- BlackRock’s iShares Bitcoin Trust (IBIT) reports $102.7M inflow, marking a nine-day streak of investment gains.

- In July, BlackRock purchased over $1 billion in Bitcoin, highlighting significant institutional interest in cryptocurrency.

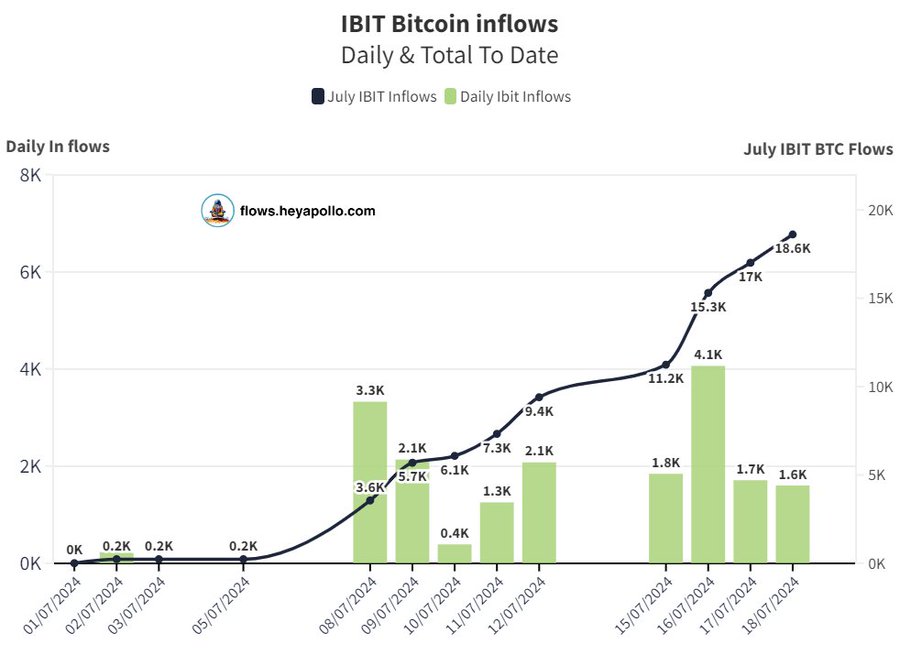

In a striking display of confidence in Bitcoin, BlackRock’s iShares Bitcoin Trust (IBIT) registered a significant inflow of $102.7 million on July 18th. This notable transaction marked the ninth consecutive day of gains for IBIT, distinguishing it as the only spot Exchange Traded Fund (ETF) to maintain such a consistent positive inflow streak this month.

This surge in investment comes at a time when BlackRock has reportedly purchased over $1 billion in Bitcoin in July alone. Thomas Fahrer, co-founder of the cryptocurrency data platform Apollo, emphasized the magnitude of these purchases, noting that on one day alone, BlackRock acquired $107 million worth of Bitcoin, equivalent to approximately 18,600 units of the digital currency.

Despite these substantial institutional investments, the overall sentiment around Bitcoin has experienced a decline. Social media platforms, including Twitter, Reddit, BitcoinTalk, and 4chan, have reflected a drop in positive discourse surrounding Bitcoin. This downturn in sentiment coincides with a modest rebound in the crypto market this week, which has not translated into renewed optimism for Bitcoin.

Moreover, an increase in short positions on Bitcoin has been observed, particularly through traders on platforms like Binance. According to the blockchain market intelligence firm Santiment, this trend suggests that many expect further drops in Bitcoin’s value.

📊 Positive commentary toward Bitcoin has plummeted despite the mid-sized crypto market bounce this week. Many traders, particularly on @binance, are opening shorts with the expectation of BTC dropping again. Both of these factors increase the likelihood of cryptocurrency rising. pic.twitter.com/50Z1TvJpUx

— Santiment (@santimentfeed) July 18, 2024

Yet, this sentiment paradoxically may fuel the potential for Bitcoin’s price to rise, as past patterns have sometimes shown an inverse relationship between prevailing market sentiment and actual price movements.

Amidst these mixed signals, long-term Bitcoin holders appear unfazed. Despite recent market fluctuations and unsettling news involving historical Bitcoin transactions, these stalwart investors have continued to add to their holdings.

The Relative Strength Index (RSI), which stood at 59, underscores the robust bullish sentiment that continues to characterize the long-term investment outlook on Bitcoin.

Long-term Bitcoin holders showed confidence last week, adding to their holdings despite fears about recent transactions involving Mt. Gox and the German government. pic.twitter.com/GCKgoFhOsX

— IntoTheBlock (@intotheblock) July 16, 2024

On-chain analytics platform IntoTheBlock corroborated this sentiment, noting a significant uptick in acquisitions by long-term holders.

Current Price of Bitcoin (BTC)

[mcrypto id=”12344″]The current price of Bitcoin is $64,562.70 USD with a 24-hour trading volume of $34,258,133,253.24 USD. The price has increased by 0.51% in the last hour, decreased by 1.80% in the past 24 hours, but has risen by 11.31% in the past week.

Current Price of iShares Bitcoin Trust (IBIT)

The current price of the iShares Bitcoin Trust (IBIT) is $37.76 USD, representing a 7.7% decrease with a drop of $2.82 USD.

Price Prediction

Bitcoin (BTC)

For Bitcoin, using technical analysis and machine learning, it is expected that the price may reach approximately $70,000 USD in the coming months, considering current trends and historical price patterns.

iShares Bitcoin Trust (IBIT)

For the iShares Bitcoin Trust (IBIT), it is predicted that the price could rise to around $38 USD in the coming months, following the general trend of Bitcoin’s price and its direct correlation with the underlying asset.