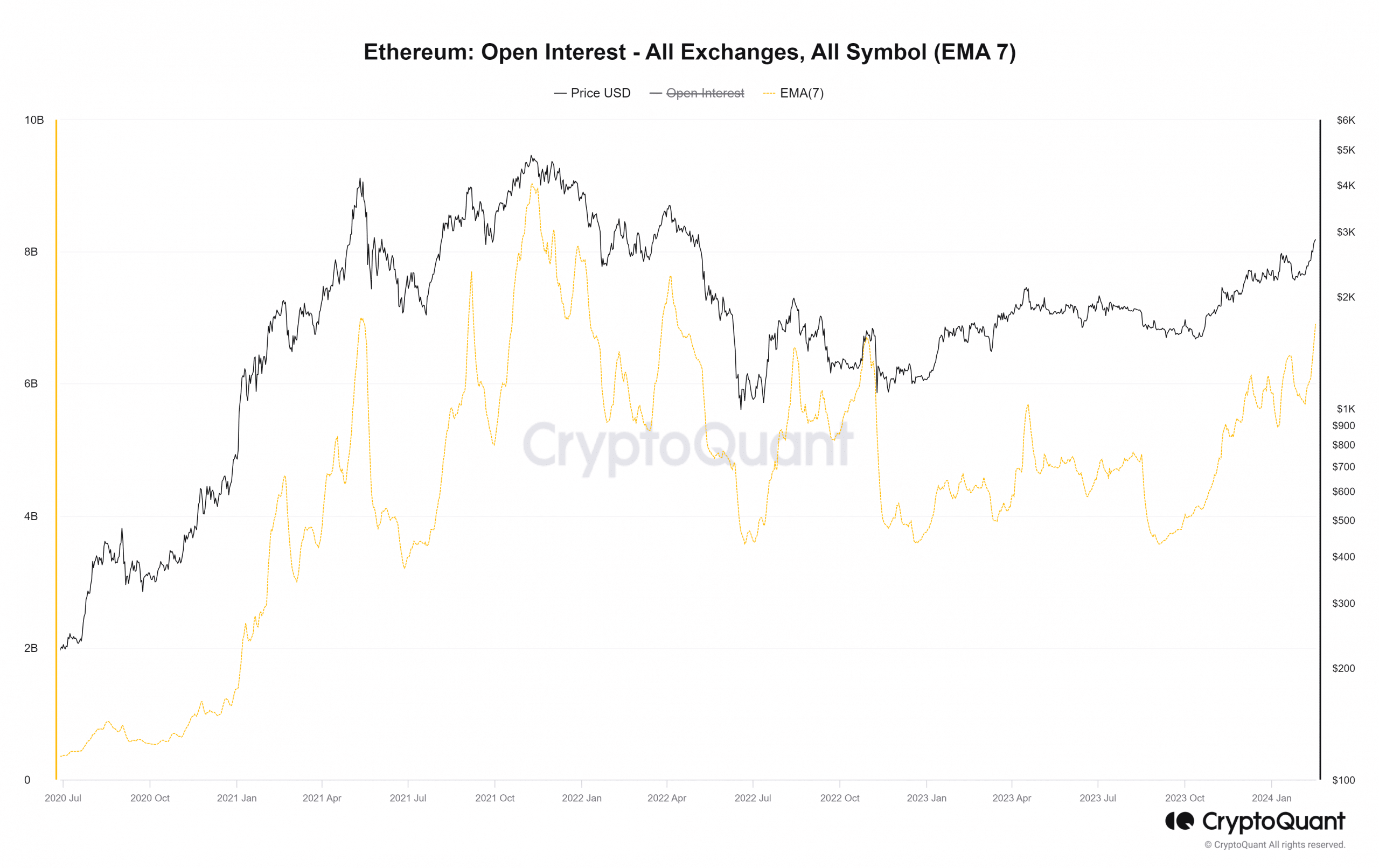

Derivatives markets reflect a predominantly positive outlook

ETHNews after analyzing open interest (OI) data for the past three years provided by CryptoQuant, we note that uptrends over longer periods have coincided with a sustained increase in OI, indicating an optimistic stance among investors.

Since October 2023, the 7-day moving average of OI rose from $1.7 billion on October 1 to $6.74 billion on February 15. The increase in OI, along with the rise in price, demonstrates that confidence in the futures market remains strong.

In examining Hyblock’s map of settlement levels, it was identified that the area between $2730 and $2835 has been breached. This area contained multiple liquidation points, valued between $10 billion and $15 billion.

It is anticipated that ETH could face resistance near $2900 after surpassing these important pockets of liquidity.

Liquidity availability near $3000, based on analysis over the past six months, was limited. Therefore, a pullback towards the $2000 area to tighten settlements seems logical.

Although the possibility of a negative adjustment remains uncertain due to the strength shown by buyers in recent weeks. A decline below $2500 would be indicative of a possible correction towards $2000. Meanwhile, a drop towards the $2500-$2600 range could represent a buying opportunity.