- TLIP and the IOTA Foundation use blockchain technology to develop a secure and efficient trade document exchange ecosystem.

- TLIP integration into international agreements and digital commerce corridor pilots strive for global standard acceptance and regulatory compliance.

With the cooperation of Trademark Africa and the IOTA Foundation on the Trade & Logistics Information Pipeline (TLIP), supply chain management technology integration has advanced significantly, in line with what ETHNews previously disclosed.

This partnership promises a more open and efficient global trade environment and is poised to transform the flow of trade data.

An Interoperability Vision

Representatives from IOTA, Jens Lund-Nielsen, and Trademark Africa, Erick Sirali, have responded to the Virtual Watch Tower’s (VWT) call for action, expressing great excitement about the parallels and possible opportunities for cooperation between VWT and TLIP.

Early conversations have uncovered a compelling interoperability vision that focuses on the technical and governance issues that must be resolved in order to connect both ecosystems.

Initially developed as a reaction to issues resembling those the VWT effort tackles, TLIP seeks to enable sustainable trade by means of a digital ecosystem that is “neutral, open, collaborative, trusted, and interoperable.” VWT concurs with this idea, indicating a logical fit between the two projects.

Creating the Ecosystem That Is Minimum Viable

With a startup mentality, the partnership’s initial focus has been on creating a “minimum viable ecosystem” (MVE) in order to demonstrate viability. This has required a complex partnership between Trademark Africa’s trade and development experience and IOTA’s technical skills.

Kenya has used a decentralized approach that enables traders to create digital identities and obtain necessary trade documents straight from the Kenyan Single Window system and other pertinent organizations.

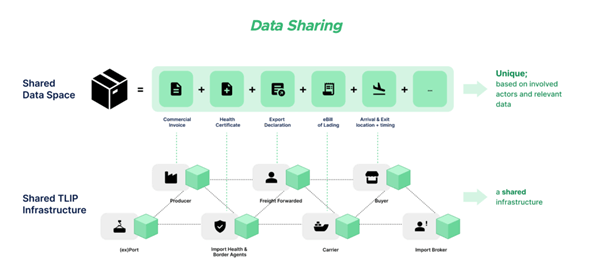

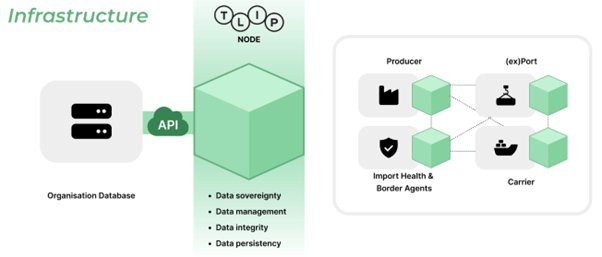

By making it easier to secure data integrity, sovereignty, and permission management, the TLIP node system makes it easier to create distinct data spaces for various trade aspects. By ensuring that digital versions of international trade documents are safely kept on a blockchain, this system improves provenance and authenticity checks.

Going Beyond the First Achievements

The deployment’s success in Kenya has made further expansion of digital trade processes possible. The Economic Partnership Agreement between Kenya and the United Kingdom now includes the TLIP system, which promotes digital exchanges and results in significant cost savings, as well as insights from pilot programs with the EU and the UK.

The ongoing expansion intends to include digital trade lanes in East Africa with nations in the Middle East and Europe, driven by growing interest from other governments and industry participants. For a more in-depth look at these developments, see this YouTube video.

Accepting Compliance and Standards

TLIP’s strategy places a strong emphasis on embracing and advancing digital and data standards. This involves utilizing APIs that adhere to UN/CEFACT, GS1, and EPCIS 2.0 standards.

By working with organizations like the W3C consortium and the European Blockchain Service Infrastructure, efforts are also being made to comply with international digital standards.

It is essential to abide by newly enacted laws, such as the EU Carbon Border Adjustment Mechanism and the Model Law on Electronic Transferable Records. These advancements are ensuring cross-industry adoption of digital supply chain management solutions.

A neutral governance framework is necessary for TLIP to succeed. During WTO MC13, a number of non-profit organizations, including Trademark Africa and the IOTA Foundation, inked a Collaboration Agreement.

These organizations are dedicated to assisting in the creation and execution of governance frameworks that will supervise the long-term growth and functioning of TLIP.

Meanwhile, CoinMarketCap shows that the price of the IOTA token is currently trading around $0.2128. It has dropped by 4.20% in the last 24 hours. It also shows that the position has been going bearish for the past 7 days, by 31.11%.

[mcrypto id=”12336″]