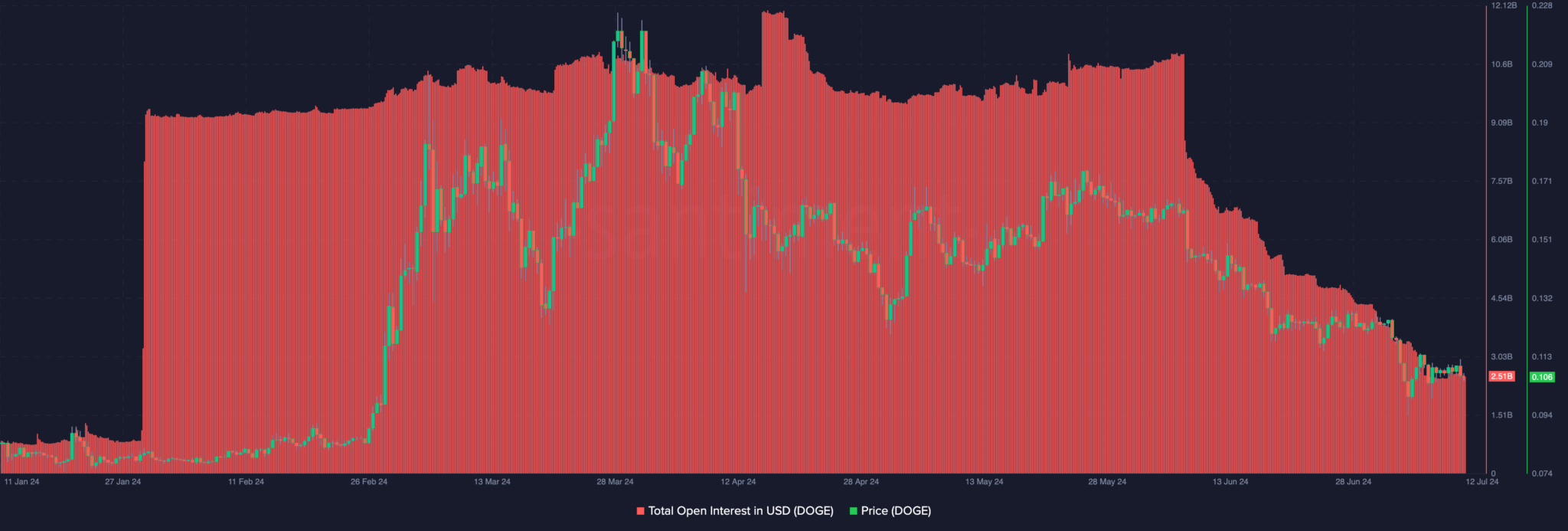

- Lowered open interest indicates reduced market confidence, impacting liquidity and diminishing expectations for substantial price movements.

- Critical liquidity levels at $0.11 and $0.098 could dictate Dogecoin’s price direction, depending on emerging buyer and seller pressures.

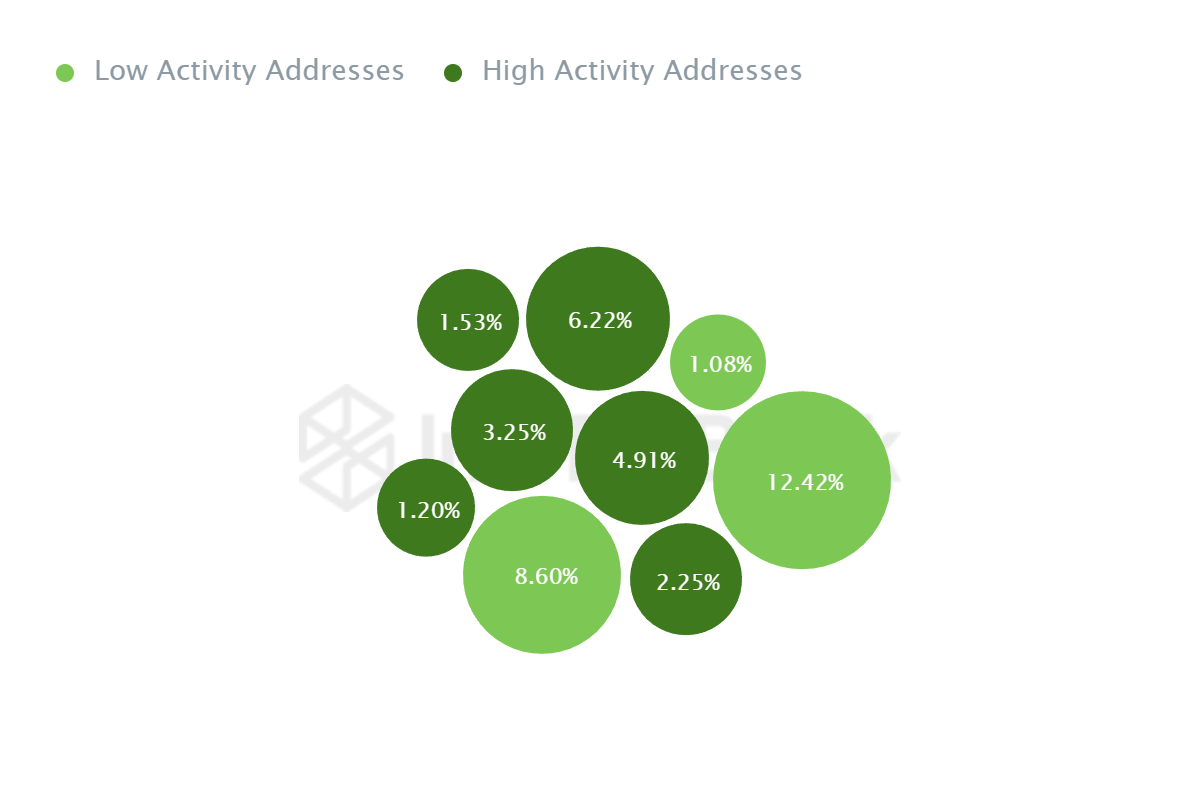

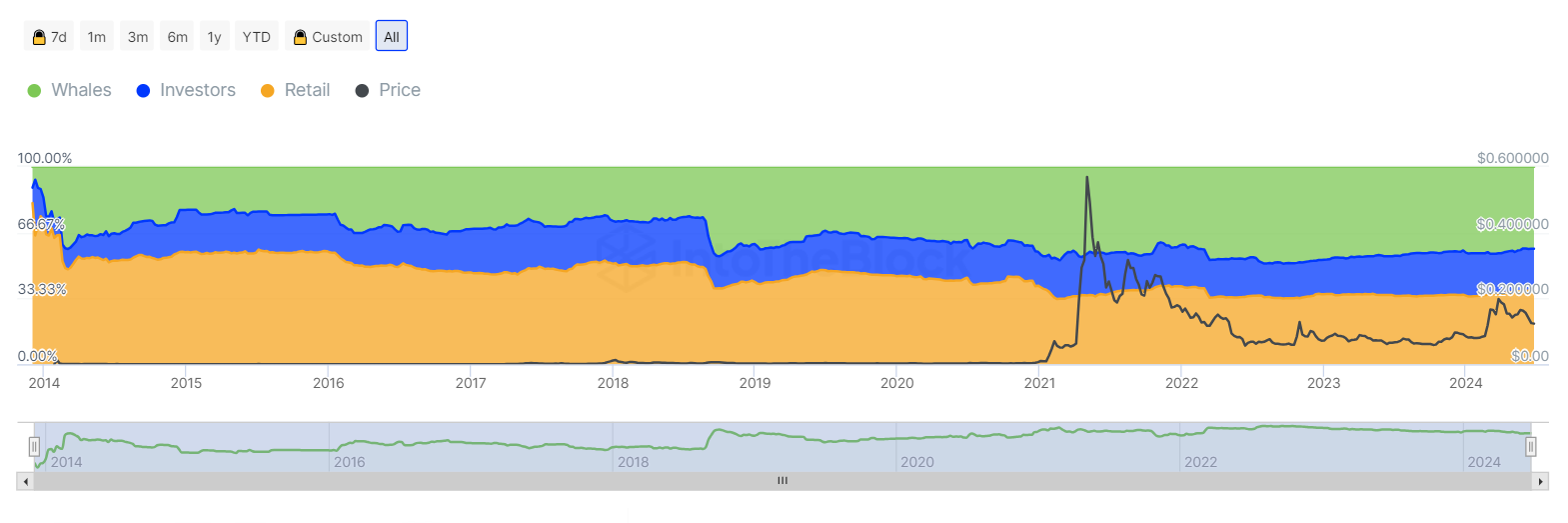

Dogecoin’s recent whale activity recorded a staggering 868% increase, casting a spotlight on the potential volatility of its market. This sharp rise in Dogecoin whale accumulation occurred from July 9 to July 11, reflecting movements by large holders.

Despite these dramatic shifts in whale behavior, Dogecoin’s price has not shown a corresponding increase, leaving market spectators watching closely.

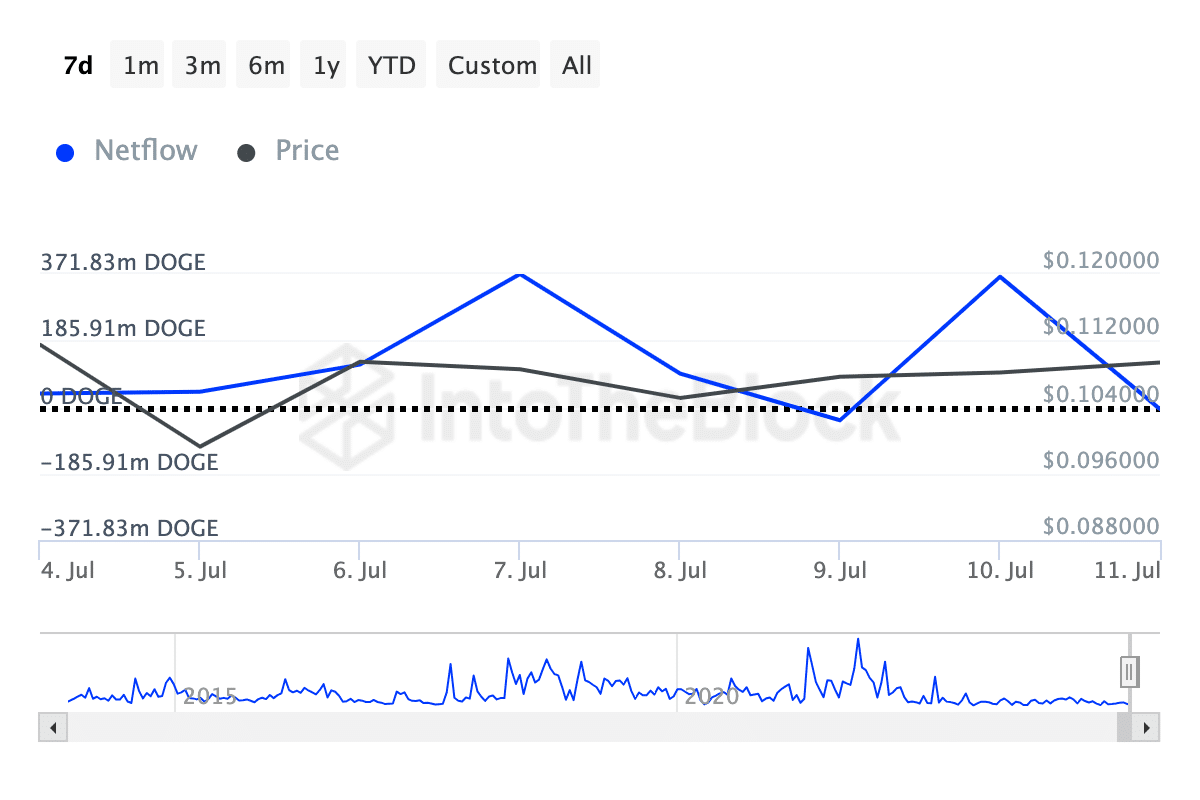

On July 11, the net flow of large holder transactions reached 364.38 million coins, up from a negative 37.05 million just days before. This change signifies a substantial accumulation of Dogecoin by whales, which typically signals to the market an impending price rise.

However, the expected bullish impact on Dogecoin’s market price has been absent or delayed, raising questions about the underlying market.

Currently, Dogecoin trades around $0.10, marking a 2.66% decline over the last 24 hours but still up 10.35% over the past week. This performance divergence raises inquiries into the factors influencing Dogecoin’s market behavior, particularly the role of open interest (OI) in its price movement.

Open interest, the total value of outstanding contract positions in the market, has been declining, reaching its lowest point since January 27 at $2.51 billion. This reduction suggests a decreasing confidence among traders, as lower OI typically correlates with a reduction in market liquidity and less aggressive positioning from traders expecting price moves.

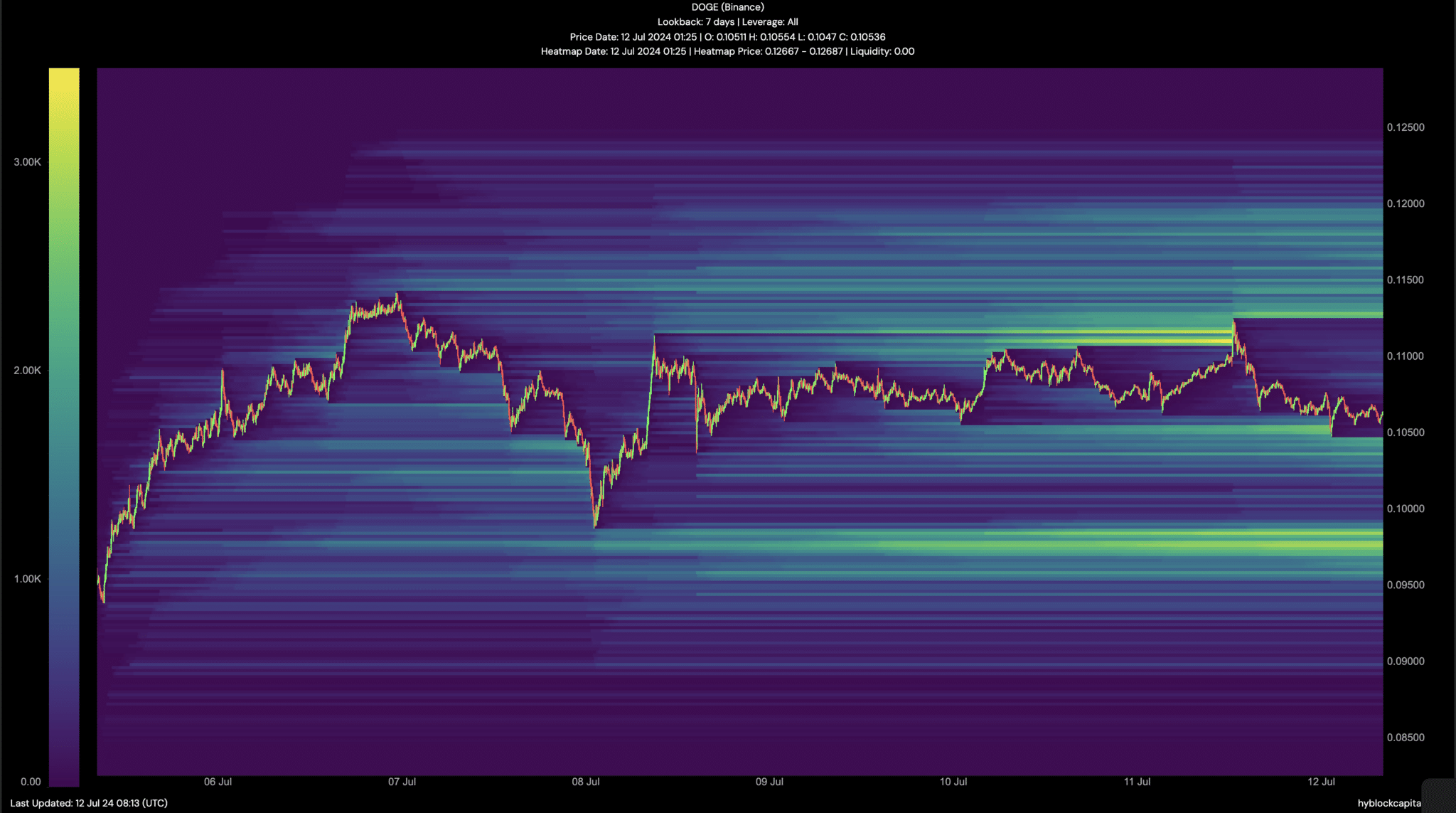

The pathway to Dogecoin’s potential rise seems pegged to its ability to breach the $0.11 mark, a level identified as having a high concentration of liquidity. Should buying pressures mount, the price might ascend toward this threshold.

Conversely, a sustained low impact from whale activities and a prevailing selling pressure could see the price dip towards the $0.098 mark, another point of significant liquidity concentration according to the Liquidation Heatmap.

ETHNews analysis indicates that while the potential for a price surge exists, contingent on market forces rallying around the recent whale accumulations, the immediate future for Dogecoin remains tethered to broader market sentiment and the speculations of its large holders.