- EOS futures open interest hit $170M, doubling April figures; traders bet on further upside.

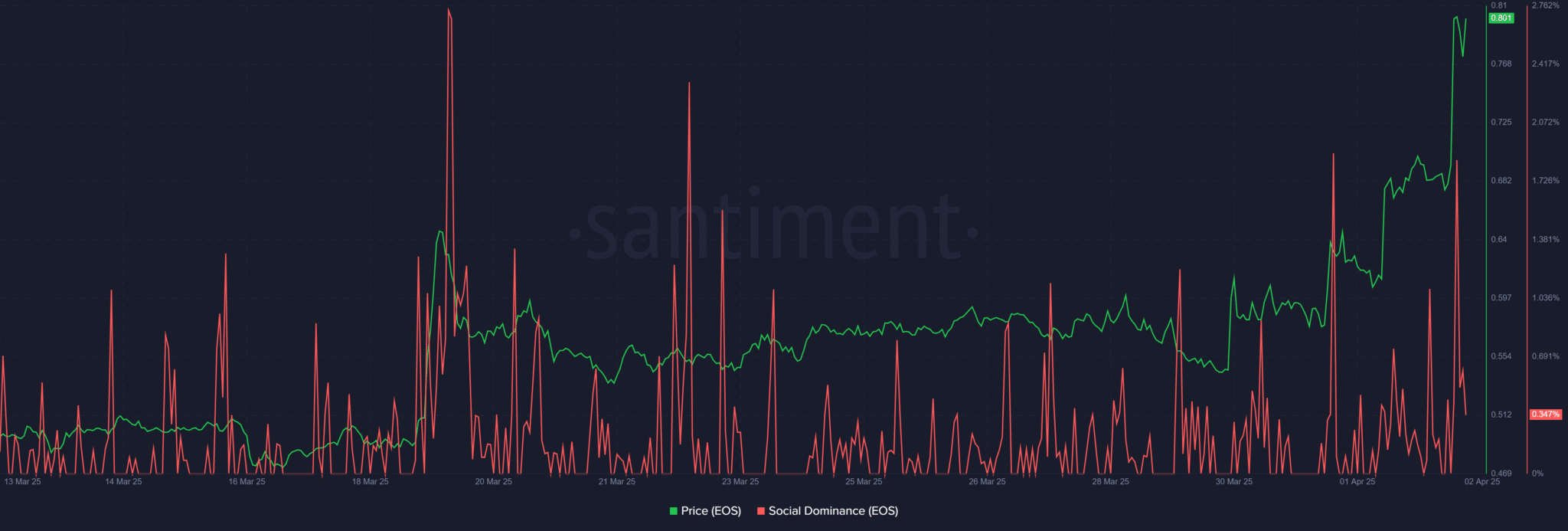

- Social mentions fell from 2.8% to 0.35%, but price holds steady with RSI at 79.12 (overbought).

EOS has risen over 20% in value following announcements tied to its rebranding as Vaulta and upgraded staking rewards. The price increase coincides with heightened trading activity and renewed investor interest in the project.

Three factors explain the rally. First, EOS confirmed plans to transition to Vaulta, a rebranded platform targeting blockchain-based financial services. The shift includes a new ticker symbol and integration with Bitcoin banking solutions via exSat, set to finalize by May’s end.

Second, Vaulta’s proposed staking mechanism offers a 17% annual yield, outpacing Ethereum’s 2.03% and Solana’s 5.14%. This yield relies on a reserve of 250 million tokens allocated for rewards. Third, derivatives traders have amplified bets on EOS. Futures contracts tied to the token now hold $170 million in open interest, up from $90 million in April, signaling expectations of further gains.

Social media activity linked to EOS briefly spiked, with mentions peaking at 2.8% of all cryptocurrency discussions as prices crossed $0.80. By press time, engagement cooled to 0.35%, though prices remain stable. ETHNews analysts attribute the resilience to steady buying activity, evidenced by an On-Balance Volume (OBV) reading of 46.99 million.

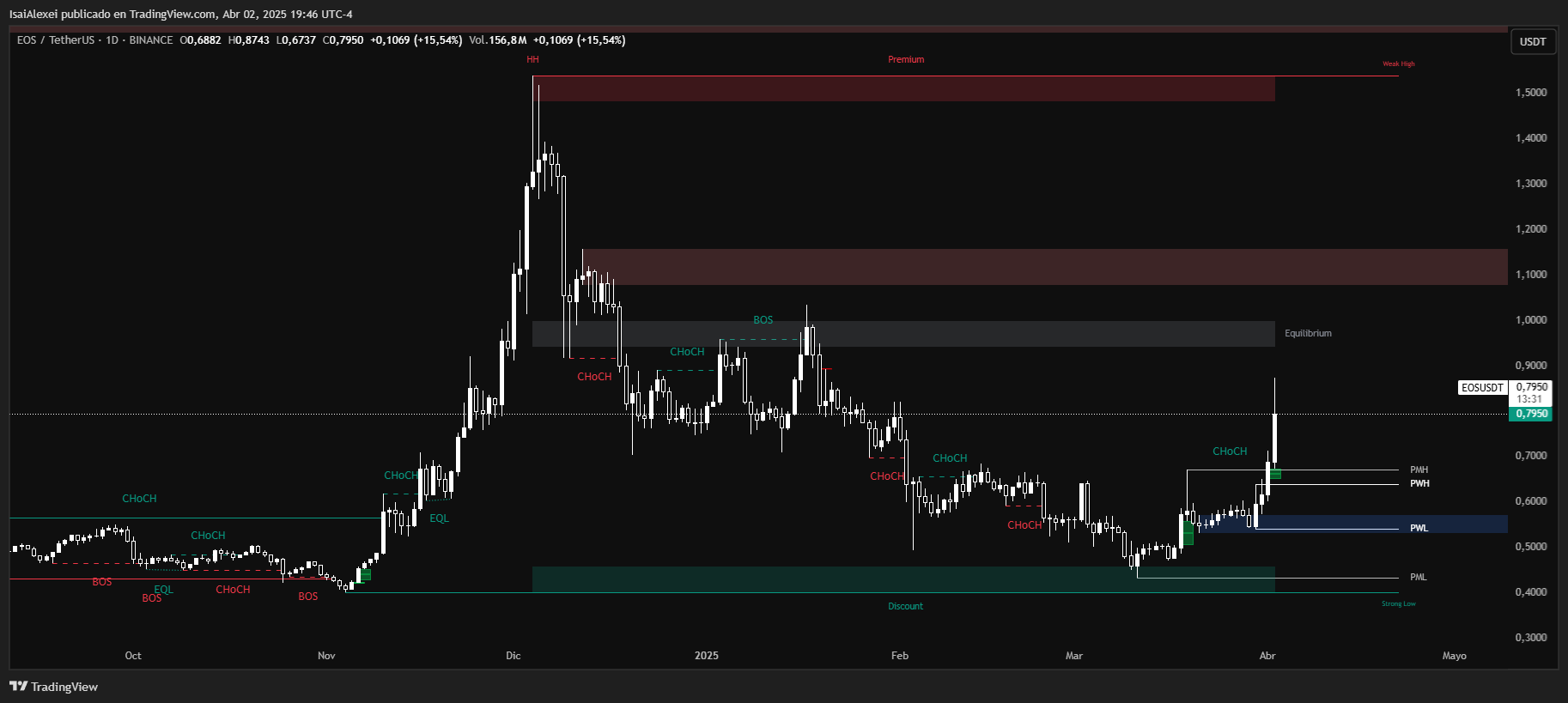

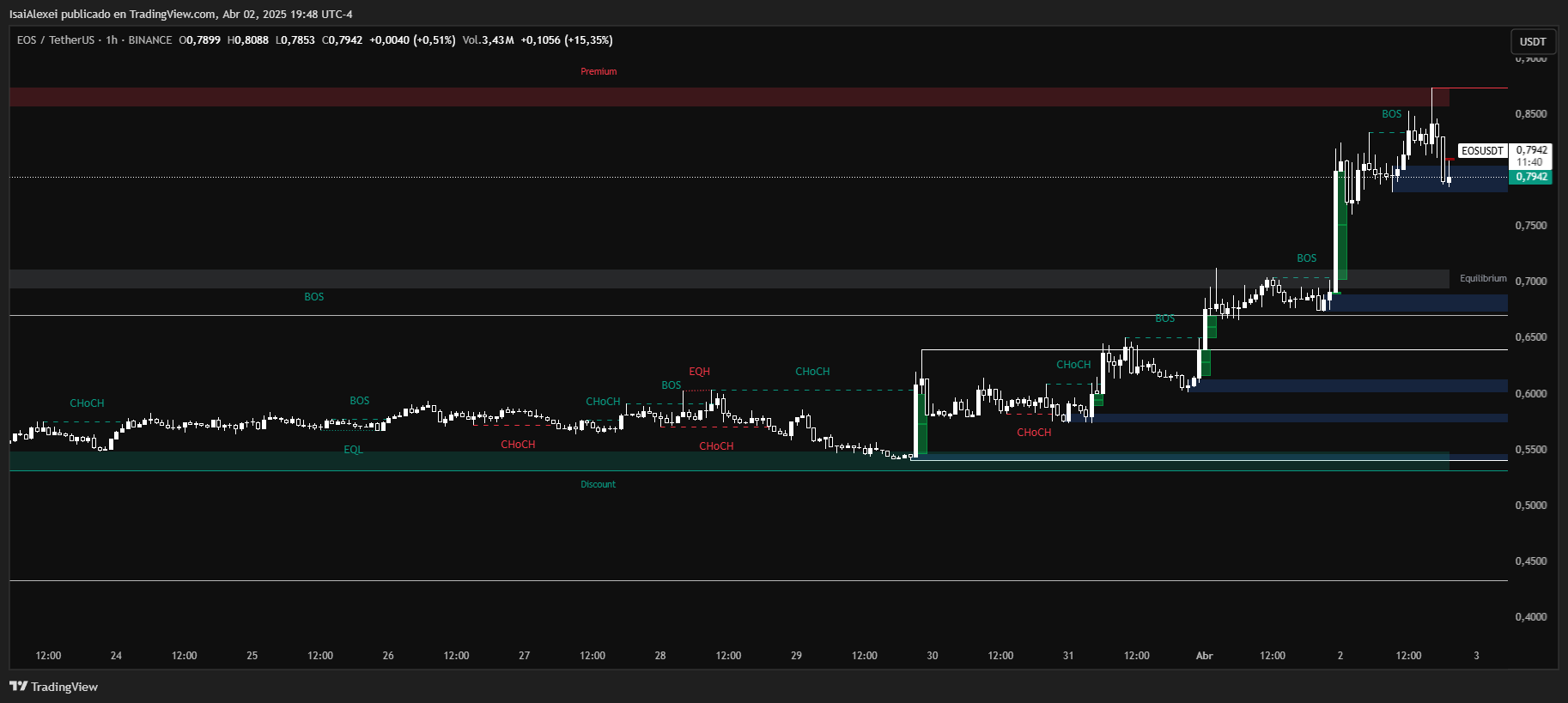

Technical indicators present mixed signals. The daily Relative Strength Index (RSI) sits at 79.12, a level often preceding price corrections. However, sustained buying pressure could push EOS toward $0.90 if trading volumes hold. Short-term profit-taking might test the $0.75 support, while a deeper pullback could stabilize near $0.68.

The rebranding and staking rewards have injected fresh optimism into EOS, but questions linger. Critics note that similar rebranding efforts in crypto often yield short-term boosts without long-term adoption. Traders now watch whether Vaulta’s banking features and yield incentives can translate to broader use.

For now, EOS’s trajectory hinges on two factors: maintaining staking participation and delivering Vaulta’s promised upgrades on schedule. Failure to meet either could dampen momentum, while success might solidify its position in a competitive sector.

As the May deadline approaches, market traders brace for volatility. The coming weeks will determine whether EOS’s revival is a fleeting rally or the start of a durable turnaround.

The current live price of EOS is $0.7989 USDT, registering an impressive +16.10% intraday gain. The day’s trading range has spanned between $0.6737 (low) and $0.8743 (high), showing strong bullish momentum and volatility.

Over the past 7 days, EOS has gained +39.95%, while in the last 30 days, it is up +24.72%, marking one of its strongest recoveries in recent times. Year-to-date, EOS shows a modest +3.21%, and over a 6-month period, it’s up +71.57%.

However, on a yearly basis, it’s still down −23.03%, and from its all-time high, EOS remains down more than −93%, which reflects the long-term decline it has endured since its 2018 peak.

Technically, EOS has just broken out of a long-standing falling wedge pattern, a formation often associated with bullish reversals. Analysts point to $0.92–$1.00 as the next resistance zone to watch.

If momentum continues and volume remains strong, EOS could attempt to push toward that target soon. On the downside, $0.68–$0.70 now acts as support — if broken, it could invalidate the breakout and trap late buyers.