- Recent trading shows a 25.71% increase in volume, indicating a possible near-term price adjustment for Dogecoin.

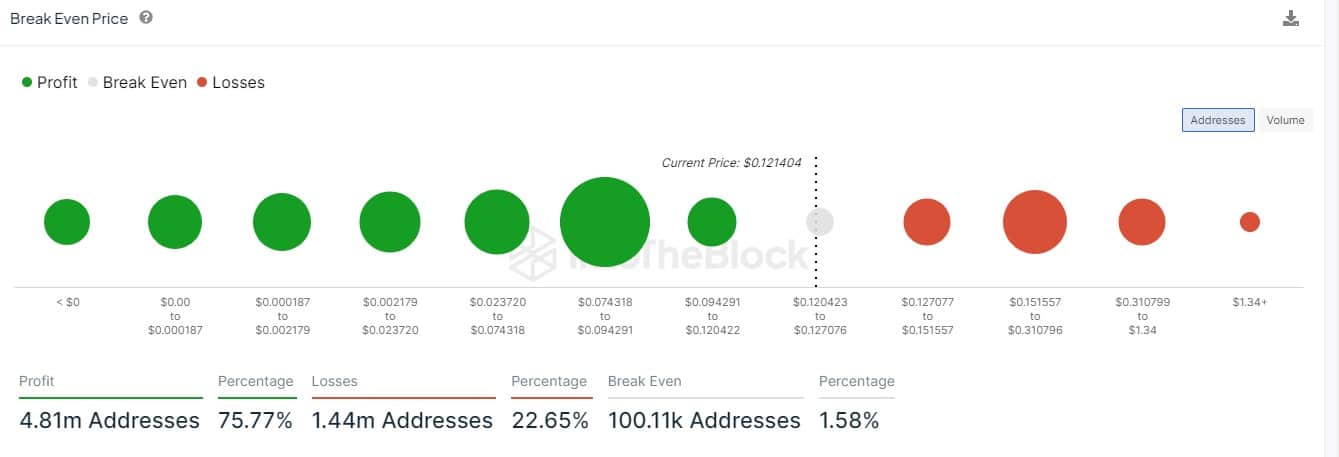

- Increased profit-taking among investors observed, with 75.77% of DOGE addresses remaining profitable in current conditions.

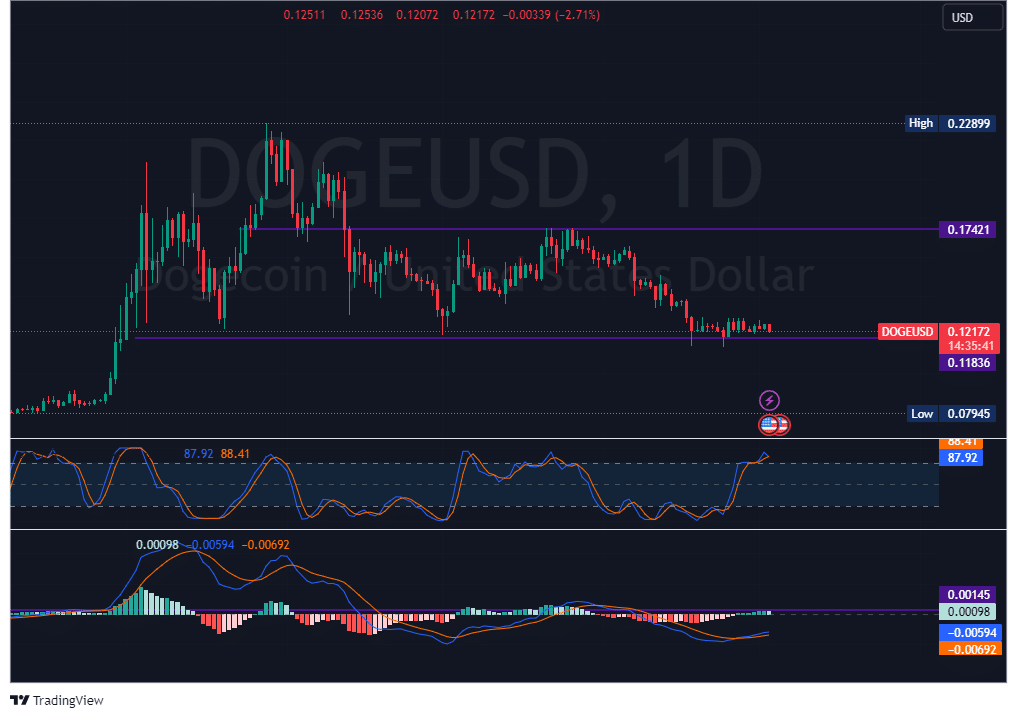

Dogecoin (DOGE) is currently facing a critical moment as it hovers around the $0.1184 support level. This price point has been tested repeatedly since March 19, suggesting its importance in the cryptocurrency’s pricing pattern.

[mcrypto id=”12355″]

As of the latest data, Dogecoin is priced at $0.1184, showing a 1.25% increase over the last 24 hours and a 3.38% rise over the past seven days. The market capitalization of Dogecoin is currently $17.4 billion.

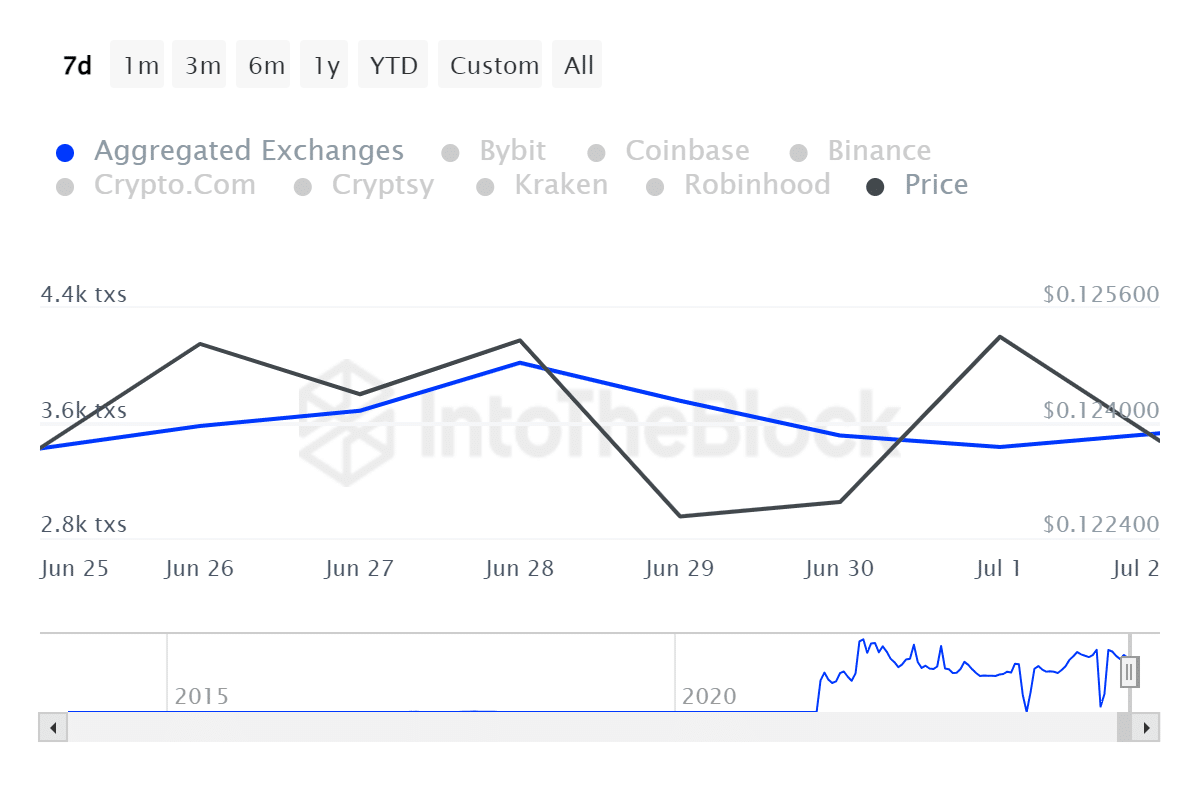

The trading activity for Dogecoin has intensified recently, with $497.7 million worth exchanged in the last 24 hours, marking a 25.71% increase in volume. This activity points to the possibility of a near-term price adjustment at this established support level.

Technical analysis indicates that the stochastic Relative Strength Index (RSI) for Dogecoin is in an overbought state, suggesting a likely correction in price soon. Concurrently, profit-taking among short-term investors has increased due to a bearish market outlook.

According to IntoTheBlock data analyzed by ETHNews, 75.77% of DOGE addresses remain profitable, which has encouraged some investors to sell their holdings.

Moreover, there has been a notable increase in the movement of Dogecoin to exchanges, as evidenced by the rise in exchange outflow transactions. This trend is important and could lead to increased selling pressure, potentially driving the price down to the $0.1184 support level again.

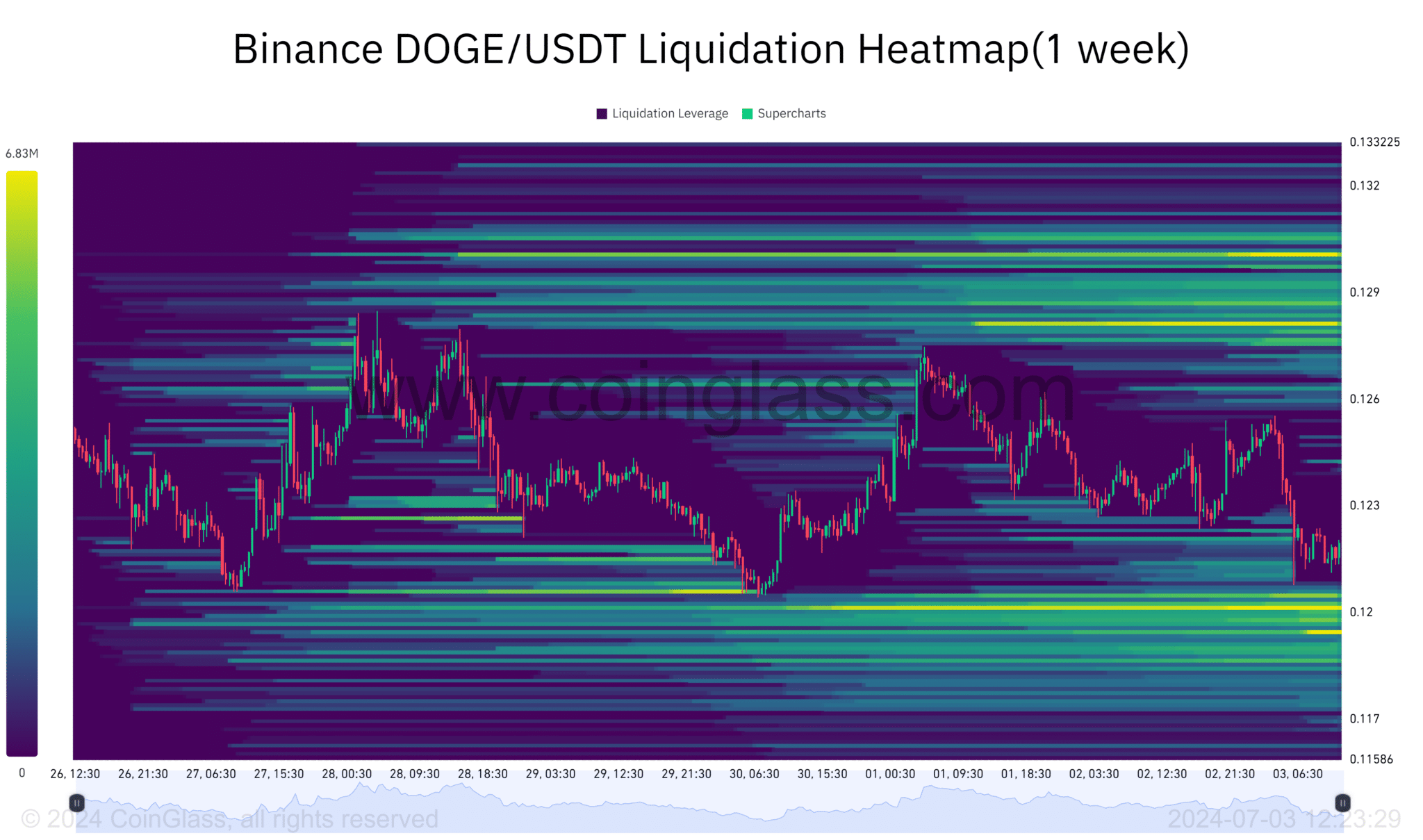

The liquidity at the $0.1184 level will be decisive in determining Dogecoin’s immediate price movement. Data from Coinglass suggests that a drop below $0.120 could initiate a series of liquidations, exacerbating the downward pressure on the price.

However, if there is adequate buying support at this level, Dogecoin could potentially recover and challenge the $0.132 resistance level.

Dogecoin’s stability at the $0.1184 support level is crucial. The interaction between selling pressure and buying support at this juncture will crucially influence whether Dogecoin can sustain its current price or if it will undergo further declines.