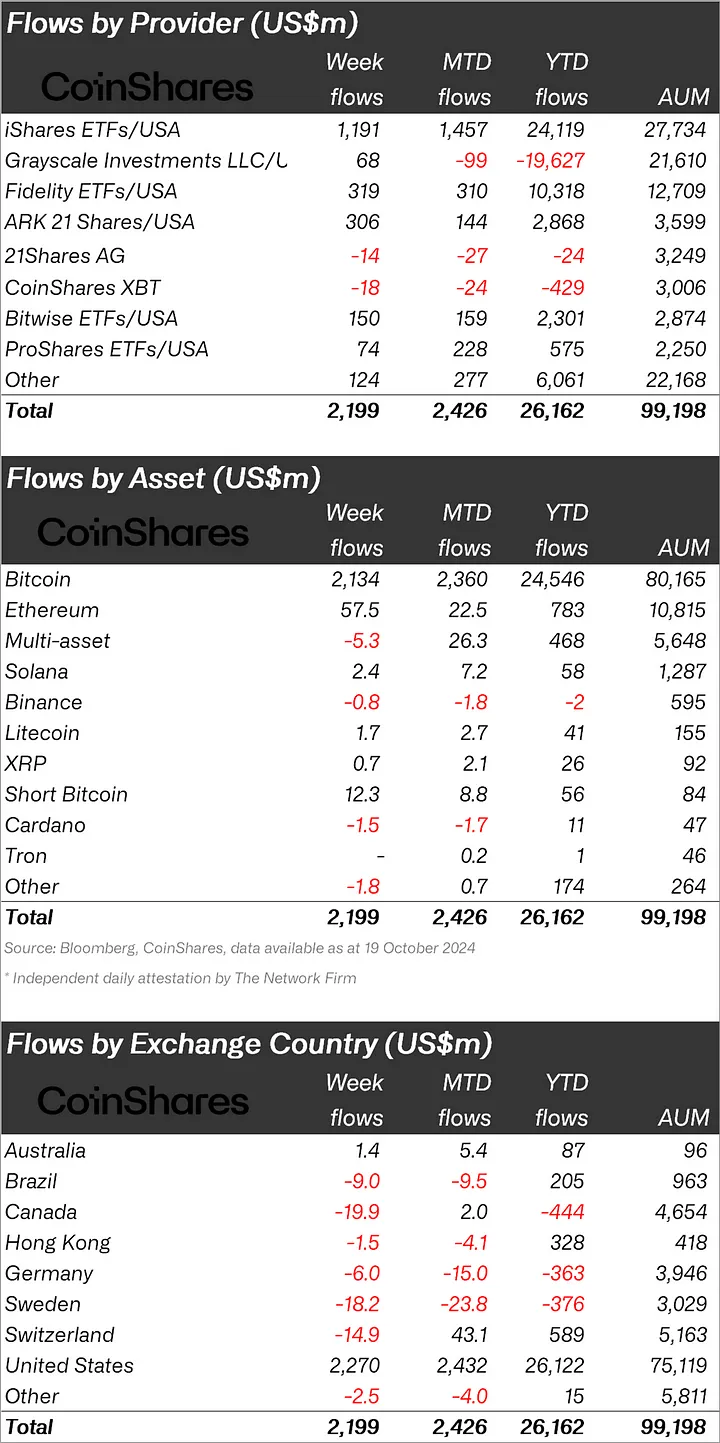

- U.S. inflows dominated with $2.3 billion, while Canada, Sweden, and Switzerland saw minor outflows due to profit-taking.

- Bitcoin received the majority of inflows at $2.13 billion, with Ethereum and other altcoins also seeing increases.

Digital asset investment products recorded a substantial increase in inflows, totaling $2.2 billion last week, the highest weekly rise since July of this year. Analysts attribute this growth to anticipations of a Republican victory in the upcoming U.S. elections, as this party is generally perceived as more favorable towards digital assets. This expectation has positively influenced asset prices, resulting in a 30% surge in trading volumes.

Concurrently, total assets under management are approaching the $100 billion mark, primarily driven by the enhanced trading activity and asset appreciation. Regionally, the investment appears divided: the U.S. experienced big inflows amounting to $2.3 billion, while countries like Canada, Sweden, and Switzerland reported outflows of $20 million, $18 million, and $15 million, respectively, possibly due to localized profit-taking activities.

Bitcoin as the principal recipient of these inflows, securing $2.13 billion. This was accompanied by an increase in short-bitcoin positions, which saw inflows of $12 million, the largest since March. Ethereum also benefited, with inflows totaling $58 million.

Among other cryptocurrencies, Solana received $2.4 million, Litecoin $1.7 million, and XRP $0.7 million. In contrast, multi-asset products saw a decline, with outflows of $5.3 million, ending a 17-week streak of inflows.

These financial shifts underscore a week for digital assets, largely influenced by political expectations in the U.S. The regional differences in flows highlight diverse investor behaviors and suggest varying strategies in markets outside the U.S. As the interplay between political events and market reactions continues, the digital asset sector remains closely linked to broader economic and political developments.